The article below is reprinted with permission from The Capital Issue, a quarterly newsletter published by Lancaster Pollard.

Many non-profit organizations have failed to construct portfolios with sufficient inflation protection because inflation has been relatively tame over the past 20 or so years. As a result, their assets are exposed to a reduction in purchasing power over time. In order to address this risk, non-profit organizations should consider a long-term, strategic allocation to asset classes that benefit from inflation, such as commodities, Treasury Inflation-Protected Securities and real estate investment trusts.

Impact of inflation

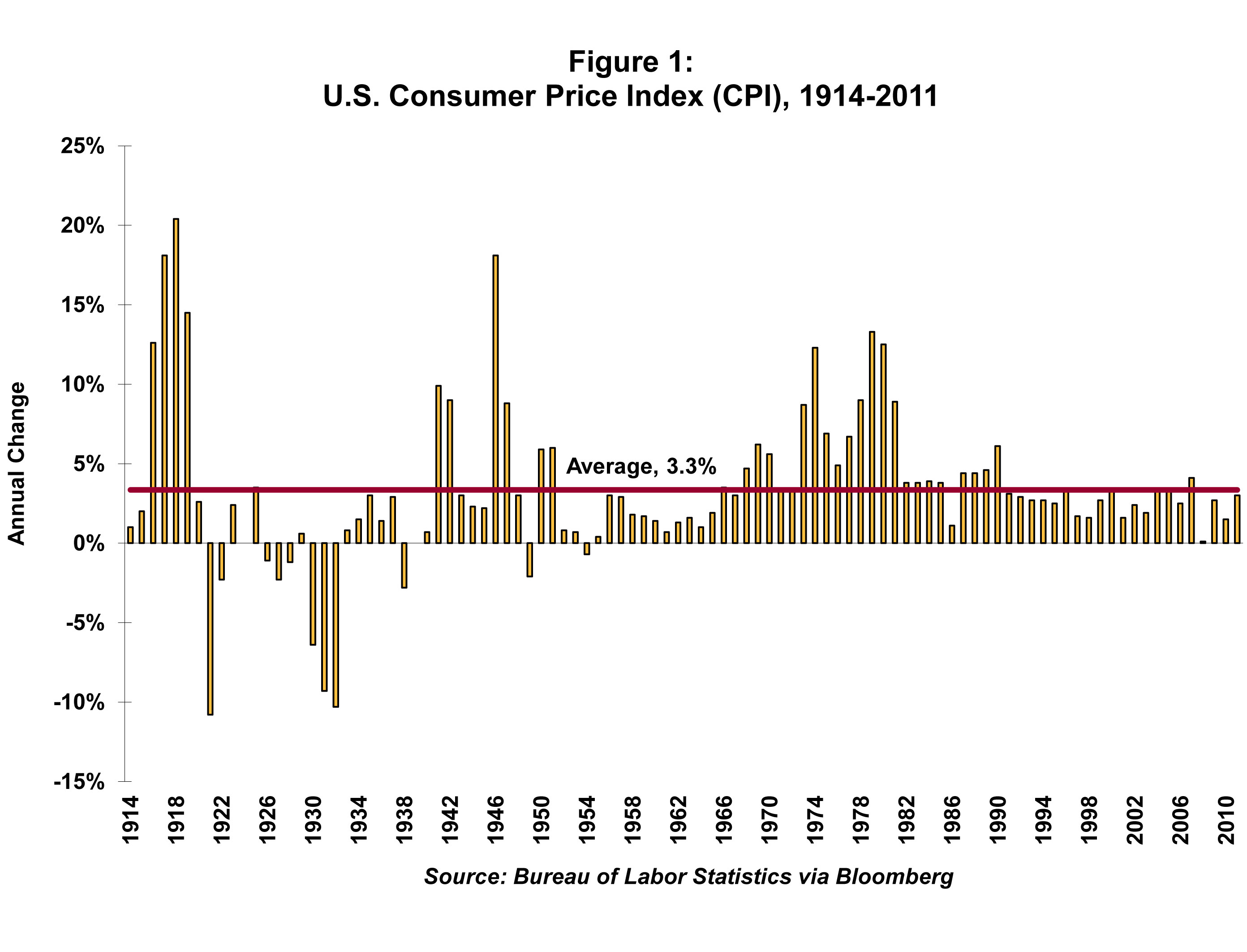

