Aging baby boomers and increasingly diverse populations create demands for new and different services. Clinical procedures continue to evolve, as do diagnostic techniques and communication technologies, creating potential synergies for collaboration. The amount of capital required to optimally deliver modern healthcare practices, adequately address and manage reimbursement issues, and effectively recruit and retain both specialized and primary care physicians will almost certainly drive continued consolidation of healthcare delivery entities whose nexus is the multi-hospital system.

Hospitals around the country are in a constant state of renovation in order to remain competitive and provide the best technology and equipment. Bond rating agencies have long recognized that large hospitals and multi-hospital systems are inherently less risky than their smaller, stand-alone counterparts. Raising capital at a reasonable cost is more difficult than ever and a well-run system’s capital advantages provide the ability to undertake projects and service line expansions that create high barriers to entry and can positively effect cash flow into the future.

This paper is designed to demystify several long-term financing options for large hospitals and multi-hospital systems and describe the advantages and disadvantages of each. Each option is a viable financing vehicle in normal market conditions. However during a major economic downturn, such as the one that began in 2008, when the auction rate bond market collapsed, and virtually all bond insurers were downgraded and bank letters of credit became more limited, systems are more challenged to find cost-effective and term-favorable funding solutions. In such risk-averse markets government agency loan programs, like FHA 242 mortgage insurance, may be compelling funding alternatives as other finance options are temporarily sidelined or their effectiveness temporarily diminished. In these times advice and perspective from your trusted advisor is of the greatest value.

The funding of a system’s growth through the most appropriate financing means helps ensure the proper maintenance of a system’s capital structure. A strong capital structure is at the foundation of a system’s credit strength, and as such, critical to the ability of a system to optimally fund organizational growth, drive profitability, and deliver enhanced health care services.

Financing Options for Large Nonprofit Hospitals & Multi-Hospital Systems

The Capital Markets for Healthcare Providers

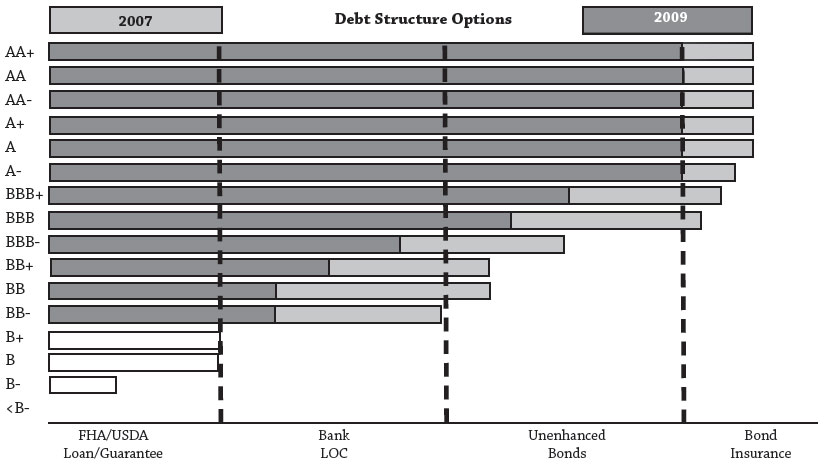

Before outlining traditional and alternative sources of capital for large non-profit hospitals and multi-hospital systems, it is necessary to address the current state of the capital markets for healthcare providers. Since the beginning of 2008 healthcare providers have witnessed historic changes to the financial markets. From the collapse of auction-rate bonds and the collective downgrade of bond insurers, to the restructuring of Wall Street (i.e., Bear Sterns, Lehman Brothers, etc.) and historically high spikes in tax-exempt variable rates, today’s capital markets are a far cry from the bullish healthcare finance market of 2005 and 2006. As illustrated in Figure 4, fixed rates for investment grade healthcare providers have skyrocketed in recent months, especially for low investment grade borrowers, as hospital rating downgrades have vastly outpaced upgrades (for the first five months of 2009, S&P has downgraded 23 hospitals and upgraded only 4).

While fixed rates have ballooned, tax-exempt variable rates have remained at historic lows, trading near 30 basis points (0.30%) as of September 2009. However, in order to access variable rates, the majority of healthcare borrowers require credit enhancement and/or liquidity support via a bank letter of credit. Unfortunately, the banking sector has been pummeled by the country’s soured residential loans, with many of the U.S.’s largest banks receiving substantial funds from the government’s Troubled Asset Relief Program (TARP). As a result, commercial enhancement has become more scarce and more expensive, increasing the net cost of variable rate capital for some hospitals, and prohibiting other hospitals from accessing variable rate debt altogether.

As a hospital evaluates funding alternatives for its capital projects it is critical for the hospital leadership team to recognize that access to capital is ultimately determined by a combination of microeconomic factors (i.e., hospital’s credit profile) and macroeconomic factors (i.e., state of the capital markets), and today’s funding capabilities are markedly different than the not so distant past.

Traditional Sources of Capital

External funding options are composed of gifts, operating and capitalized leases and long-term debt. Gifts include grants and community donations. Grant pools, even at the federal level, are highly competitive, and funding is limited. And while community donations can potentially provide a significant source of capital and demonstrate community support for hospital projects, access to funds is often limited and unpredictable.

Long-term debt, usually tax-exempt bonds or taxable notes, is a popular choice for hospitals to access capital. Bonds and notes represent an obligation of the borrower to pay interest to the investor in return for the lending of capital over a given period of time. The rate of interest is determined by conditions in the capital markets and is influenced significantly by the credit characteristics of the borrower, security provisions provided to bondholders, and the financing structure.

