With the increasing use of reimbursement models paying for the longitudinal health status of a patient, health systems' historical value proposition of simply being the provider of hard assets to the market is becoming less effective. In a fee-for-service environment, growing volumes and effective operations are the hallmarks of creating enterprise value. As the market shifts to more risk-sharing reimbursement models, the ways to create enterprise value require health systems to consider the relevance of their value proposition and create new capabilities. Those that do not make this shift are seeing their assets rapidly commoditized.

Commoditization of the industry's "sick-care" assets should be a major concern for the asset-centric health systems in the U.S. As with any asset-centric industry segment, once there is a glut of assets, or once assets become commodities, the price commanded by those assets runs down to the variable cost until enough of the assets are bankrupt to bring the cost of building new assets in line with the price of the existing.

With the costs of building new hospitals exceeding $2 million per bed, it might be logical to think the existing health systems are safe from being commoditized. However, consider most healthcare assets, be it hospitals or ambulatory centers, are operated at less than full capacity. Moreover, new delivery models are providing lower-cost substitutes for many of the services provided through these expensive assets. As an example of this substitution, consider the growth of free-standing urgent care centers. With now more than 9,000 centers nationwide, free-standing urgent care centers are growing 7 percent or more per year.1 While much of the urgent care volume is siphoning off primary care visits from physician offices, a portion, as much as 17 percent, is volume that would otherwise go to the emergency rooms.2 Even as health systems are building out the urgent care model, the reimbursement is perhaps one-third of what it is in the ER for the same patients.

To combat this commoditization of their core assets, many health systems have shifted their investments from inpatient facilities to outpatient facilities. This is proving to be a good, albeit short-term, strategy. As inpatient and hospital facilities are commoditized, they are typically done so by the lower-cost ambulatory facilities. As a result, ambulatory care utilization has been growing faster than inpatient care over the last several decades. Nevertheless, no sooner does the health system invest in an ambulatory asset as that asset itself becomes commoditized. It is as if the health system leaders have forgotten their core purpose is not to invest in capital assets but develop the efficient means to care for patients.

Regardless of the types of assets being developed, attempting to compete by virtue of providing assets is a recipe for commoditization.

How are health systems competitively positioned today?

Unfortunately, we find the health systems in the U.S. today have redoubled their asset-based value equation in most markets across the county. Since at least the early 2000s hospitals have moved to focus on the core inpatient and asset-centric ambulatory businesses. This overreliance of the healthcare provider industry on capital and assets for competitive advantage has resulted in those that are big becoming bigger and the long-term growth of healthcare systems.

In the wake of the Patient Protection and Affordable Care Act, small systems and independent hospitals scrambled to join systems for the protection size offered. However, studies have shown the advantage offered by a system tends to be only the increase of pricing power vis a vis the payers.3 Yet, as is being proven out in markets such as San Jose, Denver, Seattle and Boston, having a large base of assets does not make systems immune to the commoditization of those assets over time by insurers and physician organizations. In fact, the same large capital asset base that has made health systems strong can be turned to a liability as systems need volume at any cost above variable cost to maintain their returns.

The solution is to shift the health system's strategy from a capital asset strategy to a capability strategy. Successful systems are doing this by focusing on building both the systems of care and manage systems of health

The need to manage systems of care and systems of health

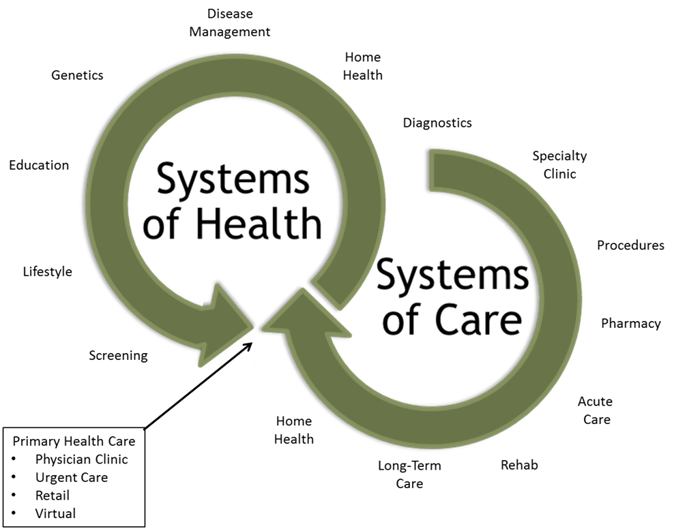

As more attention and payment is focused on keeping populations healthy, health systems must develop the capabilities to both build systems of care and manage systems of health.