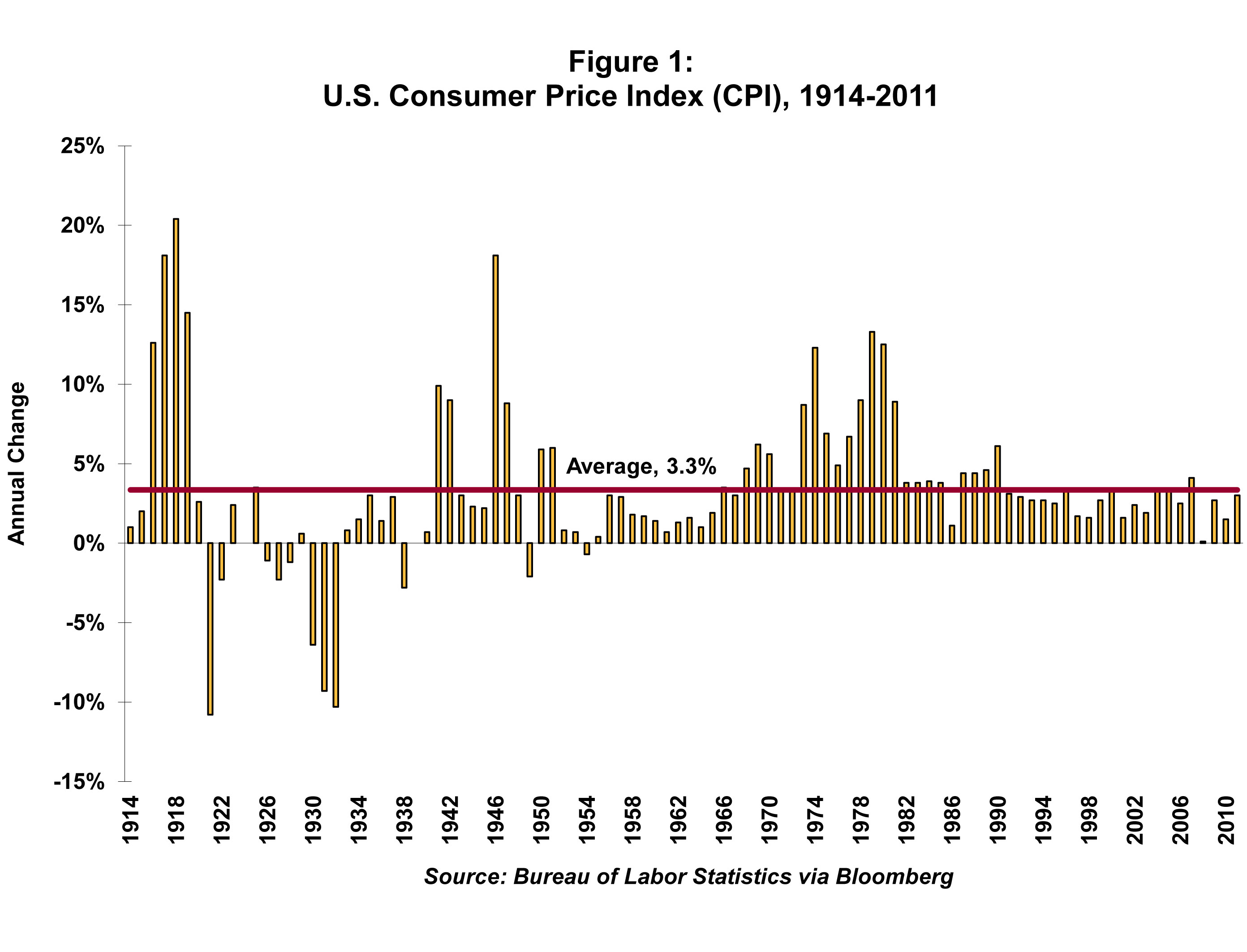

Defined simply, inflation is a rise in the prices of goods and services over time, while deflation is the opposite, a decline in prices. Most investors measure inflation using the U.S. Consumer Price Index, which is a basket of more than 200 goods and services that the U.S. Bureau of Labor Statistics uses to measure inflation on a monthly basis. Since the inception of the index in 1914, inflation has averaged 3.3% per year. (See Figure 1.) With the exception of 2007, inflation has remained at or below its long-term historical average since 1991. Furthermore, the United States has not experienced deflation since 1954.

