Just because a hospital or health system is well known, or even well regarded in a particular service line, doesn't mean it has the brand equity to influence decisions in those critical consumer choice moments where factors like co-insurance and narrow networks loom large.

In a recent blog post, Christopher Kerns, managing director at the Advisory Board, detailed his guarded skepticism about today's population health efforts. It's an interesting piece on the limited success, so far, of accountable care organizations and the potentially significant influence of private exchanges.

Intentionally or not, while pondering private exchanges, Mr. Kerns instigated an interesting conversation about branding. The narrative goes something like this:

In private exchanges, health benefit consultants work with insurance companies to fashion provider networks for employers. Employers give their employees a fixed sum of money to purchase the coverage they deem best for them among these networks. This could have a disruptive impact on the healthcare landscape. In these personal moments, employees weigh various narrow and broad provider networks, plan benefits and premium prices to make their coverage decision, and healthcare becomes more consumer-driven than it ever has been before.

So, as healthcare becomes more consumer-driven, Mr. Kerns asserts, "Individual patients, who could potentially select tailored, ultra-narrow provider networks through private exchanges, usually care most about convenience and access relative to themselves."

That's where he may be telling only half the story. Certainly convenience and access are important at the individual level. However, there is ample evidence in all of our lives that those are only two of many elements that impact decision-making. In addition to convenience, consumers also evaluate brand equity, user experience and product or service value when making a decision. Of these, research frequently shows brand equity is an especially powerful factor.

An article by Harris Interactive sharing the results of their annual EquiTrend study confirmed that even health insurance companies are beginning to grasp this new reality. "In a market where benefits and costs may be similar…those companies with strong brand equity will be well positioned to take advantage…and successfully differentiate themselves among competitors."

Makes sense. Imagine you are thinking of buying a new car. Would you simply choose the most convenient dealership, regardless of the brand they sold? Likely not.

The risk of commoditization

Convenience and access are becoming "table stakes." Sure, there was a time when the size of a bank's branch and ATM network might influence which one you chose, but now that those factors are essentially equal across all brands, how much do they drive your decision? When access, convenience and products are equal, the worst of all things can occur — no brand is truly distinct from its competitors and its unique value is negligible. Welcome to the dreadful world of commoditization.

To defend against the risk of commoditization, we contend hospital and provider brand differentiation matters more than ever before. In some cases, it may be all that matters. In those moments when employees are comparing hospitals that all "do" the same things, or weighing narrow networks versus paying a higher premium for access to the broader network to access your hospital, your brand better have equity on its side.

When confronted with the concept of brand equity, a common miscalculation is to confuse awareness ("Everyone knows our name") and general perceptions ("People believe we're good/best at treating cancer or performing heart surgery") for equity. True brand equity is the proportion of total company value that is attributable to the ability of the brand to drive demand in moments of choice.

Consider the case of Chevrolet. Clearly Chevrolet is one of the world's best-known automobile brands, but how valuable is the Chevrolet brand? By some assessments, not very. Since 2000, Interbrand has calculated the value of top global brands, and for 12 of those years, Chevrolet did not appear in the Top 100. In 2013, Interbrand named Apple the world's most valuable brand (at about $98 billion). Toyota is the highest valued automobile company (No. 10 at $35 billion). Chevrolet finally broke into the top 100 this year (No. 89 at $4.5 billion), twelfth out of twelve automotive brands.

Just because a brand is well known doesn't mean that it has the equity to drive demand through choice.

Just because a hospital or health system is well known, or well regarded in a particular service line, doesn't mean it has the brand equity to influence decisions in those critical consumer choice moments where factors like co-insurance and narrow networks loom large.

Building positive brand value and declaring your major

So how does a healthcare organization assess and ensure it is building positive brand value? Here, it's useful to turn to one of the most-published academic minds on the topic of brands and brand equity, Kevin Lane Keller, PhD, of the Tuck School of Business at Dartmouth College.

