As the health systems build urgent care platforms they must understand the market opportunity. To that end, Health System Advisors (HSA) and Urgent Care Partners (UCP) have teamed up to evaluate urgent care demand across the US and highlight areas of immediate urgent care need.

Urgent Care Demand

Various demographic, market and availability factors influence urgent care center utilization. Similar to other healthcare services, demand and utilization are often not the same. Lack of availability reduces utilization while underlying demand remains unchanged. For instance, without an available urgent care option, a person must take off work, wait for a scheduled primary care appointment, inappropriately use the emergency room, or forego the care they need. As such, simply evaluating the current urgent care utilization does not provide a clear indication of the underlying demand.

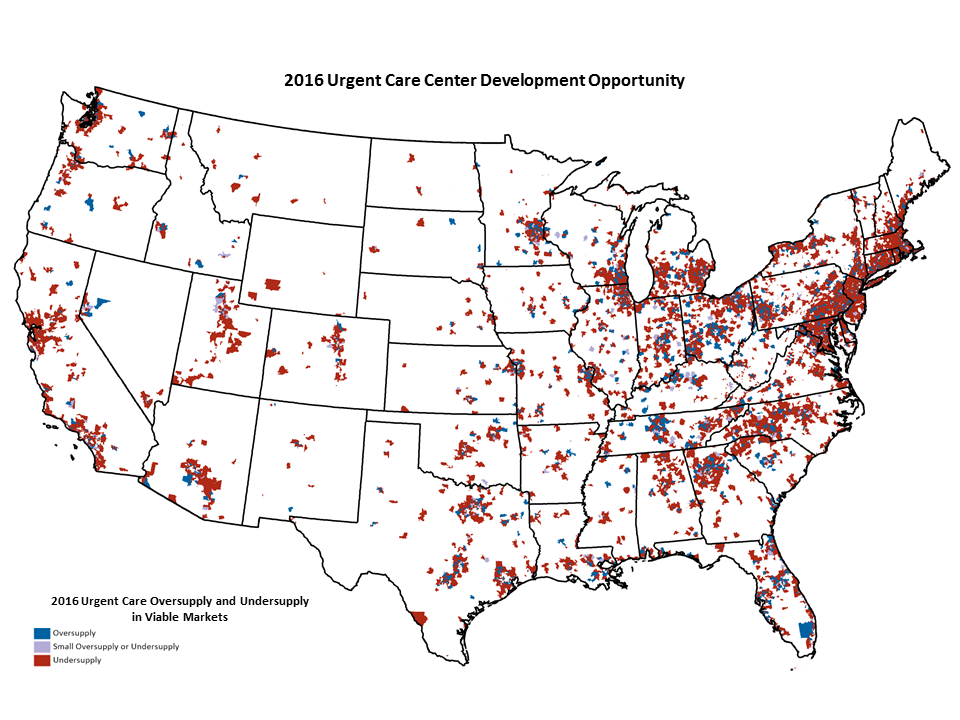

To estimate the underlying urgent care demand, HSA compared the January 2016 urgent care center supply and expected age-adjusted market demand. This analysis shows large parts of the county have limited access to urgent care centers. These undersupplied areas are often rural with population densities that do not support a typical urgent care model or inner city markets with payer mix that makes financial viability challenging. Removing the areas where the typical urgent care model cannot be financially supported eliminates much of the rural and poor urban markets.

Utilization in the remaining markets is likely closer to the underlying population demand for urgent care services. With our estimates of current volumes per urgent care center, this utilization suggests urgent care demand is 560 visits per 1,000 persons per year. Applied to the markets with the population densities, demographics and payer mix that can support urgent care centers today shows demand is more than 22% greater than supply.

The implication, an additional 1,600 typical urgent care centers are needed today to meet the unmet demand just in the areas that can immediately support the development.

Strategic Opportunity for Health Systems

Given the unmet and growing demand, the urgent care channel represents a strategic opportunity for health systems to capture financially sustainable growth, reduce unnecessary emergency room utilization and improve patient satisfaction. Those health systems positioned in suburban and urban areas should move quickly to build their urgent care platform. Those health systems serving non-metropolitan areas should evaluate if there is enough local demand and if alternative models can be deployed to create financial viability.

About Urgent Care Partners

Urgent Care Partners focuses on building client capabilities and infrastructure, in order to deliver care in a way that is distinct from primary care and retail clinics, emergency rooms and virtual care platforms.

Urgent Care Partners offers full-service and turn-key urgent care center solutions, from strategy through design, including start-up, operations/management and transition to the client. These fully-customized solutions are designed to match the specific needs of the health system and integrate existing operational standards, software and processes that will ensure a smooth transition.

UCP has extensive experience managing joint commission and Det Norske Veritas accredited sites. Urgent Care Partners’ process improvement tools and methodologies are concentrated on customer service and patient experience, and are designed around lean/six sigma process improvement standards.

About Health System Advisors

Health System Advisors advises hospital and health system leaders on their strategic issues. Our goal is to provide analysis, insight, and expertise as we facilitate leadership teams’ to new ways of thinking and strategies that advance their organizations and thereby transform the industry.

The belief that strategic advisors must know the client situation to be effective means HSA has a different business model. We work directly with the leadership teams as they think through their challenges. Our partners both sell and engage in the project with the team of experience managers and consultants. Because we spend our time advising clients rather than flying in and out of meetings, we understand our clients better and have greater impact.

About the Authors

Chiara Beckner is a Strategy Consultant with Health System Advisors and is based in Minneapolis, Minnesota. She helps to support and coordinate strategic decisions while working with internal analyst teams and client work groups. Chiara provides market, financial and analytic services to clients. Chiara works to support clients in various types of healthcare strategy with experience in service line planning, recruitment strategy, and implementation planning.

Prior to joining Health System Advisors, Chiara completed her bachelor’s degree in Physics at Carleton College in Northfield, MN. Additionally Chiara is a volunteer tutor in Minneapolis.

Luke C. Peterson is Vice President of Innovation at Urgent Care Partners and a Principal at Health System Advisors, both located in Minneapolis, Minnesota. His experience in strategy consulting to the healthcare industry spans seventeen years. Mr. Peterson’s consulting engagements have concentrated on system and organizational strategy and new ambulatory delivery models. Having worked throughout the country for national healthcare systems, regional community systems and independent community hospitals, he understands the strategic challenges facing healthcare providers today. His client list includes the largest healthcare systems, leading community and referral hospitals, and progressive academic medical centers throughout the country.

He is a frequent author and speaker and has advised numerous regional health systems on their path to create the capabilities to remain relevant, effective, and growing in the future environment.

Prior to joining Urgent Care Partners and Health System Advisors, Mr. Peterson spent fourteen years with Kurt Salmon, where he led their thought leadership on ambulatory and physician strategy and headed KSA’s national healthcare strategy practice.

Mr. Peterson holds a Masters of Business Administration from the University of Minnesota in strategy and finance and is an avid runner.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker’s Hospital Review/Becker’s Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.