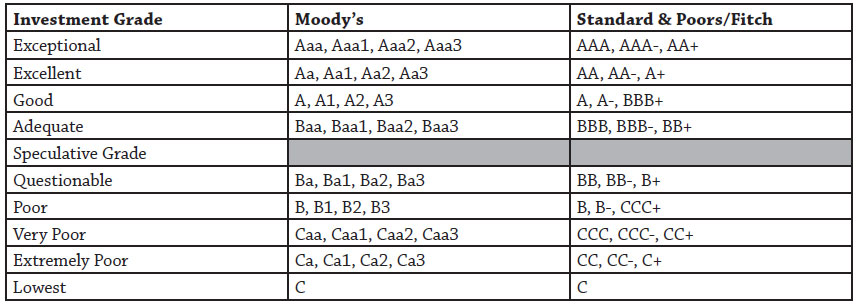

Bonds can be rated or unrated. The ratings, established by rating agencies such as Standard & Poor’s and Moody’s, range from AAA to C, as shown in figure 1, and can change if the borrower’s financial situation changes.

Rating agencies charge a fee to assign ratings to borrowers’ bond offerings. Ratings suggest to investors the amount of risk involved in purchasing a particular bond. AAA to BBB bonds are considered “investment-grade.” Unrated or low-rated bonds are often referred to as “speculative-grade,” “junk bonds” or “high-yield bonds.” The higher the bond rating, the stronger the borrower’s perceived ability to repay the principal and interest associated with the bond, and the lower the interest rate the borrower must pay to offset investor risk.

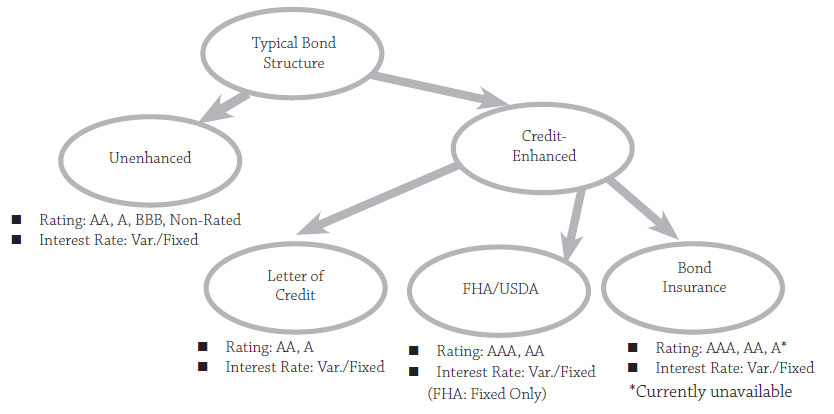

Rated and unrated bonds generally can be sold either (1) without any additional enhancement and marketed based on the strength of the borrowing hospital or (2) credit-enhanced using vehicles such as mortgage insurance, letters of credit and bond insurance (Figure 2 ).

Credit enhancement makes mortgage notes and bonds less risky to the investor and potentially more affordable to the system. Enhancement does not change the system’s credit rating, but changes the rating on the debt, allowing hospitals to borrow at potentially lower interest rates. Credit enhancement can be provided either by commercial institutions, such as banks and bond insurers, or a public entity such as a federal government agency.

Borrowers with stronger credit profiles generally have more financing options than organizations with weaker financial profiles (Figure 3). Hospitals often will choose to access the capital markets using some form of credit enhancement when they receive interest rate savings greater than the cost of the credit enhancement .

If a hospital decides to issue long-term debt, the first step is to select a financial professional to guide the process. Some borrowers choose to hire both a financial adviser to structure the debt and a separate underwriter(s) to purchase and sell the debt and assist in capital decisions and implementation. Many investment banking firms, however, can effectively provide both services, creating a seamless and singular process that often saves the organization time and money. The investment banker/adviser a hospital selects should have health care and capital market experience as well as expertise in the full range of financial options available to hospital systems. Boutique firms that specialize in health care may be as, or more, capable than large Wall Street, or “bulge bracket”, firms at obtaining the lowest cost of capital because they can be knowledgeable in a wide variety of structures to fund a specific industry rather than a few structures to fund many industries. Depending on the situation, it may be desirable to employ more than one underwriter, called a syndicate, to complete a debt sale to take advantage of the individual strengths of each firm to minimize capital costs and maximize distribution to investors. Other parties central to the transaction can be found in Appendix D: “Key Participants in Hospital Financings.”

Each hospital must evaluate its situation to find the optimal funding option, as no two situations are alike. Only after a thorough financial analysis and a clear understanding of the current credit profile should the hospital leadership team move to evaluate the hospital’s capacity to take on new debt, refinance existing debt or implement other long-term strategies to bridge the gap between the strategic plan and internal resources. Due consideration should be given to all available financial options, as the effectiveness and benefits change with interest rates, fees and other market factors. The option which initially seems the most cost-effective may actually be more expensive in the long term.

A) The Rating Process

A hospital with investment grade financial ratios may desire to secure a public credit rating. A credit rating quantifies the hospital’s financial strength in the form of a type of letter grade. Hospital ratings are provided by three primary rating agencies: Fitch, Moody’s and Standard & Poor’s.

The process for securing a credit rating takes approximately 30 to 45 days, and typically begins about 60 to 90 days prior to the bond issue closing. To begin the process, the hospital’s financial advisor or investment banker will forward the selected rating agency(ies) credit information regarding the hospital. This information will include the hospital’s historical financial data, financial projections (if any), project plans, demographic information, management and board biographies, payer and physician mix and other data detailing the hospital’s credit profile. The information will also likely include draft bond documents.

