While most business sectors have seen a slowdown in merger and acquisition activity during the current financial and credit crisis, the hospital sector continues to see a significant level of activity. The driving forces for this activity have changed and valuations are varying more dramatically than the sector has seen historically. For hospitals considering selling part of their organization or those facilities interested in mergers or acquisitions, it is critical to know how hospitals are valued and the driving forces behind these trends.

Understanding how hospitals are valued

In the last five years, the number of hospital acquisitions has remained relatively stable despite the downturn in the capital markets, and continues to be so. What has changed from prior periods is the variation in values placed on hospitals’ assets. In the past, hospital valuations, and thus sale values, were generally established by objective measures of financial performance, where pricing rationale was relatively easy to discern and typically a multiple of revenue or cash flow in the form of earnings before interest, taxes, depreciation and amortization (EBITDA).

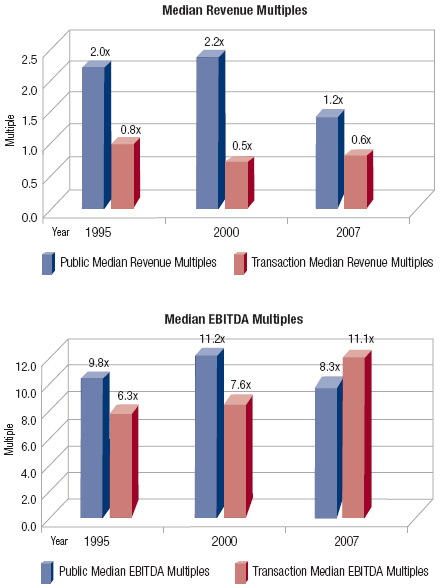

However, valuations in the hospital sector over the past year have departed markedly from historical norms reflecting increased emphasis on non-financial considerations. David Felsenthal, principle of Principle Valuation, has witnessed fluctuation of EBITDA multiples between hospitals with similar revenue multiples across the country (See “Comparison of revenue and EBITDA multiples” on p. 18).

Victoria Poindexter

Shattuck Hammond Partners

“The best explanation for this variance in hospital valuation multiples is that in addition to financial statistics, purchase prices, and thus valuation multiples, are also being largely based on strategic considerations,” says Victoria Poindexter of Shattuck Hammond Partners. “It has become a mix of art and science that dictates the range of fair value of hospitals.”

Mr. Felsenthal agrees that strategic placement is certainly at play in these deals.

“A hospital will pay more to get a competing facility out of the market than a new startup company would pay for a freestanding hospital with the same EBIDTA,” he says.

Kenneth Hawkins, senior vice president of Community Health Systems, adds that buyers are looking for strategically placed deals.

“We look for transactions that are not only good stand-alone deals but also bring efficiencies to our system as a whole,” he says.

Dramatic changes in the availability and cost of debt capital has removed a significant number of potential buyers from the market and driven down valuations for hospital assets where there are no buyers with strong strategic motivations to make acquisitions, according to Carsten Beith, managing director of Cain Brothers. Due to the lack of debt capital in the sector, a number of private equity funded hospital operators, who in the past have been opportunistic buyers of hospital assets, are no longer active and in many cases have become sellers of assets, he says.

This has driven down valuations for certain classes of hospital assets, particular hospitals in competitive markets.

While many factors do influence a hospital’s value, generally the starting point is objective financial considerations.

Carsten Beith

Cain Brothers

“The biggest factor dictating the value and viability of a hospital is the hospital’s operating margin,” says James Unland, president of The Health Capital Group. “In evaluating a hospital’s viability, potential buyers will look specifically at income from operations but will also look at the relative stability of market share and staff; and the physical facility.”

Here are five factors that experts suggest considering in a hospital valuation.

1. Income from operations. Income from operations is measured using the hospital’s net cash flow.

James Unland

The Health Capital Group

“Ultimately, the higher the net cash flow is, the better investment return you will have,” says Mr. Unland. Hospital viability is driven mainly by the physicians who practice at the facility because it is these physicians that drive utilization, he adds.

“In an environment of increasing physician shortages and aggressive employment of physicians by larger systems, the ability to secure a hospital’s revenue stream with a strong and stable medical staff is a key valuation driver,” says Mr. Beith.

2. Physical facility. The physical facility that the hospital occupies can also be a crucial factor. A buyer will sometimes pay a high multiple for a troubled hospital as long as the physical facility is in good condition and within a strategic location, says Mr. Unland. This is particularly true when the purchase is for a turnaround project.

“With the injection of good management, a troubled hospital that has a good physical location will be highly valued,” says Mr. Unland. “It will be even more highly valued if money does not need to be poured into modernizing or otherwise renovating the structure.”

Ms. Poindexter agrees that the state of the facility and its location can be key strategic factors to consider when valuing a hospital.

“From a strategic point of view, a buyer may consider both how much capital needs to be invested into the infrastructure of a hospital and the competitive landscape of the hospital’s location,” she says.

3. Market share and staffing.Market share and staff are important considerations when valuing a hospital, says Mr. Unland.

“Hospitals lose market share when there are too many physicians, medical suppliers and other healthcare providers within the community, and for that reason a buyer may pay top dollar for a less competitive environment,” he says. Buyers may not highly value a hospital in a community with duplicative services. For example, he explains that a buyer may not want to buy a hospital within a four hospital community in a state lacking a certificate of need requirement.

On the other hand, some buyers prefer to purchase a hospital in a non-CON state because of the quicker process.

“I believe that there are more deals in states without CONs than there are with CONs,” says Mr. Felsenthal. “Many purchasers do not want to play the game since it does take longer to go through the CON process.” He also believes that in the next five years, CONs will become obsolete.

