Executive Summary

Benchmarking is foundational in healthcare, used to measure performance across patient care, operations, finance, and compliance. Key performance indicators (KPIs) bring structure and clarity to this process, allowing health systems to track progress and compare against peers or national standards. Operational benchmarks like average length of stay, bed occupancy rate, emergency department throughput and nurse-to-patient ratios highlight how efficiently resources are managed. On the compliance front, hospitals track CMS Star Ratings, Joint Commission audit outcomes and HIPAA-related incidents to ensure regulatory adherence and reduce risk. Financial health is monitored through indicators such as operating margin, cost per discharge, days cash on hand and denial rates. These KPIs collectively enable hospital leaders to make data-driven decisions that enhance performance, control costs and deliver high-quality care.

- Boise, Idaho based St. Luke’s Regional Medical Center reported a 14.8% readmission rate for heart failure patients.

- In 2025, The Joint Commission unveiled their new SAFER® Peer Benchmarking tool, allowing organizations to compare their survey results against similar organizations.

- Intermountain Health reported a 6.5% operating margin over the first quarter of 2025.

Similarly, in healthcare real estate, benchmarking provides critical insights that drive portfolio optimization, compliance and cost control.

Are You Maximizing Your Portfolio’s Utility?

Real estate represents a significant cost center for health systems – one that is frequently targeted for reduction through consolidation or operational efficiency initiatives. While such strategies are often led by clinical or operational decision-making, real estate leaders play a critical role in executing these plans. Equally important to reducing footprint size, however, is ensuring that existing space is fully optimized.

Clinic efficiency analyses offer valuable insights into how effectively each site is being utilized. These evaluations can uncover opportunities to increase patient throughput or identify underused blocks of time that may support additional specialty services without expanding the current portfolio.

Understanding the local and downstream margin contribution of each site provides a holistic view of location-specific value. Key performance indicators such as Margin per Square Foot (Margin/SF) and work Relative Value Units (wRVUs) per Provider Full-Time Equivalent (FTE) enable health systems to identify areas for operational improvement. Furthermore, metrics like Margin per Annual Rent (Margin/Rent) establish benchmarks that can inform and strengthen lease negotiation strategies, ultimately contributing to a more cost-effective and high-performing real estate portfolio.

Compliance Benchmarking

Similar processes can be used to ensure every transaction is benchmarked not just for market alignment, but also for regulatory adherence:

- Stark Law & Anti-Kickback safe harbor assessments

- FMV (Fair Market Value) documentation

- Compliance-ready audit trails

This prevents costly regulatory risk and supports transparency.

The Value of Benchmarking to Control Cost in Healthcare Real Estate

Just as hospitals use benchmarking to uncover performance gaps and establish improvement goals, applying the same discipline to real estate data can yield actionable insights that drive portfolio optimization. By evaluating a site’s Margin/SF in the context of portfolio-wide benchmarks, real estate leaders can more accurately set target Margin-to-Rent ratios. This data-informed approach strengthens lease negotiation strategies and supports the pursuit of more financially sustainable outcomes.

Systematically collecting, indexing and cataloging comparable lease data across the market equips organizations with the critical insights needed to negotiate lease terms based on objective analysis, rather than anecdotal evidence. By benchmarking current or proposed rental rates against both historical data and real-time market trends, providers can uncover potential cost savings and engage in negotiations with a clear understanding of market dynamics. This data-driven approach enhances negotiating power and supports more informed, strategic decision-making.

Colliers’ Strategic Benchmarking Delivers Measurable Real Estate Outcomes

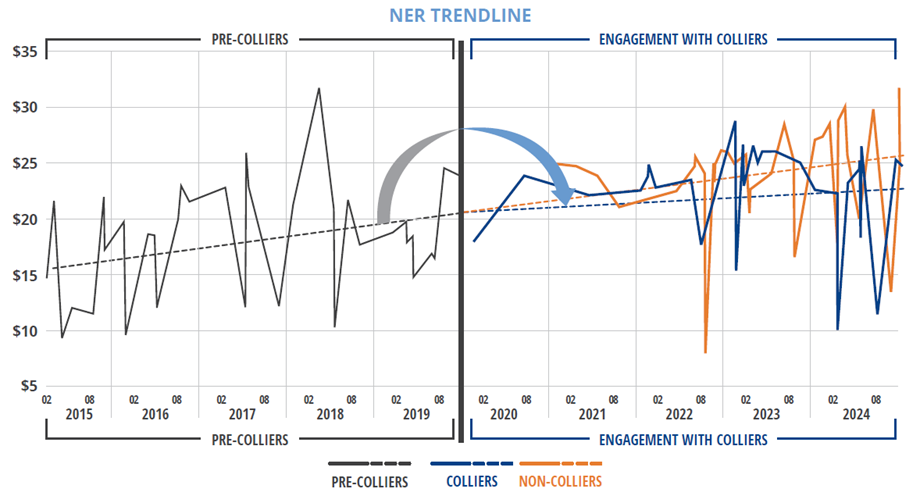

In the same way hospitals benchmark clinical and operational performance, Colliers benchmarks every lease and property decision against a robust set of market comparables, which are then indexed into meaningful, standardized datapoints. These insights empower clients to make informed, defensible, and financially sound decisions. As depicted in the chart below, the process has delivered an average savings of 7.8% compared to prevailing Net Effective Rent (NER) market rates.

Source: Colliers

Colliers recently performed a longitudinal analysis of NER performance of a client portfolio. The five-year trendline before and after their engagement with Colliers shows a noticeable inflection beginning in 2020 – the point when Colliers was engaged and began implementing the data centric approach. We successfully shifted the economic trajectory of the health system’s portfolio. This system was also able to benefit from 1.0 FTE reduction, while also unlocking additional value through annual rebates.

Source: Colliers

Conclusion: Strategic Benchmarking Drives Value

At Colliers Healthcare Services, we apply data-driven benchmarking to NER across markets and asset types. This enables our clients to achieve meaningful savings. Now is the time to move beyond reactive lease renewals and legacy cost structures. By integrating benchmarking into your real estate strategy, your organization can unlock hidden value, reduce unnecessary spend, and strengthen compliance—all while supporting broader financial objectives. Colliers brings the data, discipline, and healthcare expertise to help you achieve measurable results. Let’s start a conversation about how we can align your real estate portfolio with your system’s strategic and financial goals.

For more information:

Brian Bruggeman, CCIM, SIOR

Senior Vice President | Minneapolis

Healthcare Fellow

brian.bruggeman@colliers.com

952.837.3079

Copyright © 2025 Colliers

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report.