The rating agency will complete a preliminary review of the information and then hold an in-person meeting where hospital management, with the aid of its financial advisor or investment banker, will present the organization’s credit profile. This is either held on site at the hospital or at the rating agency offices. The presentation provides an opportunity for the rating agency analysts to ask questions regarding the hospital’s financial performance, proposed projects and other credit characteristics of the hospital. If the hospital has any potentially negative credit characteristics, it is important to demonstrate how management has, or is, correcting them as it provides an opportunity to display management talent. In addition, all positive credit characteristics need to be highlighted for the rating analysts. Following the rating presentation and any subsequent conference calls, the rating agency’s credit committee will make a rating determination.

The rating determination will be detailed in a rating report and included in the hospital’s bond offering documents which are available to investors and/or credit enhancement organizations. The rating agency will revisit the rating report on at least an annual basis upon receipt of the borrower’s audited financials for the life of the bonds and upgrade, downgrade, or affirm the credit rating after its periodic review. Additionally, it will assign a positive, negative or stable rating outlook. It is important to proactively manage this process in order to maintain, or possibly seek an upgrade, in the rating. If the organization hopes to finance future projects in the public debt markets, maintaining an investment grade rating is imperative.

B) Unenhanced Bonds

Systems with excellent credit strength may choose to issue bonds without additional credit enhancement.

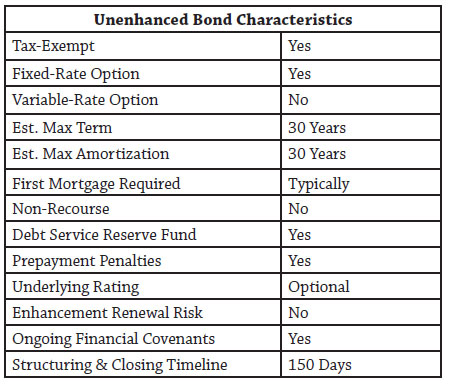

Investor acceptance of unenhanced, rated or unrated, bonds sold on the credit profile of the borrowing entity fluctuates based on credit market conditions. Unenhanced debt offerings are supported solely by the borrower’s credit characteristics. Bondholders are typically provided collateral in the form of either a first mortgage and lien on property assets, a pledge of the organization’s revenues and a lien on trustee-held reserves, including a debt service reserve fund. Appendix E: Security and Covenants provides additional information on security provisions.

Unenhanced bonds are typically structured as fixed-rate with various intermediate maturities and a final amortization of 25 to 30 years from the date of issuance. The financing normally includes pre-payment penalties in the first ten years, commonly called the call feature or lock-out period. These penalties can be structured in a number of ways from “hard-locks,” meaning a period in which no pre-payment can occur, to scaled penalties (i.e. 5% in year 5, 4% in year 6, etc.) where pre-payment can occur, but an incentive exists to allow the bonds to remain outstanding. Most tax-exempt hospital bonds include a feature called a sinking fund that leads to principal being redeemed each year, similar to a traditional home mortgage, to avoid a large balloon payment or the need to refinance at maturity, a common feature in the taxable corporate bond market. Sinking funds are paid to a Trustee who assigns bonds to be redeemed with those funds. Since sinking funds are planned in the Bond Documents there is no pre-payment penalty associated with sinking fund payments even if the payment occurs during a pre-payment hard-lock or penalty period.

Since bond investors rely on the credit strength of the borrowing entity to assess repayment ability, considerable due diligence must be conducted by finance team members and extensive disclosure provided to investors in the official statement. This may include a market and financial feasibility study conducted by a recognized accounting firm experienced in assessing similar projects, examination by a rating agency, as well as full disclosure of the hospital’s operations and historical financial results. There is also a requirement for ongoing disclosures of information to rating agencies and/or investors through a Nationally Recognized Municipal Securities Information Repository (NRMSIR), such as Bloomberg LP.

Factors to Consider

Borrowers who issue bonds and notes on their own merit do not have to pay fees to use credit enhancement provided by a bank, bond insurer or government agency; but they may find capital more expensive over time and be subject to higher or longer prepayment penalties, potentially more restrictive covenants and other investor requirements. This option may be more or less appealing to borrowers depending on the bond offering’s size, its prospective rating and market interest rate levels. Unenhanced bonds have been a viable source of funding for hospital systems for decades and for many years were the only long-term bond option available. Its suitability depends on credit spreads, yield curves, and investor appetites. Your finance professional should be able to articulate the circumstances to consider this option.

Two of the most important considerations when determining whether to use unenhanced bonds at any point in time are the yield curve and credit spreads.

The Yield Curve

The yield curve indicates the time risk an investor assumes when purchasing a debt obligation. Figure 4 demonstrates several examples of yield curves. A “normal” yield curve depicts an environment in which the cost to borrow funds for a shorter period (e.g., 5 years) is less than the cost to borrow funds for a longer period (e.g., 30 years) reflecting the lower risk of principal payment default associated with a shorter time horizon. Normal curves also vary in steepness, or the slope of a curve. A steep slope reflects a large difference between perceived short and long-term risks, and therefore, interest rates, while a flat curve indicates that the cost to borrow funds in the short term is the same as the cost of long term funds. Yield curves can actually become inverted where the cost to borrow short-term funds is higher than the cost of long-term funds. Both flat and inverted curves frequently occur during periods where central banks are employing “tightening” policies, wherein a central bank, such as the US Federal Reserve Bank, uses tools at its disposal to make funds for lending less available in an effort to slow economic growth. In flat and inverted curve environments, long-term borrowing becomes more attractive to borrowers relative to shorter term alternatives.

