Many of these deals focused on historically fragmented specialties within the provider sector, including behavioral health, dermatology, orthopedics, otolaryngology, urology, and dentistry. With the COVID-19 pandemic putting a severe financial strain on the shrinking pool of independent provider groups, it is likely that PE investment in such groups will continue over the next several years as the providers seek financial support.

PE-backed healthcare providers need to optimize their contracts with commercial health insurers and Medicare Advantage plans to deliver the returns necessary to satisfy their owners, and most importantly, their physician partners. Payer contracts should recognize the improved value PE investment typically brings—for example, expanded access through the hiring of more providers and the opening of new locations, along with technology to improve the patient experience. However, many PE-backed providers struggle to improve the financial and operational terms of their payer contracts at the same rate as their value propositions to payers and patients.

Solving the Problem

When negotiating payer contracts, there are six common challenges PE-backed healthcare organizations face. In this article, we discuss those challenges and offers solutions that can help these organizations establish and meet reasonable expectations for contractual improvements.

Challenge One: Underestimating the Payer Contracting Timeline

When a PE firm invests in a healthcare provider, they work to grow the provider organization’s top line and EBITDA as quickly as possible. However, payer contract negotiations, which should be a focus for economic growth, tend to move slowly and require attention to detail. For example, analyzing rates and contract language and developing a negotiation strategy can take up to two months before the provider even initiates contact with payers. The provider and a given payer may then share multiple rate proposals during the negotiations, with each proposal coming a month or more apart to allow for analysis and consideration. This adds up to a significant and time consuming work effort.

Solution: Understand the time frame for negotiating and implementing new payer agreements, and know how to increase the likelihood of an expedited process.

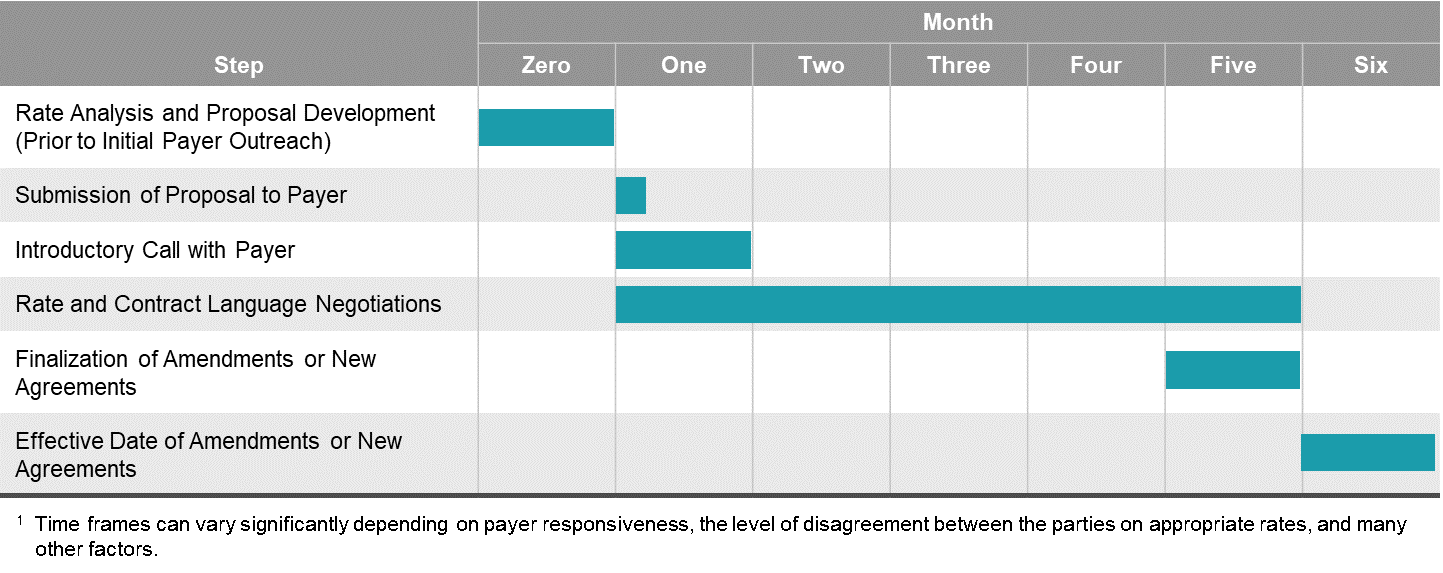

Negotiating a contract—from the initial outreach to a payer to the effective date of the new agreement—typically takes between three and six months. See figure 1 for a typical payer contracting timeline.