- Systems of care focus on patients seeking medical attention, whether prevention, diagnostic or treatment services

- Systems of health focus on populations seeking ways to prevent, manage and improve health

While building systems of care continue to require capital assets, managing systems of health require very little capital assets and instead requires a broad set of new capabilities. Moreover, while the revenue model for systems of care can be linked to assets, the revenue models for systems of health must be linked to health, and thus, the ability to maintain health. As such, health systems must begin to shift their value equation from simply providing the assets necessary for systems of care to building the capabilities to coordinate systems of care and manage systems of health.

Capability strategies

Definition: Strategies that create organizational potentiality and ability

Capability strategies focus on developing the abilities and talent needed to coordinate systems of care and manage systems of health. In the changing environment of healthcare today, adaptability and innovation need to be top of mind for organizations. As Darwin said, "It is not the strongest species that survive, nor the most intelligent, but the ones most responsive to change." The systems that understand and embrace this concept will be the ones that excel because they focus their energy on creating new capabilities and options.

Capability-based strategies stem from the premise that core competencies derived from distinctive capabilities provide strategic advantage, profitability and sustainability in the market. In the seminal business paper on the topic, Stalk, Evans and Schulman4 identified four principles that serve as guidelines to achieving capability-based competition:

1. Corporate strategy does not depend on products or markets but on business processes

2. Key strategic processes are needed to consistently provide superior value to the customer

3. Investment is made in linking across functions and departments

4. Because capabilities cross functions, the strategy must be top-down

Applying a capability strategy framework to health systems causes a radical shift in strategy for most health system leaders. It starts with the envisioning the role of the health system in the future environment and the shift away from sick care towards population health. In this journey there are four roles health systems must play: partner (system of health), innovator (system of health), expert (system of health) and improver (system of care).

Partner: One that shares

Developing the partnership capability is critical for success in managing systems of health. To affect populations' health, a mindset of partnership is the most important capability a health system can have. As most of the population health depends on the individual's own actions, health systems must create partnerships across a wide range of organizations to create the environment for health.

Moreover, health systems who take on the partner role know the value is not in duplicating services for populations, but the value is organizing, managing and integrating these services into a coordinated offering that individual organizations cannot do on their own. It matters less who owns the services and more that the delivery model across the care continuum works for individuals and results in better health. Partners in systems of health will range from retail partners (e.g., CVS, Walgreens) to technology vendors (e.g, Siemens, McKesson) to employers and payers.

The core capability developed is the ability to integrate the delivery model for populations as they seek care.

Expert: One that has, involves or displays special skill or knowledge derived from training or experience

Those health systems that have built a strong relationship with and intimately understand the needs of their communities may already have the capability of expert being developed today. Just as partnering is critical to success, so is the capability to understand and know more about the population and their needs to remain healthy. This expert function is a role that the U.S. healthcare industry has depended on nonprofit health systems for over the last several decades.

As such, health systems who take on the expert role applied to systems of health, strive to understand the needs of the populations intimately. They track data and information about the population not just the patients inside their hospitals. This understanding of populations requires access to data from across the continuum and the capability to collect through partners, analyze with sophisticated predictive modeling, and act to preemptively change actions.

The core capability is data analytics and interpretation to prospectively determine what populations will need.

Innovator: One that does something in a new way

Healthcare in the U.S. has recently been about providing a service demanded by a population that was generally acutely ill. Innovators were those that created new technology or techniques to treat acute (or soon to be acute) health issues. To succeed in a population health era, the innovative focus of the last five decades needs to be shifted away from only the acute and towards the population's lifestyles, environment and activities. There is some argument that this cannot be done by health systems and must be undertaken by larger, social networks and governments. However, health systems that do understand their communities and the activities and health lifestyles of their local populations can be a strong influence in developing new thinking and action by populations on maintaining health.

Improver: One that enhances quality or value

There is also a new capability that is needed inside the systems of care. It is no longer enough to simply build and provide capital assets to the market. The health systems that successfully develop systems of care do so by improving on the individual parts and creating coordination across elements. It is this improvement through coordination that many health systems have begun to make progress in their capability strategies.

