With the declining inpatient focus for many health systems, the ambulatory enterprise must increasingly financially stand on its own. Successful business plans will balance the roles of the ambulatory enterprise and build a realistic financial model.

Ambulatory Investment Drivers

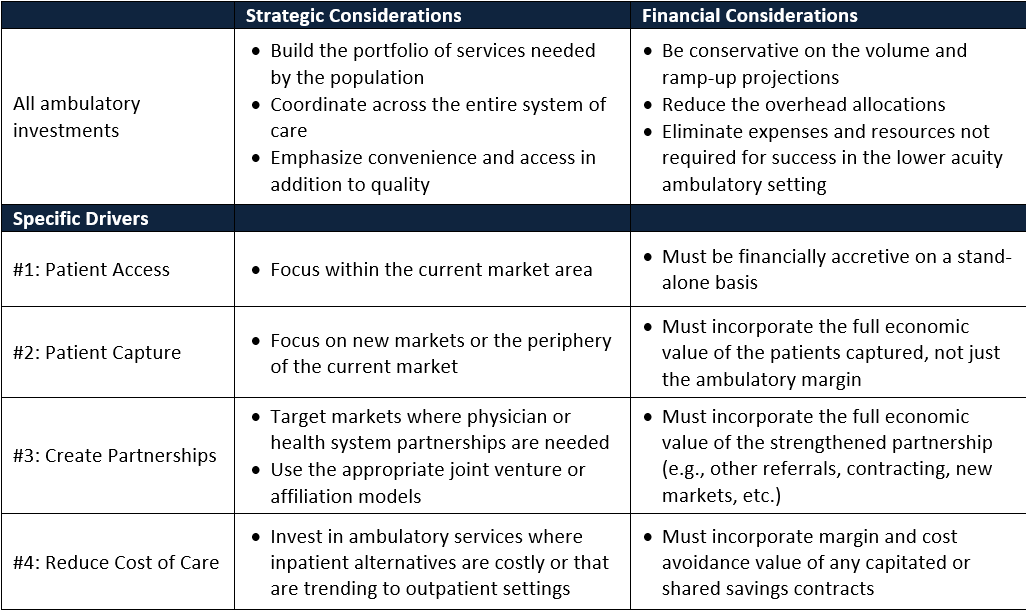

In the current environment there are at least four major ambulatory development drivers: access, patient capture/feeder, other provider partnerships, and cost of care reduction.

Driver #1: Creating new access points

Ambulatory services accounts for more than 95% of the total healthcare encounters. As such, growth requires many more ambulatory access points. Moreover, as patients have a much higher expectation of convenience in the ambulatory environment, these ambulatory access points must be located throughout the market and easily accessible.

Driver #2: Capture new patients to feed the health system

Ambulatory services require a smaller critical mass than hospitals and as a result can be used to enter new markets and connect patients with the health system. Often in these new markets, the downstream referrals can support the start-up costs incurred to enter a new market.

Driver #3: Building partnerships with other providers

Ambulatory investments can spur new partnerships in two major ways. First, investing through joint ventures with physicians can create stronger physician relationships as economic alignment increases. Second, through developing ambulatory services in competitive outlying markets, the potential to gain referrals from the ambulatory development provides incentives for health systems to form broader partnerships with the developing health system.

Driver #4: Reducing the total cost of care

Reducing the total cost of care requires better care management, coordination, and more efficient processes. Ambulatory locations often provide the one of the tools to create these efficient, coordinated care protocols. The lower investment costs, fewer regulations, and reduced complexity mean services in an ambulatory setting can be delivered at a much lower total cost.

Balancing Drivers and Expectations

The successful business plan will balance these major drivers to create realistic expectations of the ambulatory investment’s impact. Creating realistic models is important because it forms the foundation for the metrics with which the investment will be measured. In all cases, the business plan for ambulatory services must be treated different from the inpatient and hospital-based investments. In the ambulatory investments, margins are often in total size smaller and thus errors in development costs, ramp-up, pricing, etc. cannot be as easily accommodated after the opening. Additionally, because the complexity and acuity is far less than the inpatient setting, the management infrastructure needed should be significantly less. This means hospital-level overhead allocations are not appropriate for ambulatory settings where a much larger portion of the total resources used are direct cost resources.

The specific drivers also make a difference in how the returns and future expectations should be modeled (see table below). For instance, if the primary driver is new access points (driver #1), the ambulatory business model should financially stand on its own; whereas if the primary driver is capturing new patients (driver #2), the ambulatory business model should take into account the full economic value of the new patients being captured. In each case, the successful ambulatory investments take into account the driver primacy and approach the case with realistic expectations. Health systems that can clearly articulate the drivers and realistic expectations will create the best investment environments and be positioned to make the most of their ambulatory investments.

Kate Lovrien and Luke C. Peterson are principals at Health System Advisors. They can be contacted at Kate.Lovrien@HealthSystemAdvisors.com or Luke.Peterson@HealthSystemAdvisors.com. Health System Advisors is a strategy think tank and consulting firm with a mission to advise leaders, advance organizations, and transform the healthcare industry. For more information contact HSA at 877.776.3639 or www.HealthSystemAdvisors.com.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker’s Hospital Review/Becker’s Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.