Hospitals that issue a relatively large amount of debt can take advantage of a yield curve in any environment through the judicious use of serial and term bonds. Term bonds are traditional tax-exempt bonds where a stated maturity

occurs at some date in the future and sinking fund payments redeem some value of the total maturity each year and serial bonds are issued in a series with a full maturity occurring in every year of the serial bond series in lieu of a sinking fund. In a normal yield curve environment an organization may save a significant amount in interest expense by issuing more than one series of bonds as opposed to a single term bond with sinking fund redemptions, see figure 5.

The Credit Spread

Credit spreads reflect the additional borrowing cost associated with borrowers with different ratings. Credit spreads are usually described as a margin to an index (i.e., Treasuries, Bond Buyer Revenue [BBR], SIFMA, LIBOR swaps, etc.) or highly rated bonds in a similar category (i.e., AA+ rated hospital bonds). When credit spreads are wide (i.e., the borrowing cost of a lower-rated borrower is notably higher than the cost of capital for a higher-rated borrower) some of the enhancement techniques described below become particularly attractive because the cost of the enhancement is less than the cost savings associated with obtaining a higher rating. Conversely, when credit spreads are narrow (i.e., the borrowing cost of a lower-rated borrower is near the cost for a higher-rated borrower) the benefit of enhancement may be low and unenhanced bonds become a relatively more attractive option for all borrowers. Credit spreads are usually particularly pronounced for longer-term issues and fluctuate over time.

Bank Loans, Private Placements and Bank-Qualified Bonds

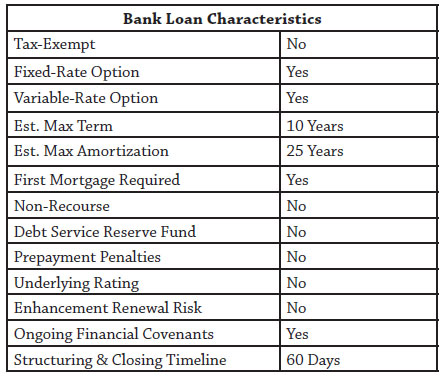

Another source of unenhanced capital comes from traditional commercial bank loans in the form of real estate or equipment term loans. These products are readily available from local and national banks. Interest rates associated with these loans can be fixed or variable. Long amortizations, similar to traditional bonds, can be obtained, but a lender is usually only willing to commit to provide the funding for a limited period (5-10 years) creating the need to refinance or pay down outstanding principal at maturity. Furthermore, most lenders are unwilling to commit to fixing the rate of the loan for its entire period.

Commercial banks can provide a hospital with a short-term loan to begin work on a project in anticipation of a longer-term tax-exempt bond financing. This type of financing can be thought of as a bond anticipation loan where a commercial bank is committing to a short–term (< 1 year) loan to be paid off with the proceeds of a bond issuance. These loans carry some risk to a hospital; for instance, if a loan is obtained and markets or operations change significantly from the assumptions made at the time of the loan it may become costly to issue longer-term bonds. A system may prefer to wait for a more opportune time to issue bonds, but the maturity of the loan could force a system to borrow in longer-term markets or face significant penalties from the lending institution in the form of higher rates on a short-term loan, prohibitive financial covenants, and other operational restrictions. The primary benefit of a bond anticipation loan is its ability to provide capital that allows project work to begin without the multi-month delay usually associated with issuing tax-exempt bonds.

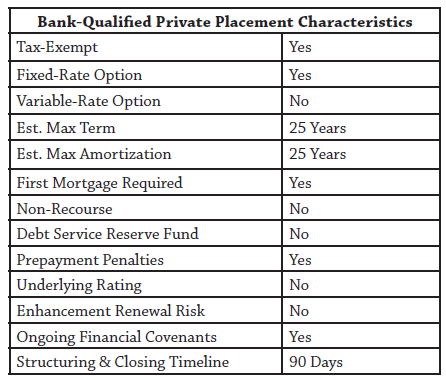

Tax-exempt bonds also can be privately placed with financial institutions such as local banks. This structure may allow the system to reduce issuance costs, but it is usually not viable for larger issues where better execution is obtained using other options.

When tax-exempt bonds are “bank-qualified,” banks can deduct 80% of their purchase and carrying costs, and can pass along the savings to borrowers by way of a reduced interest rate. Until recently, only $10 million in bonds could be designated bank-qualified by any single bond issuer (often the local municipality) in one year, and the bonds had to be issued for qualified tax-exempt obligations. However, the American Recovery and Reinvestment Act, which became law in February 2009, increased the amount of bank-qualified bonds that can be issued in 2009 and 2010 to $30 million and applied this new limit to the borrower, not the bond issuer. The Act also created a temporary rule that allows banks to deduct 80% of the cost of buying and carrying any tax-exempt bond, bank-qualified or not, to the extent that their tax-exempt holdings do not exceed 2% of their assets. The increased limit should expand the number of issues that are eligible for bank-qualified designation, making this option more attractive to systems than historically has been the case.

C) Commercial Enhancement

Hospitals also have the option to obtain commercial enhancements in order to secure lower interest rates on their bonds. These include letters of credit and bond insurance.

