A successful long-term strategy demands complex data governance and integration across the continuum of care, coupled with advanced analytics that can be efficiently delivered to all stakeholders, leadership and staff.

In recent years, many organizations have invested heavily in enterprise data warehouse (EDW) technology as their chosen platform to manage the growing volume of disparate digital data — and address new business analytics requirements. However, in the midst of escalating financial challenges and resource constraints, many organizations are reevaluating their options and questioning if the traditional EDW can truly meet their data management and analytics needs. Specifically, enterprise data platforms must:

- Be completely scalable

- Effectively balance analytics capabilities with transaction-based functionality

- Deliver business intelligence to support increased profitability, enhanced quality and appropriate risk mitigation

This article explores the national EDW adoption trends, implementation and scalability challenges, and key factors for healthcare executives to consider as they look to formulate a new analytics strategy or augment their existing infrastructure.

Current trends in EDW adoption: size matters

The EDW adoption story for many hospitals is a familiar one in healthcare technology — upfront costs are high, implementation timelines are long, ongoing management costs are untenable, and measurable return on investment is sporadic. It is not uncommon for health systems to invest $5-10 million in up-front costs, followed by six- to seven-figure annual maintenance agreements. When infrastructure and analyst resource requirements are taken into account, total cost of ownership can be staggering. Larger health systems may need to employ 50 or more full-time employees just to maintain their EDW and fulfill analytics requests from stakeholders.

Furthermore, these projects are often plagued by significant rework, yielding turnaround times measured in months versus minutes. The end result can be millions of dollars invested without adequate scalability and with a lower-than-expected return on investment.

The level of commitment and capital investment in an EDW strategy correlates to an organization’s size, in terms of both revenue and geographical reach. While there are exceptions, EDW adoption strategies are generally aligned to three distinct provider categories:

- Mega systems. Characterized by a multi-regional coverage area, mega systems have been using EDWs for a decade or more. A subset of these organizations are building or refining sophisticated internal EDW business units to support centralized data aggregation, analytics and decision support. A handful are also beginning to explore new revenue streams by offering fee-based EDW and analytics services to hospitals and providers outside their network. Critical factors, such as the recent flood of new healthcare analytics market entrants, unprecedented levels of outside capital investment, increasing provider consolidation, and lack of sales and support infrastructure will likely prevent many health system-based, commercial analytics ventures from succeeding. Nonetheless, organizations may already be so financially and politically committed in the strategy that they feel they are unable to change course.

- Large IDNs. Although some organizations in this group have already made a significant EDW investment, it is typically not to the scope and scale of their larger, mega system counterparts. Hence, their information management and analytics strategies may not be wholly tied to their EDW. Senior leaders have the flexibility to evaluate deficiencies and consider alternatives or supplemental solutions. If not an EDW early adopter, large IDNs are evaluating potential strategies and solutions to address their business needs in this area.

- Small IDNs and stand-alone hospitals. Often lacking the available capital and internal IT resources to take on an EDW project, many providers in this category have remained on the sidelines of the analytics game. Some have stayed committed to siloed legacy systems while others have adopted an analytics outsourcing model (typically GPO-based). Some smaller IDNs or stand-alone hospitals are looking to their health information exchange (HIE) for support, while still others have yet to make any investment at all.

EDW investments leave unanswered questions

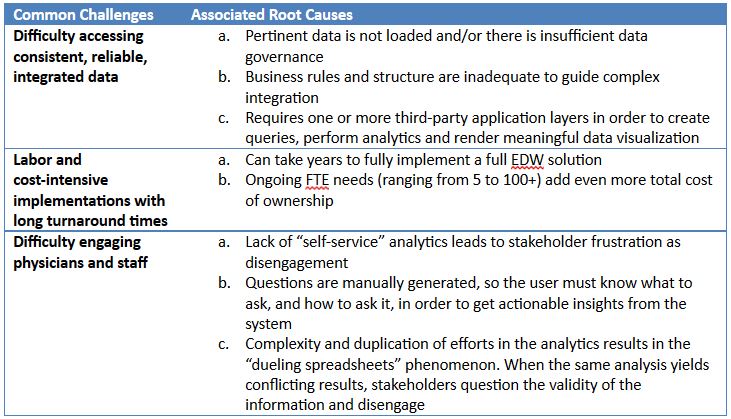

Despite representing huge investments, EDWs still struggle to find answers to key health executive questions. Here are three common issues reported by users of stand-alone EDW platforms:

Recent industry research and feedback from prospective buyers suggests that the traditional healthcare EDW model may be on the way out as progressive provider organizations look for alternatives. A recent report by Gartner (March 2015), evaluated a strategy for a new type of architecture — the Logical Data Warehouse (LDW).

Pursuing a practical, holistic approach

According to Gartner, “Providers must have agile information architectures in place to consume and deliver massive volumes of varieties of data and analytics. A single EDW is no longer the complete solution. CIOs must think in terms of an information ecosystem that supports traditional reporting and analytics along with big data processing and advanced real-time application delivery of information and decision support.”

An ideal LDW approach should be a cost-effective business strategy that offers simplified analytics support, accelerated implementation and speed to ROI, substantial back-end automation and a flexible structure that will allow your organization to adapt over time as you evolve into the next generation of analytics.

For providers seeking to either augment their current EDW or adopt an alternative strategy, such as an LDW, here are a handful of key questions to consider:

Is the solution vertically integrated?

With the growing demand for data integration, this strategy of a stand-alone approach presents multiple maintenance problems from an IT perspective. Its inherent structure — independent components — prohibits the ability to interconnect data. An integrated, holistic approach is needed for analytics and decision support. However, any viable solution must contain within it an acceptable set of vertical capabilities that are well-aligned with your core service lines and ancillary departments.

Is the solution horizontally integrated?

While deep vertical functionality is always needed, the rapidly-changing healthcare landscape requires that a data management and analytics solution also be able to work efficiently in a horizontal manner — across departmental silos. To effectively accomplish a horizontally-integrated framework, the platform must be able to connect procurement, utilization, and outcomes data in an automated fashion to yield strategic insights and actionable intervention opportunities.

Can the solution handle transactional as well as analytical demands?

Strong data governance must be a foundational element of any next-generation analytics platform. Governance is multi-faceted and inherently complex. As such, it can be difficult to identify and stratify data governance opportunities, apply consistent business rules and efficiently execute a program. A holistic analytics solution will account for transactional data governance requirements, as well as the downstream analytics needs.

Does the solution have an intuitive user interface?

There is no question that data visualization is an important element in any platform, but the coolest-looking car on the lot may not be the fastest, most comfortable or have the best gas mileage. In other words, it will take more than fancy graphics displays to meet the analytic requirements of the hospitals that will successfully navigate the winding road of healthcare reform ahead of us. Your solution of choice should be intuitive and engaging for departmental and clinical end-users — not just for IT analysts and database administrators. Requiring analyst intervention or end-users to manipulate manual queries, whether in code or “drag n’ drop SQL,” is not a sustainable practice. The ideal solution is one in which the software does the heavy lifting, so your staff can concentrate on doing their job and delivering value to your patients and the organization.

Transform data into insights — an executive requirement

Healthcare executives must invest in people, processes and technology, with advanced analytics as a core strategy for delivering value-based care. With the transition to new reimbursement models, the demand for better quality of care requires a new approach to achieve the triple aim of improved population health, patient experience and affordability. The ability to transform big data into actionable insight is paramount.

Timothy Lantz is the Senior Vice President–DataNext at Sentry Data Systems, overseeing the company’s healthcare enterprise management products and services.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker’s Hospital Review/Becker’s Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.