Most people learn what they know about health insurance on the job, when they use their employers' health plans.

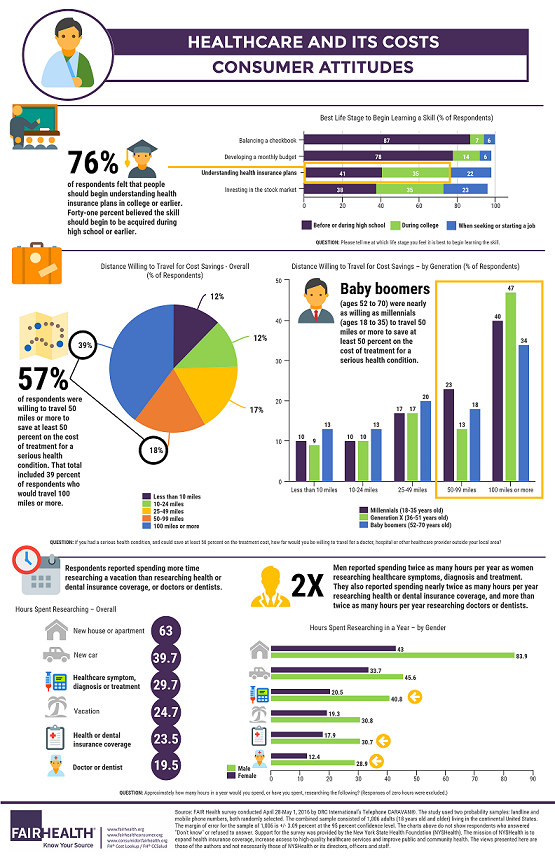

But, in a nationwide consumer survey conducted this year for FAIR Health by ORC International,1 76 percent of respondents felt that was too late. In their view, people should begin understanding health insurance plans before or during high school or college. Forty-one percent thought the skill should begin to be acquired in high school or earlier. The full survey report, Healthcare and Health Insurance Choices: How Consumers Decide, is being released this month, along with the infographic below.

These findings suggest that there is a great, unsatisfied public appetite for information on health insurance. The healthcare system has changed in ways that are making greater demands on consumers' pocketbooks and their ability to assess and choose health plans. The federal and state Health Insurance Marketplaces invite consumers to shop for coverage, but consumers may not be equipped to understand the fine points of insurance benefit design, such as high-deductible health plans, narrow networks and complex cost-sharing responsibilities.

Other survey findings support the conclusion that consumers want more information about how much they should pay for healthcare and are unsure of where to find it. When asked to name their most trusted source of information about healthcare costs, none of the options presented garnered more than a third of respondents' support. Interestingly, healthcare nonprofit sources were a strong choice overall, at 24 percent (second only to medical groups or hospital organizations, at 26 percent), and were the first choice for respondents aged 36 to 70 years, at 27 percent.

When asked how many hours in a year they spend, or have spent, researching various topics (with responses of zero hours excluded), respondents answered that they spend more time researching a vacation (24.7 hours) than researching health or dental insurance coverage (23.5 hours). That could be because consumers do not fully understand the consequences of selecting a health plan, but it also could be due to a lack of understandable, accessible health insurance information comparable to the information available on vacations.

Since consumers appear to feel they learned about health insurance too late, and that they are unsure of where to find the information about health insurance and healthcare costs that they need now, what is to be done? Perhaps health insurance concepts should be introduced in high school or earlier—so that students learn not only their ABCs but also their HMOs and PPOs. For consumers already out of school, greater access to comprehensible, unbiased information about health insurance would seem to be warranted. According to survey respondents, nonprofit organizations are one of the more trusted sources for information about healthcare costs. FAIR Health, a national, independent, nonprofit organization dedicated to bringing transparency to healthcare costs and health insurance information, already offers consumers cost transparency tools and educational resources about health insurance on its English and Spanish consumer websites and mobile apps.

The time is right for legislators and policy makers to talk about how best to meet the strong consumer demand for information on health insurance and integrate such information into the educational system. We hope that our survey report, available here, and the infographic below can help inform that conversation.

Robin Gelburd, JD, is the president of FAIR Health, a national, independent nonprofit with the mission of bringing transparency to healthcare costs and insurance reimbursement. FAIR Health maintains a national database of billions of healthcare claims; the data populate products, custom analytics, data visualizations and interactive dashboards for health plans, government, healthcare systems, providers, unions and employers. FAIR Health also uses its database to power an award-winning website that enables consumers to estimate their healthcare expenditures and increase their health insurance literacy. In addition, FAIR Health's data serve as a referenced benchmark in statutes, regulations and official memoranda and as a research platform in furtherance of academic research, policy making and analysis.

1 FAIR Health's survey was conducted April 28-May 1, 2016 by ORC International's Telephone CARAVAN®. The study used two probability samples: landline and mobile phone numbers, both randomly selected. The combined sample consisted of 1,006 adults (18 years old and older) living in the continental United States. The margin of error for the sample of 1,006 is +/- 3.09 percent at the 95 percent confidence level. Support for the survey was provided by the New York State Health Foundation (NYSHealth). The mission of NYSHealth is to expand health insurance coverage, increase access to high-quality healthcare services and improve public and community health. The views presented here are those of the author and not necessarily those of NYSHealth or its directors, officers and staff.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.