Figure 1: Hypothetical Timeline for Renegotiating a Contract1

The following actions can increase the likelihood that negotiations will be on the shorter end of the range:

1. Review any existing payer contracts for renewal limitations. Contract renewal may be tied to a specific date (e.g., the end of the initial contract term, the renewal date), and if that date is far enough away, the payer may drag its feet.

2. Identify the correct contracting representative from the payer. Contacting the payer’s negotiating representative directly is a more efficient way to initiate negotiations than calling the payer’s provider services number and expressing a desire to negotiate a contract.

3. Negotiate contract language and initiate credentialing while rate negotiations are ongoing. Contract language negotiations and credentialing are critical aspects of the contracting process that can take several months each. Initiating language negotiations and credentialing at the same time as rate negotiations can ensure that a contract becomes effective as soon as possible after rates are agreed upon.

Challenge Two: Overestimating Value Proposition to Payers

PE-backed providers may assume that building a large network of reputable physicians will enhance their value to payers. While size and breadth of services does matter to some extent, translating reputation to quality, which can help drive to better pricing, is often more difficult than it sounds.

Payers often know little about the reputation of a given provider organization and will ask for concrete evidence of enhanced quality or value to justify offering a rate increase.

Solution: Know the variables that impact rates, and bring data to the table.

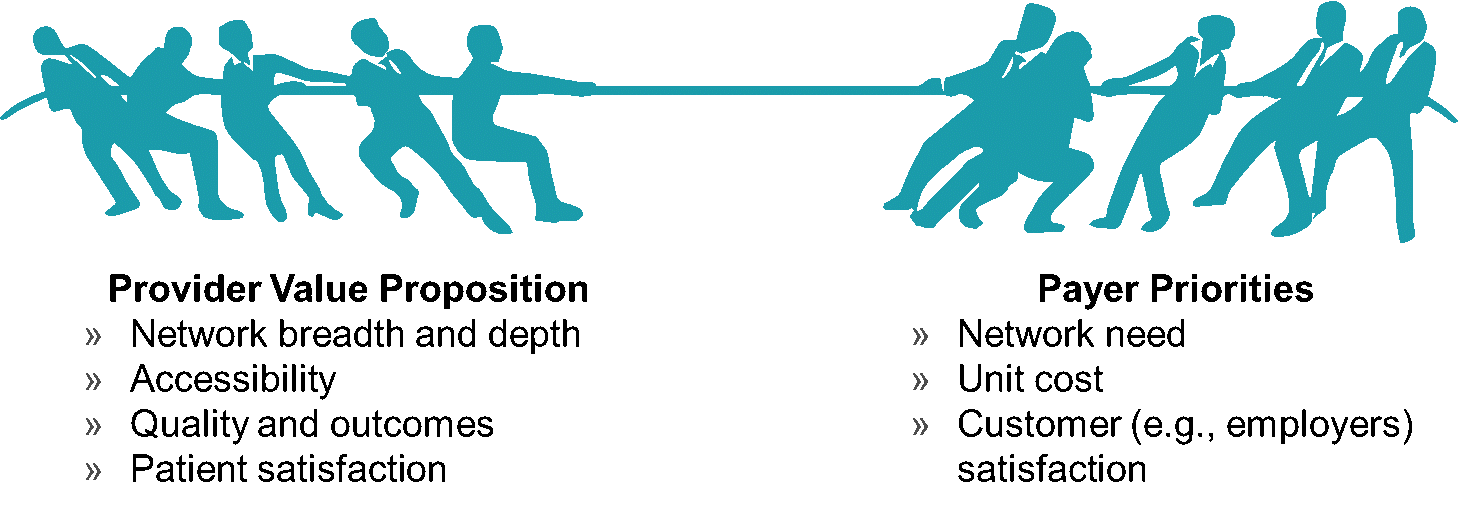

Network need is a key variable in negotiations with payers. Payers that do not need a given provider to meet their network adequacy standards are less likely to offer that provider reimbursement rates above market. One way PE-backed provider organizations can differentiate themselves is by having services or specialties that are rare or unique to the market, which can make them more valuable and help their case for rate increases. Additionally, any historical data or trends that show increased use of a provider organization by a given payer’s members can demonstrate value.

