The article below is reprinted with permission from The Capital Issue, a quarterly newsletter published by Lancaster Pollard.

As an old Chinese proverb says, “Crisis can be used as an opportunity by some.” While the U.S. debt drama played out amid a sharp economic slowdown resulting in market turmoil, short-term interest rates have been at an all-time low and may continue to be so through mid-2013, according to a recent release by the Federal Open Market Committee.

Borrowers can take advantage of the low short-term interest rates using short- and intermediate-term financing structures, such as variable rate demand bonds enhanced with letters of credit from banks, FHLB LOCs, index notes and Fannie Mae adjustable-rate mortgages. Which one that works best depends on the type of project needing financing and how comfortable the borrower is with the terms and the inherent risks.

During 2006 and 2007, LOCs were often obtained for fees of less than 100 basis points or 1 percent of the amount of the bonds. However, the cost increased dramatically after the auction-rate securities market crashed in Feb. 2008 and borrowers rushed to refinance. Recently, the outlook for the overall credit market has improved and some relatively strong borrowers may be able to obtain a LOC in the 1.5 percent range.

Benefits to LOC-backed VRDBs:

The FHLB LOC wrap

Federal Home Loan Banks, or FHLBs, are rated AA+, and can enhance taxable debt issuances when an FHLB member bank provides an underlying LOC. This means local banks could provide organizations access to investment-grade credit enhancement usually available only from larger banks.

Although a FHLB can no longer enhance tax-exempt debt, nonprofit organizations should still investigate FHLB LOCs because tax-exempt debt is not providing the cost break it has in the past. Also, taxable bonds require fewer upfront closing costs and there are fewer restrictions on the use of bond proceeds.

The FHLB LOC wrap is one option for a non-rated or low-investment grade borrower who is unable to obtain a rated bank’s LOC or needs to refinance one. The amount will be limited by the local banks’ capacity to lend, so small-to-medium-sized projects are a good fit. Some smaller banks cannot take on too much exposure to one particular borrower, so debt offerings totaling more than 15 million dollars or so may be more difficult for one bank to handle on its own. In the case of a larger project, however, the borrower has the option to involve multiple local banks, so long as the banks are willing to take a parity security position in the collateral.

Benefits to FHLB LOC wrap (in addition to LOC-Backed VRDBs):

Basically, the index floater is a VRDB with an initial index-floater mode or period (typically three years) during which the bond pays an interest rate equal to a short-term index plus a fixed credit spread (equal to about what the LOC would have been on a LOC-backed VRDB). The bond can be a public offering or privately placed directly with a bank and is subject to a one-time mandatory investor tender at the end of the initial period, at which time the bond can be remarketed to any other mode available under the documents. The index floater’s interest rate resets periodically (often monthly or quarterly, but also weekly, semiannually or annually—hence it’s multimodal) with a money market reference rate index, such as SIFMA or LIBOR.

Benefits to index floaters:

The Fannie Mae ARM 7-6 can be used for acquiring or refinancing multi-family or senior housing properties. As it name suggests the ARM 7-6 is a 7-year-term mortgage with a one-year lock-out. The interest rate adjusts based on changes to the 1-month LIBOR and is equal to the index plus a margin. Further, this interest rate is limited to a maximum monthly interest rate adjustment of 1% up or down, providing for excellent balance sheet stability even within a short-term, variable-rate structure, and the interest rate will never exceed the maximum lifetime interest rate established at the rate lock.

Benefits to Fannie Mae ARM 7-6 include:

At the risk of sounding cliché, timing is everything when funding debt with short-term rates. The key is to find the type of structure at the right time that works for your organization. Working with an investment banker or financial advisor, a borrower can determine how high of an interest rate is comfortable and then take steps to ensure payments stay within that range.

