Forming an obligated group allows organizations to combine multiple business lines or assets to create a single entity that becomes jointly and severally liable for debt. In doing so, a group of strong facilities may be able to borrow together at a lower interest rate or make the group more appealing for potential acquisition. Or an organization with, e.g., several hospitals and a single nursing home could combine its hospitals in one obligated group and isolate the nursing home to keep the nursing home’s different risk profile from diluting the credit strength of the hospitals. Obligated groups can also streamline the ability to use bank financing, as all debt becomes parity debt for the investor, and they may also make it easier for a rating agency to evaluate an organization’s overall credit strength.

While frequently employed by larger hospital systems and senior living providers, smaller multi-asset providers are generally less aware of the analyses and considerations that determine which resources should, and should not, be included in an obligated group. Cash flow and operating strength are obvious qualifiers, but geography, payor mix, and each individual facility’s future role must also be considered. No two obligated groups are created the same way for the same reasons.

Many borrowers recognize the flexibility and possibilities offered by an obligated group and choose to utilize the structure as a financial tool. But to others, the concept of an obligated group is introduced during a financing when an organization learns that it must post additional collateral in order to support a debt obligation. Regardless of whether an obligated group is wanted as part of a global debt strategy or needed because a stand-alone facility requires additional support, certain considerations must be taken into account when determining what to include or exclude.

Evaluating the possibilities

The goal of any obligated group is to prudently allocate risk across the organization while optimizing – but not necessarily maximizing – the organization’s borrowing strength. The idea is to create the most efficient borrowing situation possible among the borrowing entities, one that takes into account the future plans for each entity.

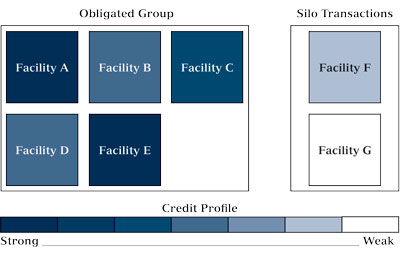

Sometimes this means combining strong entities and isolating weaker entities so they do not dilute the obligated group’s balance sheet (see Figure 1). Other times, this means combining every entity in an organization, including weaker performers, into a single obligor. While the latter can have the effect of reducing a stronger facility’s credit profile compared to what it would look like on its own, this reduction should be offset by the fact that a weaker facility is now able to issue debt at better terms. Since obligated groups are generally created or modified during a financing or refinancing, the borrower can turn to its financial adviser or investment banker/lender to compare the various scenarios.

Choosing which entities to combine and why will be a unique process for each organization. Cash flows and credit profiles are deciding factors, as mentioned above. So, too, is geography: An organization with multiple assisted living facilities across multiple states, for example, might choose to combine its assets into obligated groups by state for Medicaid reimbursement reasons. But a hospital system with facilities in multiple states may find it more productive to combine them all into a single obligor to dilute the credit profile impact of geographic risk factors, such as having several hospitals located in rural areas whose communities are dependent on a single large employer.

Figure 1: An example of an obligated group designed to strengthen the credit profile of the strongest facilities. Weaker credits are financed separately, often with credit enhancement provided by a third party or by the obligated group itself.

The futures of various facilities should also be taken into account. If one property needs considerable renovation and others are up to date, it may be prudent to finance the property needing renovation separately. Properties that are in turnaround situations may also be candidates for exclusion, at least temporarily.

Whether a facility that has been turned around can be easily added into an obligated group depends on the obligated group’s Master Trust Indenture. This document dictates how an obligated group can add or withdraw members, among other terms. Investors who rely on the collateral composition of an obligated group will have to be notified of any significant changes to the collateral that go beyond those stipulated in this governing document. In unforeseen situations not covered in the Master Trust Indenture, changes to an obligated group’s makeup may require that those who have invested in the obligated group’s debt be consulted for a vote, which can be time-consuming, but the Master Trust Indenture will lay out when these permissions are necessary.

Mastering the Master Trust Indenture

The Master Trust Indenture is an umbrella document that outlines the borrowing mechanics and covenants that affect every obligated group member on all future debt financing.

The Master Trust Indenture is by necessity a complex document, as it is custom created to accommodate the unique characteristics and goals of each obligated group. This complexity can be off-putting for organizations that have never worked with such a document, but a strong borrower attorney and investment banker will craft the language together on behalf of the organization and ensure the stewards of the obligated group understand it.

It is important to remember that the Master Trust Indenture governs not just physical buildings, but the movement of assets (including cash, investments, equipment and inventory) into or out of them. The borrower, investment banker and attorney must prepare properly and plan ahead to ensure that what can be a very borrower-friendly document provides the flexibility to manage future growth (or contraction). For example:

* The strongest property in a five-facility assisted living group has historically provided daily cash transfers to a facility with a higher Medicaid census in a state with lower Medicaid reimbursement. In forming an obligated group of all five properties, the Master Trust Indenture is written to stipulate that this cash transfer be continued so the new obligated group does not disrupt operations.

* A three-hospital system consisting of a mid-size acute care facility and two critical access hospitals recognizes that inpatient census at one critical access hospital has declined dramatically, while swing bed utilization has increased, and it may convert the facility to skilled nursing. The Master Trust Indenture outlines the circumstances under which an entity within the group can be repurposed and its respective assets can be redistributed without triggering a bondholder vote.

Additional considerations

Having a strategic plan will help in the crafting of a borrower-friendly Master Trust Indenture. Similarly, organizations that have planned ahead with regard to board governance and financial reporting will have an easier time implementing an obligated group structure. Organizations with multiple boards will have to consider how to integrate these regulating bodies and reassign responsibilities. Information technology and financial reporting will also be a concern, as individual business ventures may not yet be operating under the same systems. The organization’s chief financial officer will need to be aware of the operations of the obligated group as a whole in order to continually monitor the obligated group’s credit profile and any debt covenant considerations.

Every obligated group is different and will have various structuring possibilities, but working with an attorney and investment banker who understand the long-term goals of the organization and the implications of each permutation will help in creating an understandable tool that optimizes borrowing strength and appropriately allocates risk.