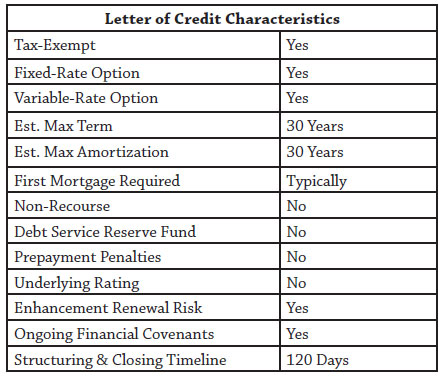

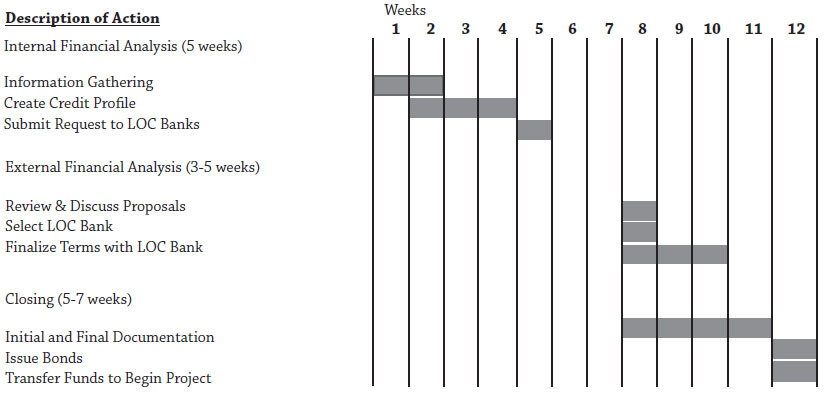

Letters of Credit

A letter of credit issued by a commercial bank is an irrevocable obligation to make principal and interest payments in the event the borrower is unable to make payments. With that credit support, a hospital can issue bonds backed by the bank’s credit strength at correspondingly lower interest rates. Borrowers pay letter of credit banks a fee to utilize this option. The cost of a letter of credit is largely driven by the perceived credit risk of the organization and typically includes a one-time upfront fee along with an annual charge. Letters of credit are usually issued for three- to five-year terms and can be renewed or substituted, while the bonds they enhance have variable interest rates and generally amortize over 20 to 30 years. Letter of credit structures provide more flexibility than many other options, but banks may be hesitant to extend credit. The project and the obligor’s credit profile must fit into the conservative underwriting requirements of a commercial bank.

There are two types of letters of credit, stand-by and direct-pay. A stand-by letter of credit is used when a hospital utilizes its own high investment grade rating to back the bonds (unenhanced), has sufficient liquid assets to cover the principal amount of the bonds, and is comfortable providing a self-guarantee for payment of the bonds if necessary.

The stand-by letter of credit provides liquidity support to the bond issue, a requirement of buyers of variable-rate bonds. Liquidity support refers to the mechanism available to quickly pay off principal and interest in the event of a failed remarketing (sale of variable rate bonds). Alternatively, a direct-pay letter of credit provides credit enhancement and liquidity support. Investors receive normal principal and interest payments from the commercial bank providing the letter of credit and the commercial bank is immediately reimbursed for debt service payments by the hospital. Direct pay letters of credit are commonly used for low investment grade or non-investment grade systems where the investor demands assurance that payment will not in any way rely on the credit strength of the underlying system if the system does not have sufficient liquidity to cover the entire principal amount of the bonds.

Bonds issued with a letter of credit are called variable rate demand bonds (VRDB), and as the name implies, the rate on the bonds is variable and in most cases resets at a regular frequency, typically every day or week. In periods of low short-term interest rates it is not uncommon for these bonds to bear a coupon of under 1%. The downside to these potentially low interest rates is that investors need to be assured that they can liquidate their positions on short notice. Remarketing agents are responsible for coordinating the sale (remarketing) of VRDBs to investors.

In periods of great turmoil, as experienced after the collapse of Lehman Brothers in September 2008, or when a bank is downgraded, the liquidity feature of the letter of credit can be called upon to pay off investors in the event there are no buyers for the bonds, termed a failed remarketing. In this infrequent, but real scenario, a system, if providing a self-guarantee, would need to potentially liquidate a portion of its own investment portfolio to pay investors or reimburse the letter of credit provider if using a stand-by letter of credit. If the system is using a direct-pay letter of credit, there is more flexibility in the timing and terms of reimbursing the letter of credit provider. The bonds are not canceled in this scenario, and a remarketing agent can usually place the bonds with third party investors once the market returns to a state of normalcy (assuming the letter of credit bank is still highly rated). At that time, the letter of credit provider is reimbursed the par value of the bonds that are sold back to investors. Of note, most investors monitor and evaluate the credit strength of commercial bank letter of credit providers due to the large volume of bank letter of credit backed issues they hold. In uncertain market conditions, many investors will demand a premium rate to accept bonds backed by hospital liquidity and a stand-by letter of credit since an investor needs to dedicate resources to evaluating and monitoring a system’s operations.

Once a system obtains an acceptable letter of credit, it can issue tax-exempt bonds that carry the same rating as the letter of credit provider. The primary benefits of this approach are lower costs of issuance and lower annual debt service when compared to some other structures, especially in low short-term rate environments. The process for obtaining a letter of credit is generally shorter than that of other enhancement options, and up-front closing costs are relatively low. Unlike some alternatives, there is a yearly fee determined by the risk associated with the hospital to maintain the letter of credit (~1-2% for direct-pay letters of credit).

Recent expansion of the Federal Home Loan Banks’ (FHLB) authority to provide letters of credit for tax-exempt transactions affords systems the ability to work with unrated or low-rated community banks and gain access to the usually high investment grade ratings of an FHLB. An FHLB letter of credit provides up to a 10-year term and its annual fees (in addition to the annual fee paid to the participant member bank(s)) are relatively low, currently ranging from 20 to 45 basis points depending on the FHLB and letter of credit structure. However, FHLB member banks are required to post collateral with the FHLB equal to the amount of the letter of credit, making this option overly restrictive for some member banks. Additionally, community banks often have low lending limits prohibiting them from providing all of the required letter of credit capacity.