Becoming a (Financially Stable) System

Slaying the Monster Called Negative Arbitrage

As an old Chinese proverb says, “Crisis can be used as an opportunity by some.” While the U.S. debt drama played out amid a sharp economic slowdown resulting in market turmoil, short-term interest rates have been at an all-time low and may continue to be so through mid-2013, according to a recent release by the Federal Open Market Committee.

Show me the interest savings

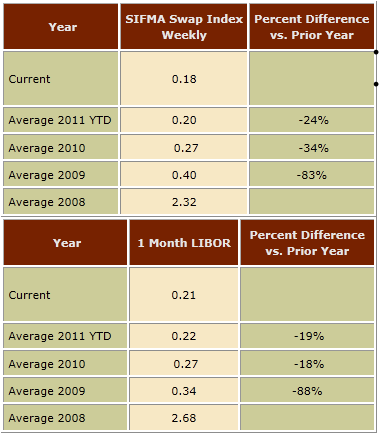

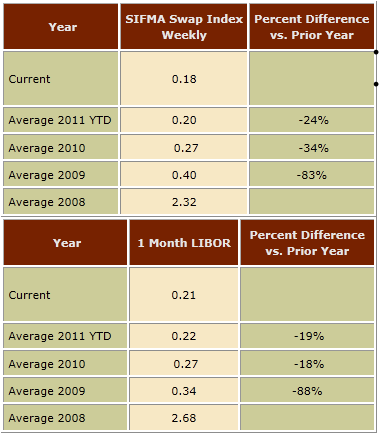

The LIBOR (London Interbank Offered Rate) one-month rate and SIFMA (Securities Industry and Financial Markets Association) index, which are appropriate for taxable and tax-exempt borrowers respectively, provide benchmarks for financing debt with short-term rates. Currently, the one-month LIBOR rate is .21. This rate is used to price floating-rate notes and variable-rate mortgages. The SIFMA municipal swap index, currently at .18, is used in remarketing tax-exempt variable rate demand bonds. As the charts indicate, both rates have fallen significantly since 2008 and the current rates are lower than their year-to-date averages.Borrowers can take advantage of the low short-term interest rates using short- and intermediate-term financing structures, such as variable rate demand bonds enhanced with letters of credit from banks, FHLB LOCs, index notes and Fannie Mae adjustable-rate mortgages. Which one that works best depends on the type of project needing financing and how comfortable the borrower is with the terms and the inherent risks.

LOC-backed variable rate demand bonds

A LOC-backed VRDB structure provides the borrower access to short-term variable interest rates using a bank’s credit rating instead of the borrower’s. The VRDB interest rate is set by a remarketing agent, who sets the rate according to current market levels, often using the SIFMA index as a guide. Over the history of the structure, VRDBs have repeatedly provided the lowest cost of capital, and with index reference points at an extraordinarily low .18 and .21 basis points, this is especially true today.During 2006 and 2007, LOCs were often obtained for fees of less than 100 basis points or 1 percent of the amount of the bonds. However, the cost increased dramatically after the auction-rate securities market crashed in Feb. 2008 and borrowers rushed to refinance. Recently, the outlook for the overall credit market has improved and some relatively strong borrowers may be able to obtain a LOC in the 1.5 percent range.

Benefits to LOC-backed VRDBs:

- Cost effective way to provide credit enhancement.

- Allows ready access to bond market.

- Indices used to set VRDB rates are currently at extraordinarily low levels

The FHLB LOC wrap

Federal Home Loan Banks, or FHLBs, are rated AA+, and can enhance taxable debt issuances when an FHLB member bank provides an underlying LOC. This means local banks could provide organizations access to investment-grade credit enhancement usually available only from larger banks.

Although a FHLB can no longer enhance tax-exempt debt, nonprofit organizations should still investigate FHLB LOCs because tax-exempt debt is not providing the cost break it has in the past. Also, taxable bonds require fewer upfront closing costs and there are fewer restrictions on the use of bond proceeds.