Three other quantifiable factors that play a role in rate negotiations are quality, patient satIsfaction, and accessibility. Demonstrating better performance than peers through MIPS measures and surveys such as CAHPS can make the case for rate increases. Data about wait times and offerings such as extended hours and telehealth can demonstrate accessibility. See figure 2 for a summary of key variables that impact rates.

Figure 2: Factors Impacting Rates

Challenge Three: Requiring New Payer Contracts and Relationships in New Markets

Provider organizations typically cannot add new locations to existing contracts without a payer’s permission—or at all if the new locations are in a state where the organization does not operate currently. Even payers with a regional or national presence will require separate contracts in different states because each state has its own laws and regulations for health insurance that must be addressed in payer contracts. “Nationwide” contracts do exist but are less common than many PE-backed healthcare providers realize and are often limited to nationally recognized ancillary providers such as laboratories, physical therapy companies, and behavioral health companies.

Another challenge associated with entering new markets is that a PE-backed provider organization’s value proposition does not carry over into the new market. If a PE-backed provider organization’s attributes and reputation do not resonate with the payers in a new market, then the contracts the provider organization secures for its new location may be at the standard market rates.

Lastly, some payers have minimum provider thresholds for offering group rather than individual contracts. If a PE-backed provider organization does not meet those thresholds in a new market, it may have to accept individual contracts in that market, which can make it more difficult to get additional providers contracted in that market in the future.

Solution One: Determine how the provider organization can add value to the market.

PE-backed provider organizations ideally should only enter new markets where they can add value (e.g., markets with a shortage of the PE-backed provider organization’s specialty). Additionally, when conducting contract negotiations for the new market, the PE-backed provider organization should focus on the elements of its value proposition that are applicable to the new market.

Solution Two: Understand sources of reimbursement benchmark data.

Reimbursement levels can vary significantly from market to market based on variables such as payer consolidation and cost of living. Using market specific rate benchmarks such as those available from FAIR Health can confirm that requested rates are reasonable in the new market, which can expedite negotiations.

Solution Three: Mine existing payer relationships for assistance.

PE-backed provider organizations should understand that their payer representatives from one market may not be the ones with whom they are negotiating in another market. However, payer representatives are usually willing to connect providers to their counterparts in other markets. PE-backed provider organizations should not hesitate to mine existing payer connections when inquiring about contracts in new markets.

Challenge Four: Lacking Payer Contracting History and Infrastructure

Prior to receiving PE backing, these provider organizations are often relatively small. They sometimes lack the resources to invest in payer contracting and the value proposition to negoti-ate higher rates with payers. As a result, many of these organizations have “standard” contracts and fee schedules from payers with rates and language terms that do not align with the value propositions that the providers develop after their PE investments.

Solution: Dedicate experienced resources to assess payer contracting opportunities.

If an immediate goal is to identify and secure revenue improvements, PE-backed provider organizations should invest in the information and expertise needed to optimize contracts. For some organizations, the information gathering may start with two basic efforts: (1) obtaining copies of existing contracts and fee schedules and (2) pulling payer mix and utilization data for at least a recent one year period. The provider organization can use this information to compare its rates across payers and compare them to market benchmarks (although benchmark data can be pricey).

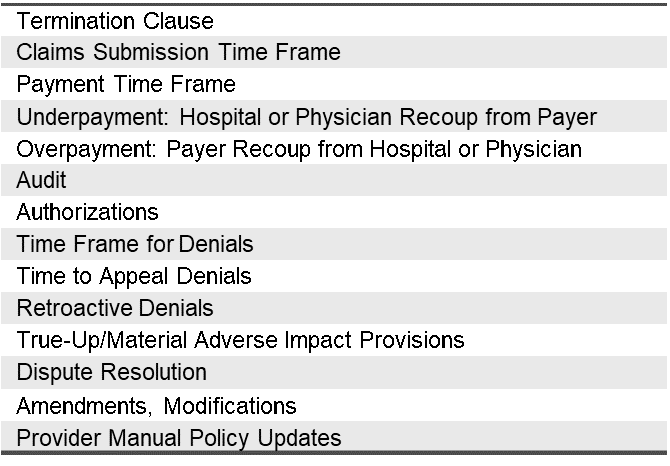

Growing PE-backed provider organizations may not have the expertise or bandwidth to review rates and contract language in great detail (see figure 3 for key contract language provisions to review). A managed care resource can help develop and execute payer contracting strategies. For organizations that cannot yet justify a managed care hire, there are plenty of consultants with managed care expertise to temporarily fill the void.

