To reduce bad debt so expected revenue comes in this year, consider the impact of uncompensated care costs and whether your revenue recovery efforts effectively address them. Improving these two factors could be your springboard to success in 2024.

Uncompensated Care in 2023

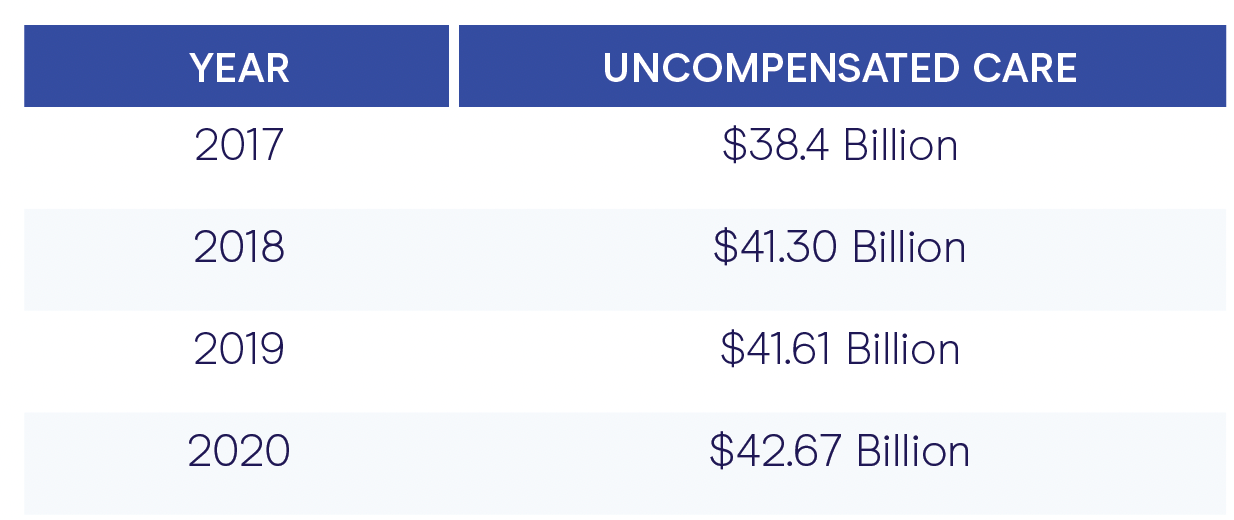

Uncompensated care costs are staggering and still rising steadily. According to the American Hospital Association’s (AHA) annual survey, hospitals have lost more than $745 billion in uncompensated care between 2000 and 2020. The table below shows rising costs over time.

In 2023, uncompensated care costs were even higher, in part due to Medicaid redetermination, the process by which the Centers for Medicare & Medicaid Services reinstated Medicaid renewals following the COVID-19 pandemic. Since March 2020, patients have had their coverage automatically renewed. But in 2023 that process stopped, leaving millions without coverage for varying reasons.

Consequently, hospitals have seen a rise in self-pay patients and, subsequently, uncompensated care. According to the AHA, uncompensated care rates rose from 6.4 percent in Q1 2023 to 8.7 percent in July 2023, a one-third increase.

The AHA also found that more than half of hospitals saw negative operating margins at the close of 2022. For your hospital’s profitability, recovering reimbursement is more important than ever.

What Can Be Done to Improve This Year?

Most hospitals and health systems have an existing insurance discovery solution. Insurance discovery, or the process of combing all available insurance sources for a claim with unreported insurance, is a main source of revenue recovery. Ineffectively searching for insurance (or not searching at all) can drastically reduce compensation and leave money on the table.

Not all services are created equal, and what was high performing one to two years ago could be underperforming today. Administrators owe it to themselves and their organizations to conduct an audit as part of any assessment. Running performance audits will help flag areas for improvement in 2024.

When evaluating your insurance discovery solution and running an audit, be sure to examine the following:

-

Hit rates: How successful is your insurance discovery solution? What did the solution find, or how many “hits” did it get for your claim?

-

Claims recovered: How many previously uninsured claims were recovered after running through your insurance discovery solution?

-

Overall financial impact: Is your solution worth the money? Is the investment paying for itself in its success, or is it having zero effect on your bottom line?

Consider an insurance discovery solution that provides a free assessment to evaluate what is still available for you to capture.

Analyzing Assessment Results

Audit findings will almost certainly lead to changes because the healthcare industry is always evolving. This causes points of failure in technology that demand continuous innovation. If not treated as a “living” solution, systems will crack, causing revenue leakage.

If your assessment finds that your insurance discovery solution is underperforming, consider adopting a run-behind solution like Insurance Discovery by Office Ally. This software can work alongside existing processes and solutions without interruption (so you can continue business as usual) to help you find missed revenue recovery opportunities.

Get a Free Insurance Discovery Assessment

Start 2024 with a free Insurance Discovery assessment from an industry-leading team of specialists at Office Ally. With just a basic file export, this free assessment finds coverage that was missed by your existing discovery tool.

This assessment is 100 percent risk-free. There is no up-front cost, and you only pay if Office Ally helps you recover revenue. Implementation is simple and results in a complete and trusted back-end revenue recovery loop with guaranteed results.

Start the new year strong by aligning your revenue recovery efforts with the hospital’s budget and financial goals. With the right tools and strategies, 2024 can be the year your team takes control of uncompensated care.