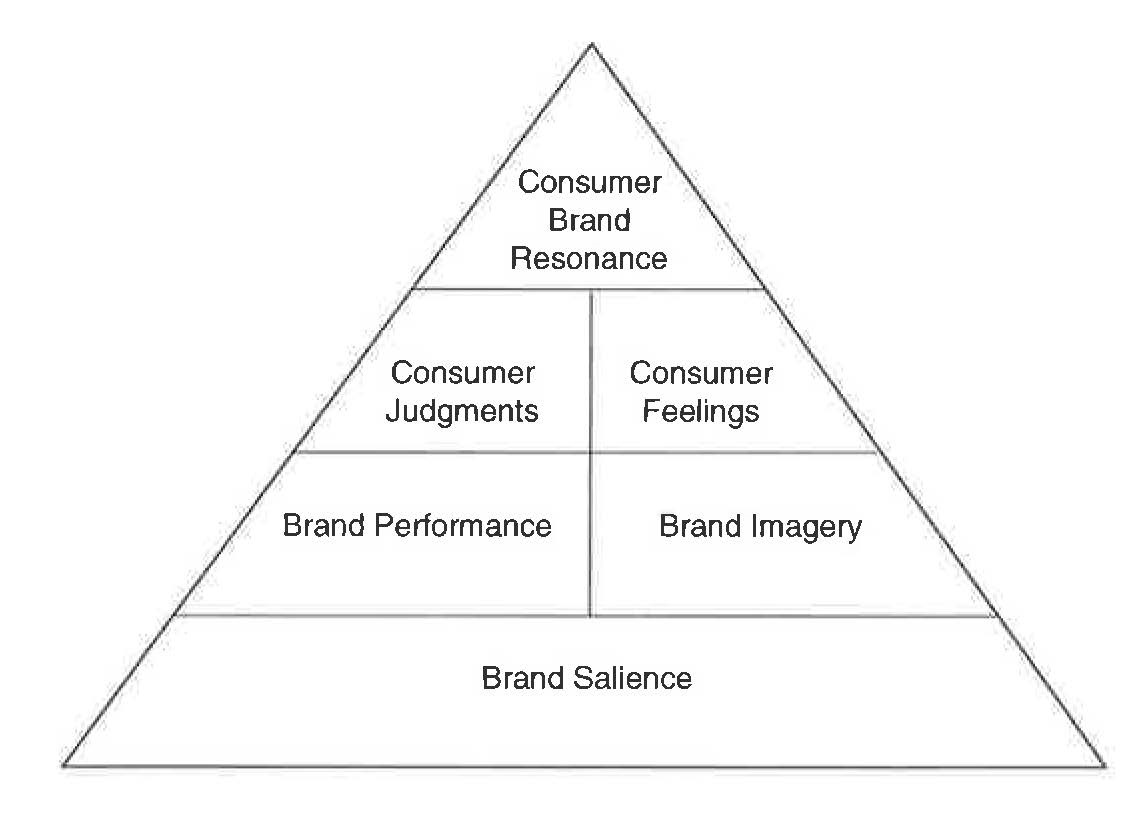

Dr. Keller has shown brand equity is built — and measured — across a pyramid that has brand salience/relevance at its base (see graphic, right). "Do I need the kinds of healthcare services that you offer?" From there equity grows through brand performance (e.g., characteristics such as range of capabilities and the service experience you provide).

As noted earlier, for healthcare providers, the concept of relevance and elements of performance, such as convenience and access, are just the beginning. To create strong, positive brand feelings, healthcare organizations must focus on "higher order" brand equity building blocks. Brand image marries your organization's history and heritage with patient experiences and the personality you exude. Next, consumer formulated brand judgments about the quality, credibility and superiority of your services build additional equity. In a moment of choice do consumers perceive your clinical and service capabilities not just as 'good' but 'superior?'

Brand feelings, how your brand makes consumers feel across a range of possibilities such as warmth, excitement, security and social approval (e.g., "How does identifying myself with your healthcare organization make me feel and be perceived in the eyes of my friends and family?") add distinction. All these factors ultimately feed brand resonance (e.g., loyalty, attachment, sense of community and engagement).

Considering this intricate web of influences, it is essential for hospitals and health systems to think deliberately about how they position themselves and organize their care so to be perceived as unique and, ultimately, essential among other marketplace options.

To define and build brand equity, we expect hospitals and health systems will have to "declare their major;" and by this we don't mean "high quality." The Advisory Board counsels healthcare organizations to "define the product you are trying to build" such as a best-in-class acute-care destination, a consumer-oriented ambulatory network or a full-service population health manager. IBM's Institute for Business Value asserts, "We believe it will be harder to maintain an undifferentiated service delivery model…forc[ing] many clinical delivery organizations to adopt and develop service delivery models with a new and sharper strategic focus." These models include community health networks focused on optimizing access, centers of excellence focused on optimizing clinical quality and safety for specific conditions, medical concierges focused on optimizing the patient experience or price leaders focused on optimizing productivity and workflow.

Regardless of the path or options, the direction is clear; being "all things to all people" is a risky path that may leave a hospital in a Chevrolet-like brand equity situation.

Once the pathway is chosen, the other dimensions of equity must be planned accordingly. What feelings should a Center of Excellence provider engender among patients, referring physicians, payers and employers? What would a consumer-oriented ambulatory network show, say or do to shape consumer judgments of the brand’s quality, credibility and superiority?

It is critical to carefully craft products and services, communications, service delivery and organizational culture to deliver on the chosen positioning and mold the desired customer (however defined) mindset. Done properly, the totality is a brand — and associated brand equity — that goes way beyond baseline parameters such as convenience and access. And, ultimately, is the difference between being known for nothing and demanded as something unique.

Dan Miers is a 20-year healthcare veteran and key leader of SPM’s business strategy team and helps turn new insights into fresh communications strategies. He keeps SPM on the leading edge of healthcare business and policy issues. When he's not uncovering new trends, you can find him serving on SHSMD committees and sharing his thoughts in articles, blog posts and nationally by speaking at conferences.