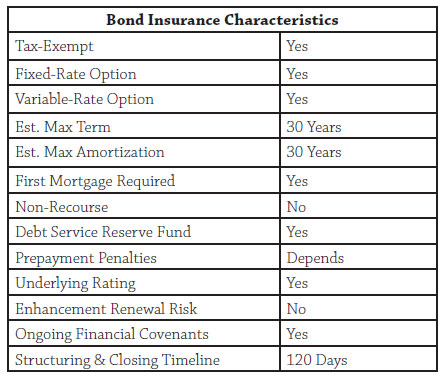

Bond Insurance

Bond insurance, like a letter of credit, is a form of credit enhancement that guarantees investors will be paid even if the hospital cannot make its scheduled payments. This generally allows the system to access capital at much lower interest rates than it could have without enhancement and was a very popular option for many years.

Several companies have historically offered this option, including AMBAC, MBIA and FSA. Each bond insurer has its own credit rating based on its own unique credit profile, and their individual appetites for certain credit risks have varied significantly, as will the market’s acceptance of bonds enhanced by their insurance. These factors must be taken into consideration when evaluating bond insurance credit enhancement options, especially during times when most of the insurers lose their high credit ratings.

Prior to the collapse of the auction rate bond market in 2008, bond insurance was generally available to systems that could independently achieve an investment-grade rating of BBB or better. It could be used for both fixed-rate and variable-rate structures, and was generally less expensive on an annual basis than the letter of credit option. However, the cost is paid up front; therefore, bond insurance may not be the most cost-effective option for hospitals that expect to pre-pay their bonds or restructure the debt before the final scheduled maturity. Unlike letters of credit, there is no annual fee to maintain bond insurance.

Bond insurers tend to be more receptive to slightly longer amortizations (25 to 30 years) than banks providing letters of credit. Insurers are generally indifferent to a project’s geographic location, and tend to focus on larger projects when compared to letter of credit banks. Unfortunately, most bond insurers were downgraded in 2008 because they provided insurance to pools of residential mortgage loans. For the foreseeable future, bond insurance is not expected to provide the benefit it once did. As of mid-2009 most insurers are considered insolvent, and at the time of this writing the only remaining AAA-rated bond insurer that has an interest in insuring health care debt is the merged insurer Financial Security Assurance/Assured Guaranty.

D) Agency Enhancement

In recognition of hospitals’ essential roles in society, the federal government created several funding and credit enhancement programs to assure that hospitals can access capital in order to continue their missions, evolve with changing technology, and remain competitive and viable. Government agency enhancements put the full credit support of highly rated federal agencies behind hospital loans and bonds, making them more attractive (less risky) to potential investors.

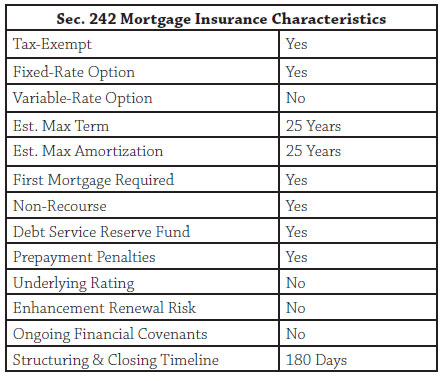

FHA Sec. 242 Mortgage Insurance

The Federal Housing Administration introduced its 242 hospital mortgage insurance program in 1968. Since then more than 300 loans have been insured for more than $10 billion in 40 states and Puerto Rico. Project sizes have ranged from a few million dollars to nearly a billion dollars and participants range from small, stand-alone Critical Access Hospitals, to some of the country’s largest systems. Borrowers taking advantage of this type of credit enhancement must work with FHA-approved mortgage lenders to complete the funding.

In 2007 changes were introduced to streamline the 242 process. The program was placed under the exclusive control of the Office of Insured Health Care Facilities, a division of the Department of Housing and Urban Development. A select team experienced in health care processes the 242 applications.

The FHA Sec. 242 program is available to fund new facilities, acquisitions or the substantial renovation and modernization of existing facilities. Systems may refinance debt through the 242 program as long as at least 20% of the funding pays for new projects.

The FHA 242 program offers borrowers the opportunity to issue bonds at a AAA-equivalent rating and take advantage of the lower interest rates that accompany these higher credit ratings. Interest rates are fixed, which can be very appealing in a low long-term interest rate market. Borrowers have up to 25 years after construction completion to repay the principal of the FHA mortgage-insured loans. The FHA does not require the parent or affiliated entities to provide financial guarantees, and a high loan-to value ratio can minimize up-front cash requirements.

There is no limit to the amount of debt the program will insure, so long as the hospital can prudently support the debt repayment. The 242 program allows hospitals to borrow up to 90 percent of the value of the project; therefore, the debt available in some cases can meet 100 percent of the actual project cost. Project value calculations can include existing assets in addition to the actual project costs of new financing or construction.

To qualify for the 242 program, a facility must principally be an acute care hospital that derives less than 50 percent of its revenues from chronic convalescence, drug and alcohol treatment, epileptic treatment, nervous and mental deficiency and tuberculosis treatment. Average operating margins must be positive, and the average debt-service coverage ratio must be equal to or greater than 1.25 for the previous three years. Recently approved Critical Access Hospitals have the option of recasting their historical financial statements to enhance their qualifications.

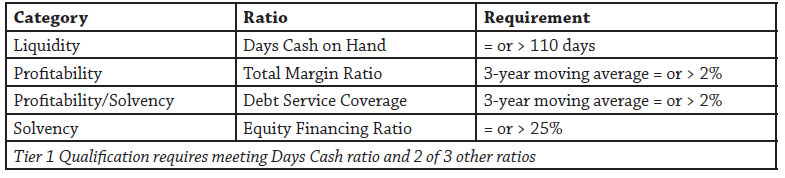

Loans insured by the FHA program are secured by a mortgage and pledge of revenues related directly to the project. Subject to attaining the financial ratios listed in figure 17 and some other credit requirements, hospitals utilizing the program may transfer assets, including cash, to the parent health system or affiliate hospitals, which can be an attractive feature for those organizations. The ability to leverage hospitals in a system individually can be of great value to a system. Leveraging a facility individually or using the FHA 242 structure to fund a new hospital allows a system to segregate that debt in a non-recourse entity. This allows the system to borrow for other purposes, maintain conservative financial ratios and preserve credit ratings, while still maintaining the upside of realizing excess cash flows from the segregated facility. It is important to note that the segregation applies to real estate and accounting for that pledged real estate. There is no need to segregate operations and the FHA 242 hospital(s) can maintain their operational integration with the rest of a system.