Figure 1: U.S. Consumer Price Index

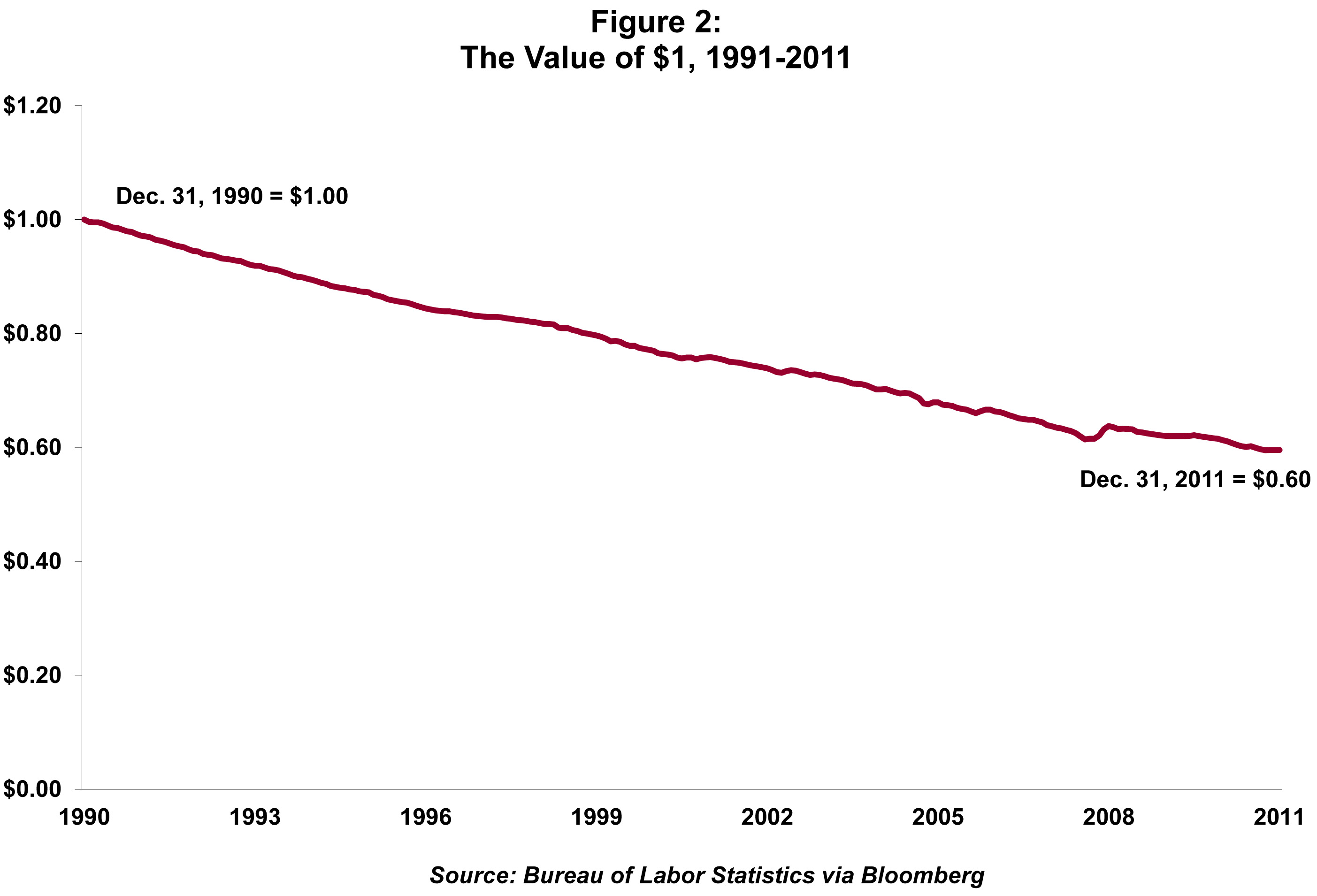

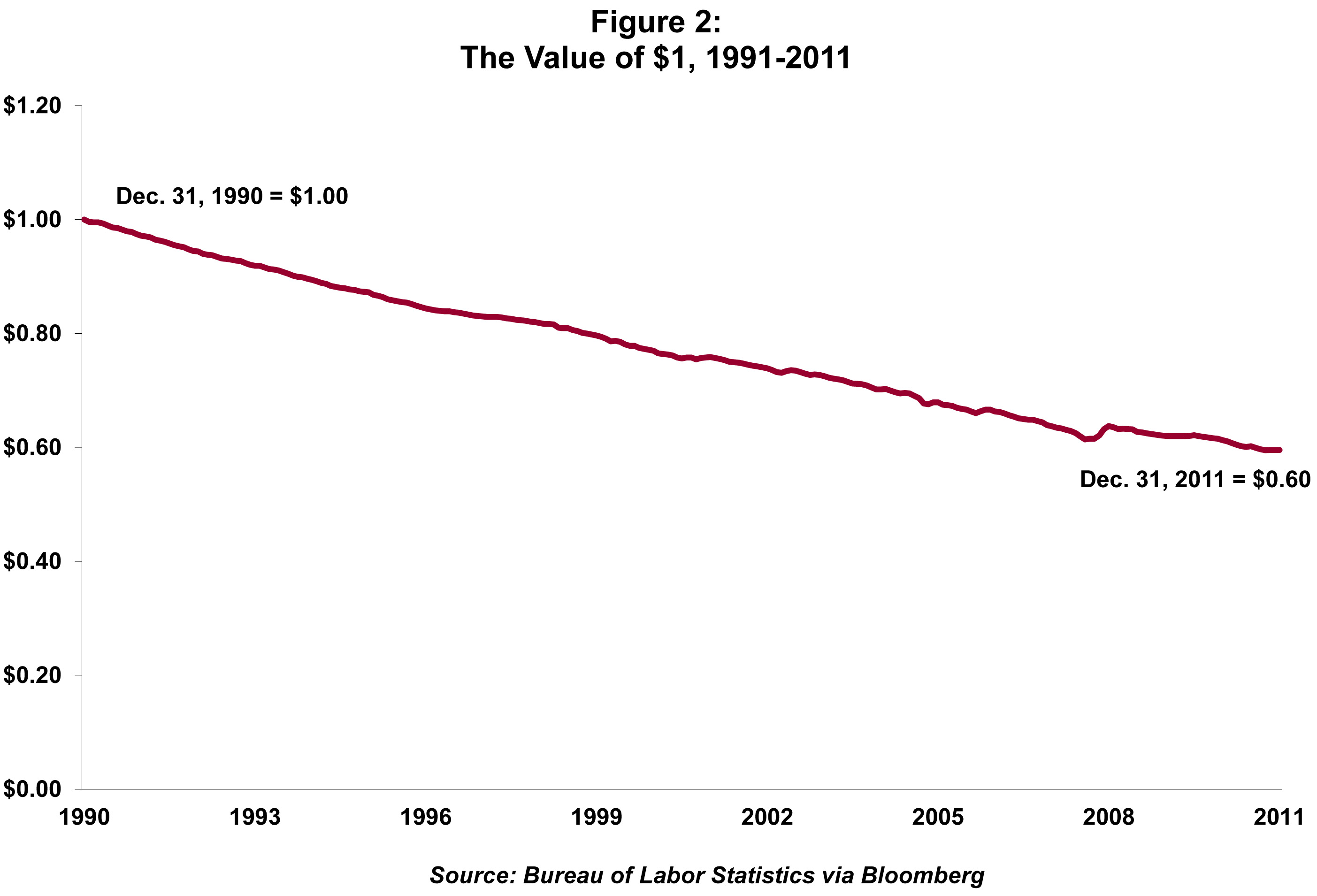

Although it has been relatively tame over the past 20 years, inflation is a constant risk that many non-profit organizations face due to their long-term investment horizons. For example, most, if not all, non-profit organizations seek to operate in perpetuity; therefore, over time, inflation erodes the purchasing power of an organization’s assets, such that $1 spent 10 years from now cannot purchase the same amount of goods and services as $1 spent today. This point can be illustrated with a simple example. During the 21-year period 1991-2011, when inflation was at or below its long-term historical average in every year except one, the value of $1 at the end of 1990 fell to just $0.60 by the end of 2011. (See Figure 2.) Put another way, $1 at the end of 2011 could purchase just 60 percent of the goods and services that $1 could purchase at the end of 1990.

Figure 2: The Value of $1

Inflation hedges

Inflation can be thought of as a "silent tax," and even during periods of relatively tame inflation, purchasing power can be eroded significantly; therefore, nonprofit organizations should focus on ways in which they can protect their portfolios from the negative impact of inflation. One way they can do this is to invest in asset classes that often serve as the source of higher inflation, such as commodities, or asset classes that benefit directly from higher inflation, such as TIPS and REITs.