Ms. Poindexter further stresses the strategic importance of market share and staffing but says it is important to understand how those factors influence marketplace leverage.

“Many buyers are purchasing in order to leverage their position within the marketplace,” she says. “A multi-hospital buyer may be interested in buying a hospital, and paying a higher valuation for it, if owning that hospital provides the buyer greater negotiating leverage with payors across all of their hospitals.” The market share and staffing will also help leverage increased cases and patients and attract more and better physicians, she adds.

4. Geographic and demographic region. The geography and demographic of the hospital’s location may play an important role in its valuation. The hospital industry is highly regulated and as such is vulnerable to government reimbursement. For this reason, a highly valued hospital will likely have a growing pool of commercially insured patients.

“A study of the surrounding geographic area will let a buyer evaluate the demographic of its patients,” says Mr. Unland. “A community of commercially insured patients will increase the hospital’s viability. Even the best managed hospital won’t make money without paying clients, unless it is a great academic institution.”

5. Managed care contracting. With the increased concentration and pricing power of the managed care companies, the ability to effectively contract with payors can have a significant impact on financial performance and thus valuations, says Mr. Beith. In a number of markets, hospital acquisition activity has been driven primarily to offset increased market concentration among payors. Every percentage increase in reimbursement rates that a hospital can recognize through better contracts will instantly drop to the bottom line and thus help improve hospital performance and increase valuations. It is not uncommon, according to Mr. Beith, to see managed care rates improve 10–15 percent in market acquisitions occur.

Who is buying?

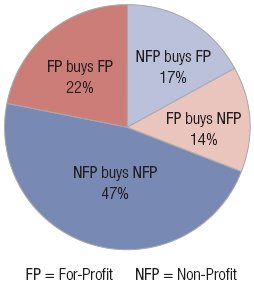

Both not-for-profits and for-profits were active participants in hospital merger and acquisition activity in the past few years. Data for 2007 from Shattuck Hammond indicates that while not-for-profit organizations were engaged in over 60 percent of merger and acquisition deal volume and were net buyers, forprofit organizations were net sellers, albeit slightly (See “Distribution of transactions by ownership” on p. 18). The numbers have remained relatively consistent over the past few years, Ms. Poindexter says.

Despite the current problems in the credit and financial markets, private investors are still looking to invest in healthcare, says Ms. Poindexter.

“The healthcare sector typically is not as negatively affected as other industries in economic downturns,” she says. “There are still investors out there with money that needs to be invested, and healthcare is a relatively stable and lower-risk alternative.”

But investors may pass up certain opportunities that are not strategically sound.

“Even though there is still capital for acquisition, the higher cost and lower amount of leverage is driving down valuations for stranded assets where strategic buyers have limited interest,” says Mr. Beith.

For-profits, even in this market, have access to a great deal of private capital, says Ms. Poindexter. These for-profits are looking to buy hospitals that have strong utilization, opportunities for increasing revenue and good cash flow or, in the case of struggling hospitals, those that meet the buyer’s strategic needs and can be turned around financially.

In addition, for-profits often seek opportunities that require no upfront cash.

“Many mergers are more like bailouts in reality,” says Mr. Hawkins. “The purchasing entity will assume the debt of the hospital they are buying and not pay anything more. Oftentimes though, the purchaser will need to put a good amount of money into the purchased hospital to modernize its systems.”

What the future holds

While the experts agree that the future of hospital acquisitions looks better than mergers in other industries, the future in the midst of the current financial crises will present significant challenges for many organizations. For example, the financial crisis has caused a backlog of hospital financing deals waiting to be completed, says Mr. Unland.

“Basically hospital deals are stalled and the future of many is unknown, which is an uncomfortable position to be in,” he says. “It could be backlogged for another two years. This includes all sorts of deals like refinancing debt and acquiring money for capital projects and/or new construction.”

While private investment groups and larger hospital systems should weather the storm, says Ms. Poindexter, the credit market will continue to negatively affect smaller buyers like physician groups who typically depend on external capital for an acquisition.

But that could turn around as well, according to Mr. Unland.

“In the next few years with a let up in the credit markets, many hospitals will be so financially stressed, and I predict that physician groups will enter the acquisition field,” he says. “Many services within many hospitals are already co-owned with physicians.”

But Mr. Felsenthal disagrees.

“I am not sure that there will be more doctor-owned hospitals in the future,” he says. “The federal government has been looking at this very carefully and it seems to frown on the doctor getting it from both ends.”

Mr. Beith says he expects that hospital systems with strong balance sheets will see the current environment as ripe for strategic acquisitions, often through noncash mergers where minimal up front cash is necessary. He also sees that standalone hospitals, even if financially strong, will seek to affiliate with larger systems where they can assure more predictable access to capital.

Comparison of revenue and EBITDA multiples

This two chart comparison of revenue multiples and EBITDA multiples reflect data, collected by Shattuck Hammond Partners between 1995 and 2007, shows the variances in valuation of hospitals with like revenues. This data will be part of a report to be released by Shattuck Hammond.

Source: Shattuck Hammond Partners, “Mergers and Acquisitions in the Hospital Sector 2008.” Report to be released on the Shattuck Hammond Partners Web site at www.shattuckhammondpartners.com.

Distribution of transactions by ownership

The pie chart below reflects data collected by Shattuck Hammond Partners in 2007 and shows the distribution of acquisitions across the not-for-profit and forprofit sectors. This data will be part of a report that will be released by Shattuck Hammond.

Distribution of Transaction by Ownership Model

Source: Shattuck Hammond Partners, “Mergers and Acquisitions in the Hospital Sector 2008.” Report to be released on the Shattuck Hammond Partners Web site at www.shattuckhammondpartners.com.

Ms. Kulvin (mrbones@the-beach.net) is a freelance writer based out of Surfside, Fla.