Understanding key change elements: Quantifying the value of the healthcare continuum

The value of the healthcare continuum can be best evaluated in terms of the clinical or operational improvements it provides to the overall delivery of care. This implies that a more integrated care continuum offers some combination of better quality, better service and lower costs per unit of service.

We believe changes to reimbursement principles will drive disparate providers to work together. Below are four key elements that we believe will drive this change toward coordinated care along the care continuum.

• Reduced reimbursement rates. With legislators desperate to bend the healthcare cost curve, few doubt that reimbursement rates will be cut — in fact, some cuts have already been passed — but no one has accurately predicted the magnitude, allocation or phasing of these cuts.

Given that more than 50 percent of all U.S. hospitals already lose money on Medicare, and that Medicaid rates in nearly every state are lower than those of Medicare, federal reimbursement cuts will intensify the economic pressure on care providers. The distribution of payments between providers along the continuum is also being closely scrutinized — with the current specialist-centric reimbursement model often considered a disincentive toward greater care coordination.

• Bundled payments. Our current fee-for-service model allows, and even encourages, redundant testing and duplication of efforts. Bundled or episode-based payments can cut costs by encouraging providers to coordinate patient care more effectively.

In 2011, the CMS Center for Medicare & Medicaid Innovation announced the Bundled Payments for Care Improvement Initiative, and many private-sector insurers are undertaking similar experiments.

Providers, whether or not they choose to participate in the initiative, will benefit from taking steps to understand how to work more efficiently within the continuum. This includes developing a system to distribute payments to providers across the continuum, evaluating care pathways to ensure coordination and adherence to evidence-based medicine standards and continuing to explore cost-containment and efficiency strategies to ensure shared savings are achieved.

• Value-based purchasing — the quality connection. While significant attention has been paid to the issue of quality, there has been limited demonstrable improvement. The latest federal proposal related to quality improvement, detailed in the Patient Protection and Affordable Care Act, is called hospital value-based purchasing. Buyers of healthcare will hold providers accountable for both the quality and cost of care, in the same vein as pay-for-performance systems. The approach of aligning financial incentives with quality of care ties payment to a set of quality measures on process of care, health outcomes, cost-efficiency, patient satisfaction and information technology.

In FY 2013, inpatient prospective payment system payments will be cut 1 percent across the board. Those savings, an estimated $850 million, will then be used as incentive payments to hospitals based on their performance on select quality measures. In the future, CMS plans to add additional outcome measures that focus on improved patient outcomes and prevention of hospital-acquired conditions.

• Eliminating reimbursement for avoidable readmissions. The ACA will start to restrict Medicare payments to hospitals that have “excessive readmissions” in October 2012. While the definition is still to be defined, it will extend the current law that prohibits payment for a readmission on the same day of the discharge to up to 30 days post-discharge.

Many hospitals are already launching initiatives to prevent readmissions, forcing them to think more about care outside their four walls. This challenge, if successfully tackled, can improve both their bottom line and the health of their patients.

One size does not fit all

Despite the intuitive logic of building an integrated continuum of care from the perspective of rational health policy, it must be developed deliberately. Hospitals must answer several questions as they contemplate their role within a future integrated continuum of care.

1. How will local market dynamics influence the development of care continuums?

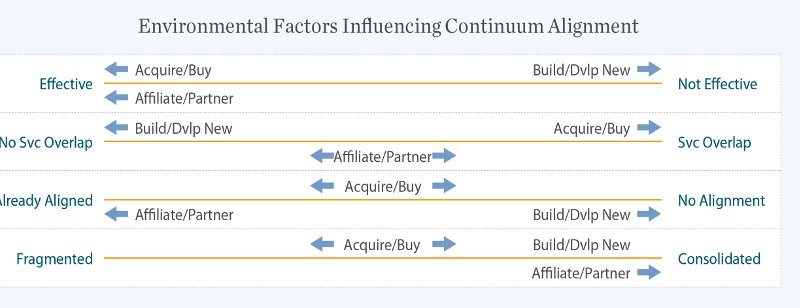

The impetus behind the development of an integrated care continuum must be carefully evaluated in the context of each hospital’s competitive environment. Creating an integrated continuum can be accomplished through a plurality of buy, build or partner decisions. Our research has suggested there are four key dimensions — unique to each market and to each sector along the continuum — that must be evaluated in order to identify the optimal integration strategy.

i. Effectiveness relates to the ability of an existing provider in the market to deliver care effectively and efficiently. If an existing provider can demonstrate superior value, there is an incentive to either affiliate with or acquire them to integrate them into the overall continuum.

ii. Scope of services relates to the overlap in functionality between an existing provider in the market and the hospital itself. For example, if a hospital already provides inpatient rehabilitative services, there is less incentive to acquire another provider that offers a similar service offering.

iii. The level of alignment between the hospital and different care continuum providers in the market is also critical. For example, if the hospital’s medical staff already admits most of its chronic vent patients to one specific skilled nursing facility, it may make sense to strengthen that alignment by developing a closer partnership or making an acquisition.

iv. And finally, if there is not a great deal of competition within the market for a specific sector of the continuum there is often a greater impetus to acquire or affiliate with an entity with a strong market presence — as is being played out in numerous markets between hospitals and large multispecialty physician groups.