Issuing debt through the FHA 242 mortgage insurance program can save organizations a considerable amount of debt service over time, but initial costs and the time necessary to apply for the program should be taken into consideration as part of the funding option analysis. Borrowers must pay a one-time fee of .8% of the loan amount. Additionally, an annual premium of .5% of the remaining principal balance is required, a relatively small fee given the extent of the credit enhancement and AAA-rated debt. Organizations must also have the financial capacity to make monthly payments to a mortgage reserve fund, which must equal two years of debt service after ten years.

All FHA insured mortgages are guaranteed by the full faith and credit of the United States government. While an FHA insured mortgage carries essentially no credit risk to the bondholder, it does not guaranty timely, problem-free payment and is therefore not in and of itself ratable and marketable as a AAA security without additional upfront deposits. Under certain circumstances, an FHA insured loan may be wrapped into a GNMA mortgage-backed security, which carries a AAA rating and is a highly marketable debt instrument.

Hospital borrowers traditionally have accessed the tax-exempt bond market to reduce their overall borrowing costs. However, they have been limited by a 1980 amendment to the National Housing Act that prohibits the use of GNMA securities to secure tax-exempt bond financings for hospitals. As a result, tax-exempt financings for FHA insured hospitals have required intensive structuring around the FHA insured note to achieve a AA or AAA rating, including providing for upfront deposits to cover potential delays in paying insurance claims and differences between the note rate and the interest rate payable on an FHA insurance claim after an event of default. This structuring and the resulting reserve deposits impose costs on the transaction that would not be present with a GNMA security. Historically, the lower interest rates offered in the tax-exempt bond market have often been sufficient to justify these upfront structuring costs. However, when market conditions result in low reinvestment rates and relatively high yields on tax-exempt bonds (compared to Treasuries), FHA-insured transactions can become inefficient for many hospital financings, with the hospital required to post as much as 10% of the loan amount as additional security to receive a AA or AAA tax-exempt bond rating.

Additionally, the publicly-offered tax-exempt bond market expects and requires bonds to be issued in whole at closing. When reinvestment rates are very low, construction fund negative arbitrage produces an extreme drag on new construction tax-exempt bond transactions. By contrast, the taxable GNMA market is accustomed to draw-down funding in which purchasers of GNMA securities commit at the time of initial endorsement, to fund mortgage loan advances in installments as they are made, and interest only accrues on amounts previously funded. These factors can dramatically reduce construction fund carrying costs, though some up-front deposits may still be required in some situations.

On July 1, 2009, FHA introduced the 242/223(f) refinance option to assist borrowers who were negatively affected by the increasing capital costs during the 2008-2009 credit crisis. Under this program hospitals are able to refinance outstanding debt by meeting certain criteria. Elements of the program will be finalized after a review period.

FHA Sec. 242 Mortgage Insurance for Critical Access Hospitals

Hospital systems that include Critical Access Hospital should be aware that these small, rural facilities are entitled to special underwriting provisions that increase their chances of qualifying for the program.

Critical Access Hospitals may qualify for FHA Sec. 242 insurance even if more than half of their services are dedicated to drug and alcohol treatment, chronic convalescence or other services described above that prevent general hospitals from using the FHA Sec. 242 program. The government also streamlines the application process to speed up consideration.

Critical Access Hospitals still, however, must meet the requirements that the average operating margin be positive over the past three fiscal years and the average debt-service coverage ratio exceed 1.25x for the same time. This is where the special provisions make a significant difference. Many systems can qualify a Critical Access Hospital for the FHA 242 program by judiciously managing transfer payments between the hospital and parent system.

Build America Bonds

As part of the 2009 American Recovery and Reinvestment Act (ARRA) government-owned hospitals are temporarily able to issue Build America Bonds (BABs) to finance capital expenditures. Unlike traditional tax-exempt bonds, interest on Build America Bonds is taxable to the bond investor and the federal government provides a subsidy equal to 35% of interest cost of the issue as either a direct payment to the borrower, or as tax credits to the investors. The direct payment (or direct subsidy) option, limited to new construction and acquisition, allows the bond issuer to receive a cash subsidy from the federal government at the same time debt service payments are made, while the tax credit option provides the bond holders tax credit over the life of the bonds. Ultimately, tax credit BABs provide the issuer a lower subsidy than Direct Payment BABs, in part because holders must include the tax credit they receive in taxable income. The ability to issue BABs expires on December 31, 2010.

Build America Bonds were created by Congress because municipal bond issuers were effectively unable to lower borrowing costs through the issuance of tax-exempt bonds as a result of the financial market crisis that began in the Fall of 2008. The bankruptcy of Lehman Brothers and a major money market fund “breaking the buck” set off a financial panic in September, 2008, causing a broad array of investors to flee to the safety of US Treasury Securities, driving taxable yields to record lows. Simultaneously, the cost of credit and liquidity provided by banks and other financial institutions skyrocketed, forcing unwinds and liquidations of liquidity vehicles for billions of dollars of long-term municipal bonds that were ultimately returned to the marketplace. This in turn pushed long-term tax-exempt yields to record highs and resulted in a record inverse spread between long-term taxable and tax-exempt yields. State and local governments asked Congress for relief in the stimulus legislation when they were unable to use municipal bonds to lower borrowing costs.