Commodities

Commodities are real assets (i.e. tangible assets), many of which serve as the raw materials used to produce goods, the food we consume or the energy we utilize. The primary commodity sectors as well as examples of specific commodities within each include: energy (oil, gasoline, natural gas); industrial metals (copper, aluminum, nickel); precious metals (gold, silver); agriculture (corn, wheat, soybeans, cotton); and livestock (cattle, hogs).

Commodity investments can be a good inflation hedge primarily because commodities themselves often serve as the key drivers of rising inflation, particularly food and energy commodities. For example, an increase in the price of corn or cattle can lead to higher food prices, which comprises more than 14 percent of the index, while rising energy prices, which comprise almost 10 percent of the index, increase the cost of traveling or heating your home or office. As a result, an investment in a broad-based commodity strategy can benefit from higher inflation due to rising commodity prices.

TIPS

TIPS are bonds issued by the U.S. Treasury that are backed by the full faith and credit of the U.S. government. Although the market price of TIPS can fluctuate due to changes in interest rates, the principal of TIPS increases with inflation and decreases with deflation, unlike U.S. Treasuries. TIPS pay interest twice a year, at a fixed rate; however, the rate is applied to the adjusted principal, so like the principal, interest payments rise with inflation and fall with deflation. When TIPS mature, investors receive the inflation-adjusted principal or the original principal amount, whichever is greater.

A simple example illustrates how TIPS work. Say an investor purchases TIPS directly from the U.S. Treasury with a 5-year maturity, a principal value of $1 million and an annual interest rate of 2% paid semiannually. Assuming inflation increases 1% over the first six months, the principal amount of the investor’s TIPS would be adjusted to $1.01 million. The semiannual interest payment due to the investor would be $10,100, which is equal to 1% (half of the annual interest rate of 2%) multiplied by the inflation-adjusted principal of $1.01 million. Additionally, assuming inflation is 2% each year over the 5-year life of the bond, the investor would receive about $1.104 million at maturity, which is the inflation-adjusted principal. As a result of this structure, TIPS provide investors with inflation protection because both interest payments and the principal repaid at maturity increase with inflation.