The FHLB LOC wrap is one option for a non-rated or low-investment grade borrower who is unable to obtain a rated bank’s LOC or needs to refinance one. The amount will be limited by the local banks’ capacity to lend, so small-to-medium-sized projects are a good fit. Some smaller banks cannot take on too much exposure to one particular borrower, so debt offerings totaling more than 15 million dollars or so may be more difficult for one bank to handle on its own. In the case of a larger project, however, the borrower has the option to involve multiple local banks, so long as the banks are willing to take a parity security position in the collateral.

Benefits to FHLB LOC wrap (in addition to LOC-Backed VRDBs):

- Provides a higher credit rating and, therefore, lower interest rate.

- Borrower’s LOC fee stays local, rather than leaving community to non-local institution.

Index floaters

The index floater has been a long available, but often overlooked, financing structure. Like the LOC wrap, an index floater would be most affordable to high noninvestment-grade and investment-grade borrowers, but could also work for borrowers farther down the credit continuum and, for lower rated and unrated borrowers, may be a more feasible option than an LOC.Basically, the index floater is a VRDB with an initial index-floater mode or period (typically three years) during which the bond pays an interest rate equal to a short-term index plus a fixed credit spread (equal to about what the LOC would have been on a LOC-backed VRDB). The bond can be a public offering or privately placed directly with a bank and is subject to a one-time mandatory investor tender at the end of the initial period, at which time the bond can be remarketed to any other mode available under the documents. The index floater’s interest rate resets periodically (often monthly or quarterly, but also weekly, semiannually or annually—hence it’s multimodal) with a money market reference rate index, such as SIFMA or LIBOR.

Benefits to index floaters:

- Doesn’t require a credit-facility fee or remarketing fee.

- Multimodal flexibility helps keeps interest rates as low as possible.

Fannie Mae adjustable rate mortgages

In general, an adjustable-rate mortgage (ARM) is a mortgage with an interest rate that changes in response to changes in the prime rate. The mortgage holder is protected by a maximum interest-rate ceiling, which might be reset annually. ARMs have lower initial rates than fixed-rate mortgages to compensate the borrower for the additional risk that future interest rate fluctuations may create.The Fannie Mae ARM 7-6 can be used for acquiring or refinancing multi-family or senior housing properties. As it name suggests the ARM 7-6 is a 7-year-term mortgage with a one-year lock-out. The interest rate adjusts based on changes to the 1-month LIBOR and is equal to the index plus a margin. Further, this interest rate is limited to a maximum monthly interest rate adjustment of 1% up or down, providing for excellent balance sheet stability even within a short-term, variable-rate structure, and the interest rate will never exceed the maximum lifetime interest rate established at the rate lock.

Benefits to Fannie Mae ARM 7-6 include:

- Has a loan-to-value (amount of the loan compared to the value) of up to 80% for multi-family properties and up to 75% for senior housing.

- Features a built-in protection against spikes (±1 %) in the monthly interest rate adjustment and an embedded cap or maximum interest rate set at the onset of the loan, essentially eliminating much of the volatility and interest rate risk usually inherent in variable-rate debt.

- Can convert to a fixed-rate mortgage, such as an FHA LEAN 232 (a) (7) or 223 (f), anytime between the second and sixth loan years with a very low, 1% prepayment provision.

Timing IS everything

The benefit of lower short-term-rate financing is that it can reduce the cost of capital compared to financing with higher, long-term fixed rates. While interest rates stay low, the debt-service savings can be quite significant and be put to other uses. When interest rates stay low for an extended period of time, the net return can be larger than the expense and risk associated with a variable-rate finance plan.At the risk of sounding cliché, timing is everything when funding debt with short-term rates. The key is to find the type of structure at the right time that works for your organization. Working with an investment banker or financial advisor, a borrower can determine how high of an interest rate is comfortable and then take steps to ensure payments stay within that range.

More Articles by Lancaster Pollard:

The Importance of a Strong Investment Policy StatementBecoming a (Financially Stable) System

Slaying the Monster Called Negative Arbitrage