The response to BABs has been very strong. BABs are expected to comprise 20% or more of the $400 billion annual municipal bond market before the program expires. The potential market for BABs is much broader than the market for tax-exempt bonds, and the market for direct payment BABs has rapidly developed, narrowing their spreads to US Treasury Bonds over the first four months of the program. Issuers may choose to combine BABs for capital expenditures with tax-exempt bonds for working capital or to refinance existing debt. Another combination that can be considered during a period with an inverse spread between long-term taxable and tax-exempt yields is to issue tax-exempt bonds maturing in the first ten years, where the tax-exempt yield curve is currently steep, and issue BABs for maturities longer than ten years where the difference between taxable and tax-exempt rates is currently minimal.

Rated governmental hospital borrowers, such as city and county hospitals, hospital districts, and any other governmental entities that own health care facilities may issue Direct Payment BABs to acquire or construct those facilities and secure the BABs with GNMA securities that might otherwise be sold in the conventional market.

After applying the BABs’ subsidy payment, these bonds could be structured to provide an effective cost of funds that is roughly equivalent to 65% of the rate otherwise available to the borrower in the conventional market. An example: Assume 30 year, AAA-rated municipal bonds could be sold at par at a 5.75% coupon and assume the same bonds could be issued on a taxable basis at a 7.00% coupon using direct payment BABs. After the 2.45% rebate from the US Treasury (35% of 7.00%), the net borrowing cost totals 7.00% – 2.45%, or 4.55%. Compared to the 5.75% coupon of the traditional municipal bonds, the interest savings is 5.75% – 4.55%, or 1.20%.

Another structuring alternative is to combine BABS, FHA Sec. 242 mortgage Insurance, and GNMA securities to eliminate many of the upfront deposits otherwise required in a traditional FHA insured tax-exempt financing (see FHA 242 section above) and reduce the net interest cost. For example, the typical up-front deposits required by the rating agencies for a new construction Section 242 tax-exempt hospital transaction amount to approximately 10% of the loan amount. These deposits could be reduced to zero if the BABs are issued as draw-down bonds. Although an up-front deposit for negative arbitrage may still be required in certain situations, several structuring techniques are available to help reduce those amounts considerably. This structure will also reduce net interest cost. For example, the estimated coupon on tax-exempt bonds insured by FHA hospital mortgage insurance might total 6.25%. The estimated coupon on taxable notes insured by FHA mortgage insurance and wrapped with GNMA securities might total 7.00%. The estimated coupon on taxable notes using BABs, insured by FHA mortgage insurance and wrapped with GNMA securities would be 7.00% – 2.45% (35% of 7.00%), or 4.55%, a reduction of 1.70% versus the tax-exempt issue and 2.45% versus the FHA/GMNA alternative.

Alternative Sources of Capital

While the majority of capital finance for hospitals is funded via traditional sources of capital as described above, hospitals also have alternative funding options available for project finance. Two of the primary finance alternatives are Off-Balance-Sheet (OBS) structures and Real Estate Investment Trusts (REIT). These options are typically taxable and utilized in order to preserve balance sheet debt capacity or because of the inability to secure traditional financing.

A) Off-Balance-Sheet (OBS)

OBS financing involves a third-party investor who owns hospital-related property and leases the property to the hospital. This arrangement is described in an operating lease, typically with a long term and an option for the hospital to retain ownership at the end of the lease.

The three primary forms of OBS financing are: (i) sale/leasebacks, (ii) synthetic leases, and (iii) master leases. Each form offers a different balance between hospital control of the property and the hospital’s ability to exit the arrangement.

A sale-leaseback involves an investor purchasing an existing hospital asset and leasing it back to the hospital. This transaction provides the hospital with cash from the sale, but still allows the hospital to continue operating the property. The hospital’s lease payment is at least equal to the investor’s debt service associated with funding the purchase. Ownership of the property reverts to the hospital at the end of the lease, which usually takes the form of a ground lease.

A synthetic lease is similar to a sale-leaseback, but offers shorter terms and interest-only lease payments. Because no principal is included in the lease payment, the purchase option at the end of the term equals at least the debt principal outstanding.

Finally, a master lease involves the funding of a new project by a third party in concerted effort with the hospital. The developer manages the construction of the project and can serve as the initial operator upon project completion, while the hospital is able to use the space to offer services.

Of note, while OBS financing can provide a short-term boost to a hospital’s cash position and allow the hospital to continue operations or grow without accumulating traditional long-term debt on the balance sheet, it is important for hospitals to work closely with their accountant in evaluating the accounting classification of the OBS alternative, because some OBS structures will result in a contingent liability for the hospital.

B) Real Estate Investment Trust (REIT)

A REIT is a company that purchases real estate assets and leases the assets to one or more operators. Similar to an OBS financing, this allows a hospital to operate the facility without technically owning the property. REIT’s are compensated through the receipt of lease payments made by the hospital and via the ultimate sale of properties.

Summary

Concluding Comments

The financing options for large hospital and multi-hospital systems can be complex and are continually evolving. Each financing structure has a unique set of characteristics that will likely be perceived to have both desirable and undesirable qualities. Each option must be evaluated with input from a knowledgeable investment banker/financial adviser and in concert with the unique credit profile of the organization and its long-term strategic plans.

Steven W. Kennedy is a senior vice president with Lancaster Pollard, a national leader in debt financing for hospitals. Find the nearest office at www.lancasterpollard.com or call (866) 611-6555. Reprinted with permission.