REITs

REITs are companies that are involved in the commercial real estate industry, which is defined as income-producing real estate and excludes single-family homes or other types of privately held real estate that does not produce income. There are three types of REITs: equity, mortgage and hybrid. Equity REITs own and manage commercial properties, mortgage REITs own mortgages secured by real estate and hybrid REITs are a combination of the two. In addition, REITs are typically comprised of the following types of properties: apartments; malls and shopping centers; health care; office; industrial; self-storage; and hotels. REITs are required by law to pay out at least 90 percent of their taxable income in the form of dividends, which results in REITs having a higher dividend yield than the broad equity market.

REITs protect portfolios from rising inflation due to the structure of commercial real estate leases. For example, leases for properties, such as offices, malls and industrial building, are for longer periods, typically 5-10 years, and include an automatic inflation escalator that increases the amount of rent tenants pay each year by an amount not less than the annual rate of inflation. Therefore, if investors use an allocation to REITs in order to provide inflation protection, they should focus exclusively on equity REITs rather than mortgage REITs or hybrid REITs. Doing so should provide investors with exposure to the ownership of commercial real estate and ultimately the benefit of rising rents due to higher inflation.

Although not a significant issue over the past 20 years, inflation remains a risk with which non-profit organizations should be concerned because it acts as a "silent tax" that reduces the purchasing power of their assets over time. Non-profit organizations can mitigate this risk, however, by allocating to asset classes that benefit from inflation, such as commodities, TIPS, and REITs. Doing so should allow these organizations to focus on advancing their mission rather than worrying about the impact of inflation on the spending power of their assets.

Many non-profit organizations have failed to construct portfolios with sufficient inflation protection because inflation has been relatively tame over the past 20 or so years. As a result, their assets are exposed to a reduction in purchasing power over time. In order to address this risk, non-profit organizations should consider a long-term, strategic allocation to asset classes that benefit from inflation, such as commodities, Treasury Inflation-Protected Securities and real estate investment trusts.

Impact of inflation

Defined simply, inflation is a rise in the prices of goods and services over time, while deflation is the opposite, a decline in prices. Most investors measure inflation using the U.S. Consumer Price Index, which is a basket of more than 200 goods and services that the U.S. Bureau of Labor Statistics uses to measure inflation on a monthly basis. Since the inception of the index in 1914, inflation has averaged 3.3% per year. (See Figure 1.) With the exception of 2007, inflation has remained at or below its long-term historical average since 1991. Furthermore, the United States has not experienced deflation since 1954.

Figure 1: U.S. Consumer Price Index

Although it has been relatively tame over the past 20 years, inflation is a constant risk that many non-profit organizations face due to their long-term investment horizons. For example, most, if not all, non-profit organizations seek to operate in perpetuity; therefore, over time, inflation erodes the purchasing power of an organization’s assets, such that $1 spent 10 years from now cannot purchase the same amount of goods and services as $1 spent today. This point can be illustrated with a simple example. During the 21-year period 1991-2011, when inflation was at or below its long-term historical average in every year except one, the value of $1 at the end of 1990 fell to just $0.60 by the end of 2011. (See Figure 2.) Put another way, $1 at the end of 2011 could purchase just 60 percent of the goods and services that $1 could purchase at the end of 1990.

Figure 2: The Value of $1

Inflation hedges

Inflation can be thought of as a "silent tax," and even during periods of relatively tame inflation, purchasing power can be eroded significantly; therefore, nonprofit organizations should focus on ways in which they can protect their portfolios from the negative impact of inflation. One way they can do this is to invest in asset classes that often serve as the source of higher inflation, such as commodities, or asset classes that benefit directly from higher inflation, such as TIPS and REITs.

