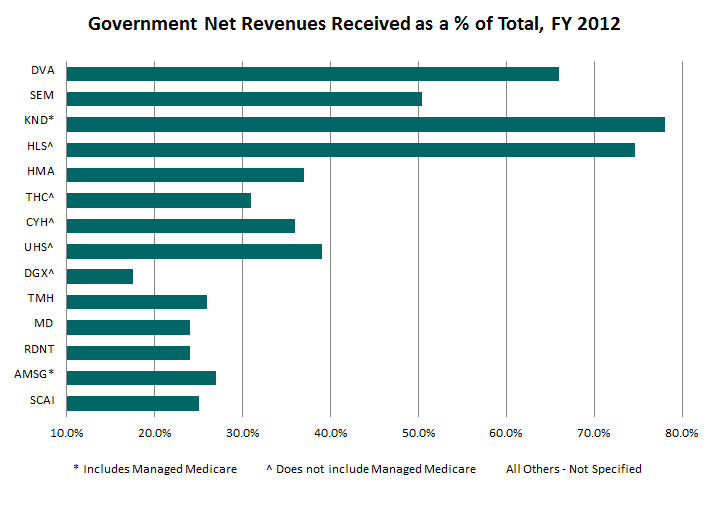

The chart below utilizes information from publicly traded healthcare companies to show the percentage of net revenue that these companies receive from government payers.

As the chart illustrates, the percentage of business generated through government payers ranged from a low of 16.2 percent (Quest Diagnostics) to a high of 78.0 percent (Kindred Healthcare), with a median of 36.0 percent and a mean of 36.5 percent. Post-acute providers, such as Kindred Health, take care of patients of more advanced age. Lab companies, such as LabCorp and Quest Diagnostics, focus on commercial payers while deferring government lab studies to hospitals.

There are many reasons to analyze the percentage of revenue generated by government payers, such as Medicare, when performing valuations in the healthcare industry. By understanding the percentage of revenue generated by government payers, one can benchmark that information to a subject company. Comparing the subject company to the industry averages can provide a better understanding of the subject company's strategy and patient demographics. In addition, government reimbursement for Medicare is directly affected by government policy. Changes to Medicare reimbursement rates have an immediate impact on reimbursement. Commercial payers often base payments on Medicare reimbursement rates. As a result, a change in governmental reimbursement rates will have not only an immediate effect on the revenues of a subject healthcare entity, but also a potential future change as the entity renegotiates contracts with commercial payers.

When benchmarking payer data from public companies, it is important to understand the metrics used in the analysis, as well as which reimbursement plans are included as government payers. Public companies can report the payer mix as a percentage of different metrics including, but not limited to: patient-related volume, gross revenue, net revenue, and accounts receivable. In addition, some public companies include third-party managed Medicare (such as Medicare Advantage) as government payers. However, other public companies will consider those reimbursement plans as commercial. To ensure that the dataset is comparable, we only included companies who report government payer mix as a percentage of net revenue as well as information regarding the inclusion of managed Medicare in the analysis.

When valuing a healthcare services enterprise, it is important for the valuation analyst to note these data differences and understand the related risks inherent in each revenue stream.