Exhibit 1: Environmental Factors Influencing Continuum Alignment

The market-specific configuration of the insurance sector has also been shown to influence care continuum integration. In markets where the insurance sector is both heavily consolidated and willing to experiment with new payment models — like Minnesota and Massachusetts — there has been a much greater emphasis on the development of integrated continuums.

2. What is the economic impact to the host institution associated with the development of more integrated care continuums?

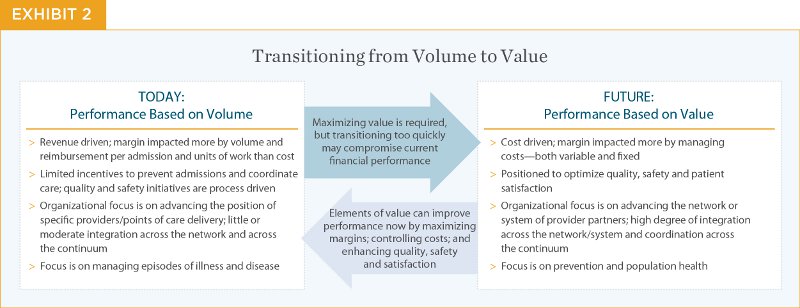

The dichotomy of the existing reimbursement paradigm is a huge issue in determining whether any provider is willing to explore the development of integrated continuums when it cannot economically justify a reduced level of clinical activity. Several hospitals participating in pilot programs that have encouraged care coordination and proactively managed patients outside the hospital in an attempt to lower total costs have been so successful that they have adversely impacted the financial sustainability of the host hospital.

For example, the Park Nicollet system in Minneapolis saved Medicare $12.3 million in 2010 by piloting an innovative care pathway that managed care of heart failure patients across the continuum. Though CMS awarded the institution $5.7 million for their successful demonstration, this was less than half the amount they would have realized had they maintained their old care pathways under the current reimbursement system.

Exhibit 2: Transitioning from Volume to Value

Understanding that the reimbursement paradigm is shifting, hospitals will have to make strategic decisions regarding the financial implications of investing now and getting ahead of the curve versus investing later.

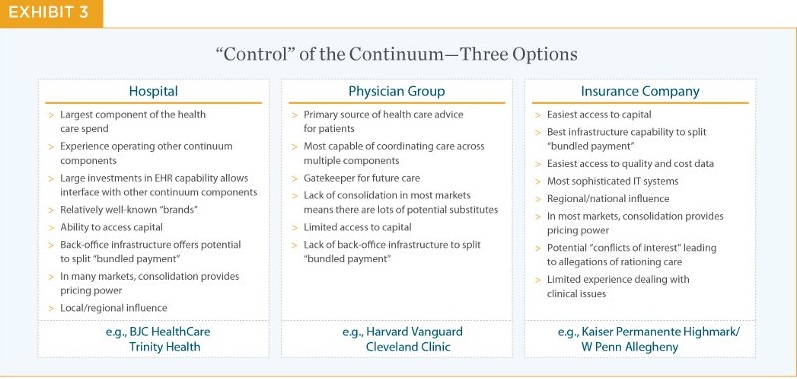

3. Which entity is best suited to “control” the delivery of care across the continuum?

Hospitals have traditionally viewed themselves as being at the center of any care continuum, but there are several arguments for saying that the multispecialty physician group, or even the insurance company, may be better suited for that role.

Exhibit 3: “Control” of the Continuum — Three Options

Conclusion

While the political winds are likely to change, the realities of an aging population, cutting-edge treatment expectations, unsustainable delivery costs, fragmented care and a sluggish economy are indisputable. The need to provide care to more people for less money may be deferred by political expediency, but it can no longer be completely ignored.

In a way, there is a silver lining to the fact that we, as a nation, have painted ourselves into this corner. As futurist Joe Flower pointed out in a recent article, healthcare in the United States faces its own version of the Nash equilibrium. For decades, the optimal solution for each independent provider has been to sustain the status quo — even though that was not the optimal solution for the system as a whole. But there is no longer enough money in the system to support this equilibrium. Systems are more integrated, information is more readily available, patients are more insistent on transparency. Moving forward, hospitals have an opportunity to lead this evolution by virtue of having many of the resources necessary to organize a system, but this will mean building value-based relationships that will benefit all — regardless of the organizational structure. A great deal of the specifics will depend on the characteristics of their markets and hospitals’ willingness to be proactive. Regardless of how these integrated continuums of care evolve, patients will be the big winners.

Farzan Bharucha, Harvey J. Makadon, MD, Shannon Sale, Cole Wheeler and Audrey Yoest are trusted advisors to the nation’s leading hospitals and health systems. They can be reached at farzan.bharucha@kurtsalmon.com and harvey.makadon@kurtsalmon.com.

More Articles From Kurt Salmon:

4 Considerations for Constructing a Hospital

6 Tips for Running an Effective Hospital

Kurt Salmon Partners With StrategicplanningMD