Commodities

Commodities are real assets (i.e. tangible assets), many of which serve as the raw materials used to produce goods, the food we consume or the energy we utilize. The primary commodity sectors as well as examples of specific commodities within each include: energy (oil, gasoline, natural gas); industrial metals (copper, aluminum, nickel); precious metals (gold, silver); agriculture (corn, wheat, soybeans, cotton); and livestock (cattle, hogs).

Commodity investments can be a good inflation hedge primarily because commodities themselves often serve as the key drivers of rising inflation, particularly food and energy commodities. For example, an increase in the price of corn or cattle can lead to higher food prices, which comprises more than 14 percent of the index, while rising energy prices, which comprise almost 10 percent of the index, increase the cost of traveling or heating your home or office. As a result, an investment in a broad-based commodity strategy can benefit from higher inflation due to rising commodity prices.

TIPS

TIPS are bonds issued by the U.S. Treasury that are backed by the full faith and credit of the U.S. government. Although the market price of TIPS can fluctuate due to changes in interest rates, the principal of TIPS increases with inflation and decreases with deflation, unlike U.S. Treasuries. TIPS pay interest twice a year, at a fixed rate; however, the rate is applied to the adjusted principal, so like the principal, interest payments rise with inflation and fall with deflation. When TIPS mature, investors receive the inflation-adjusted principal or the original principal amount, whichever is greater.

A simple example illustrates how TIPS work. Say an investor purchases TIPS directly from the U.S. Treasury with a 5-year maturity, a principal value of $1 million and an annual interest rate of 2% paid semiannually. Assuming inflation increases 1% over the first six months, the principal amount of the investor’s TIPS would be adjusted to $1.01 million. The semiannual interest payment due to the investor would be $10,100, which is equal to 1% (half of the annual interest rate of 2%) multiplied by the inflation-adjusted principal of $1.01 million. Additionally, assuming inflation is 2% each year over the 5-year life of the bond, the investor would receive about $1.104 million at maturity, which is the inflation-adjusted principal. As a result of this structure, TIPS provide investors with inflation protection because both interest payments and the principal repaid at maturity increase with inflation.

REITs

REITs are companies that are involved in the commercial real estate industry, which is defined as income-producing real estate and excludes single-family homes or other types of privately held real estate that does not produce income. There are three types of REITs: equity, mortgage and hybrid. Equity REITs own and manage commercial properties, mortgage REITs own mortgages secured by real estate and hybrid REITs are a combination of the two. In addition, REITs are typically comprised of the following types of properties: apartments; malls and shopping centers; health care; office; industrial; self-storage; and hotels. REITs are required by law to pay out at least 90 percent of their taxable income in the form of dividends, which results in REITs having a higher dividend yield than the broad equity market.

REITs protect portfolios from rising inflation due to the structure of commercial real estate leases. For example, leases for properties, such as offices, malls and industrial building, are for longer periods, typically 5-10 years, and include an automatic inflation escalator that increases the amount of rent tenants pay each year by an amount not less than the annual rate of inflation. Therefore, if investors use an allocation to REITs in order to provide inflation protection, they should focus exclusively on equity REITs rather than mortgage REITs or hybrid REITs. Doing so should provide investors with exposure to the ownership of commercial real estate and ultimately the benefit of rising rents due to higher inflation.

Although not a significant issue over the past 20 years, inflation remains a risk with which non-profit organizations should be concerned because it acts as a "silent tax" that reduces the purchasing power of their assets over time. Non-profit organizations can mitigate this risk, however, by allocating to asset classes that benefit from inflation, such as commodities, TIPS, and REITs. Doing so should allow these organizations to focus on advancing their mission rather than worrying about the impact of inflation on the spending power of their assets.

More Articles From Lancaster Pollard:

Opportunity Knocking: Taking Advantage of Low Short-term Interest Rates

The Importance of a Strong Investment Policy Statement

Becoming a (Financially Stable) System