Health systems that do recognize the need to improve (or recreate) the system of care, often are driven by a vision of multi-disciplinary care and coordinated handoffs. Recently these beliefs have led to increased mergers, acquisitions and affiliation/partnership strategies. As an example consider the goal of Mayo Clinic with its Mayo Clinic Care Network. Under this strategy, Mayo has developed the linkages with other clinics and health systems to streamline the referral process and ensure handoffs between the two organizations do not result in gaps in care.

Where should health systems begin?

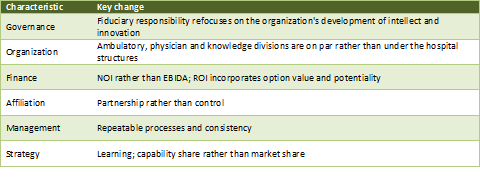

As health systems take on the new roles required of a capabilities based strategy, their organizational structure and outlook must also change. These changes must be driven from the top down as they will shift the priorities and culture of the organization from managers of assets to managers of capabilities. Below are examples of the change:

How will the provider landscape change?

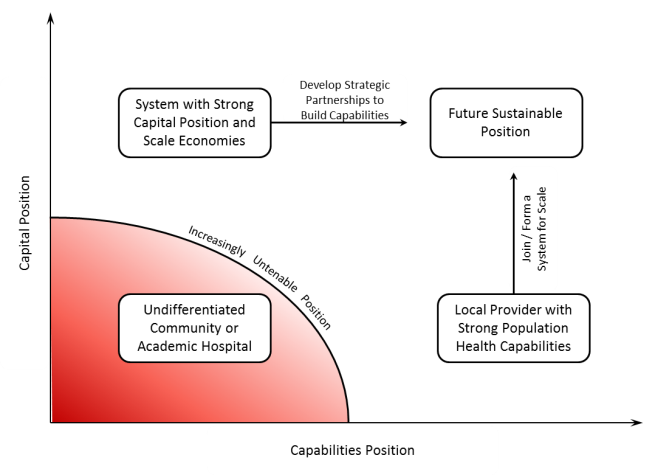

The rapid commoditization of traditional hospital-based health system assets is causing a shift away from competing on capital to competing on capability that will accelerate over the coming decade. Capital can be replaced, whereas capabilities must be developed. As the industry comes out from under the fear of the change represented by the PPACA and the specter of significant reimbursement change, health systems that have come together for access to capital are going to experience pressure to split into smaller units.

As a result, we anticipate several visible manifestations to occur in the industry over the coming five years:

1. National systems that cannot make the transition will split into semi or fully-autonomous regional units.

2. Health system management teams will reorganize and move the hospital leadership structure out of the center making it equal with physician, ambulatory and population health management enterprises.

3. Regional health systems will shift their remaining capital investments from inpatient assets to primary ambulatory assets (primary care clinics, urgent care, ambulatory diagnostic and procedural centers).

4.Partnerships between health systems and physicians, insurers, non-traditional providers (retailers, employers) and communities will proliferate as health systems seek to build capabilities to care for a population rather than treat a patient.

5. The community and academic health centers that have not developed a strong capital or capability position will close as they become increasingly irrelevant to the market and not find partners or systems to remain viable.

Conclusion

As with any major industry environment change, the organizations that recognize the change and adapt more quickly will be the winners. For health systems to thrive in the population health environment, an intense focus on building new organizational capabilities is needed. Those that develop the capabilities to partner, innovate leverage expertise and improve processes will be the winners.

Footnotes:

1 IBIS World “Urgent Care Reports”, 2012

2 Weinick, Burns, and Mehrotra, Many Emergency Department Visits Could Be Managed at Urgent Care Centers and Retail ClinicsHealth Affairs, vol. 29, no. 9, Sept. 2010, p. 1630-1636

3 Haas, D. and Garmon, C (2011). “Hospital Mergers and Competitive Effects: Two Retrospective Analyses”. Int. J. of the Economics of Business Vol. 18, No. 1. pp. 17-22

4 Stalk, Evans, and Shulman

Kate Lovrien and Luke C. Peterson are principals at Health System Advisors. Together they have spent more than 25 years advising senior healthcare leaders on their market and organizational strategy.