As a word of caution, PE-backed provider organizations that rapidly improve their value propositions may find there is a wide gap between the rates and language in their “standard” legacy contracts and the rates and language they deserve based on their enhanced value. Seldom can this gap be closed entirely in one year. However, dedicating experienced resources to payer contracting can close the gap as expeditiously as possible.

Figure 3: Key Contract Language Provisions to Review

Challenge Five: Accommodating Acquisitions and Changes in Ownership and Control in Contract Language

Adding an acquisition to existing payer contracts is not as easy as PE-backed providers may think. Most major commercial payers include contract language that puts conditions on the addition of acquisitions or enables the payer to terminate a contract if there is a change of ownership or control. While the language in contracts governing acquisitions is typically negotiable, it is unrealistic to expect that payers will add newly acquired providers to a contract—and pay them higher rates—with little more than a notification of the transaction.

Solution: Research transition language in existing contracts, and negotiate ac-commodating language in future contracts.

PE-backed provider organizations should research the payer contracting implications of potential changes in ownership or control before those transactions take place. This will almost certainly require working with legal counsel and will potentially require working with an independent third party on a “black box” analysis to remain in compliance with antitrust laws. Understanding which contract transitions can occur, when they can occur, and the financial implications will set realistic expectations.

In new payer contracts, PE-backed providers should attempt to negotiate language that accommodates the addition of new providers relatively quickly. Understanding the payer’s perspective should help. Payers are wary of low-value practice acquisitions and overnight rate increases by PE-backed providers. Convincing the payer that any future acquisitions will add value and agreeing to a waiting period before contract transitions occur would address these concerns.

Challenge Six: Underestimating Operational Aspects of Maintaining Managed Care Contracts

Negotiating good contracts is only half the battle. Operationalizing the contracts is also essential but sometimes overlooked. Revenue cycle management is necessary to ensure that PE-backed providers are realizing the rates they have negotiated. Any apparent underpayments should be promptly addressed with payers.

Another sometimes-overlooked aspect of operationalizing contracts is tracking payers’ policy and procedure updates. Payers often release important updates via electronic newsletters or email notifications. Dedicating a representative of the provider organization to receive and disseminate any policy and procedure updates ensures that changes negatively impacting reimbursement are not discovered months after their implementation.

From a credentialing perspective, PE-backed providers have to notify payers of changes to demographic information (e.g., new locations). Some contracts even have penalties for failing to provide timely notice of such changes. There can also be many credentialing challenges when there is a change of ownership or control. See figure 4 for some additional key operational aspects of maintaining managed care contracts.

Figure 4: Key Operational Aspects of Payer Contracting

Solution: Discuss operational issues with payers both during and after negotiations.

Historical operational challenges with payers (e.g., excessive denials) can often be addressed during contract negotiations, if not by eliminating the issue entirely, then by negotiating an offset (e.g., higher rates to make up for the adverse financial impact of the operational issue). So, before negotiating with a payer, PE-backed provider organizations should log any operational challenges they are encountering with the payer and propose solutions to them.

Communication with payers should not end after contract negotiations. Having regular contact with payer representatives during, for example, monthly or quarterly joint operating committee meetings, can be one way to be sure that any operational issues that arise are addressed expeditiously.

Embracing the Payer Contracting Challenges to Differentiate Your Organization

There is ample opportunity for PE firms to invest in healthcare providers, particularly those providers seeking financial support as they emerge from the COVID-19 pandemic. As PE-backed provider organizations compete for acquisitions or PE firms look to exit their investments, optimized payer contracts will make the provider organization more attractive. While payer contracting can be challenging, understanding the solutions to some common issues can help PE-backed provider organizations ensure that their payer contracts are commensurate with the value they deliver to patients, payers, and the market as a whole.