The article below is reprinted with permission from The Capital Issue, a quarterly newsletter published by Lancaster Pollard.

You’ve decided to fund your next capital project with a rated bond issue. Your next step is to decide which credit rating agency (CRA) to use. Now the dilemma: how do you pick the one that will get you the lowest cost of capital?

Role of credit ratings

Credit ratings, essentially opinions about credit risk issued by CRAs, play a role in enabling businesses, governments, non-profits and other entities to raise money in the capital markets through bond issuances.

"Having a rating is similar to a compass,” said Tom Woolsey, senior vice president at Lancaster Pollard and manager of its trading desk. “As an investor, a rating gives you a direction to your purchase and a focus point in the credit evaluation process. It allows you to consider ranges of rates within each rating category, which are used to differentiate between multiple types of issuances, such as hospitals, senior living and affordable housing.”

From an investment perspective, there are generally more buyers interested in rated debt than non-rated debt; therefore, having a rated issue increases the universe of prospective investors. On the whole, a rated product finds an easier path to portfolios than a non-rated one does, according to Woolsey.

The field: Fitch, Moody’s and S&P

However, finding a CRA that will give you the best rating for your issue involves research and serious consideration by you and your investment banker.

The three largest credit agencies in the United States are Standard & Poor’s (commonly called S&P), Moody’s Investors Service and Fitch Ratings. “The Big Three,” as they are called, have about 95 percent of the world-market share for ratings.

Each has its own criteria and methodology in measuring credit worthiness. In forming their opinions of credit risk, these credit agencies primarily use analysts or mathematical models or a combination of the two.

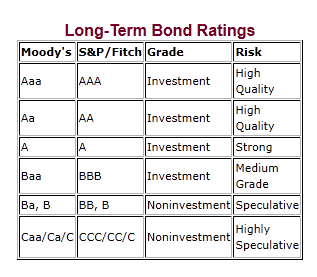

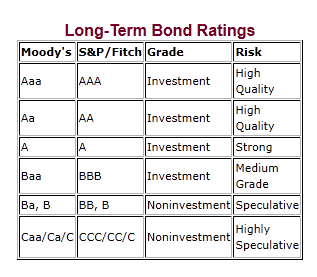

Moody’s uses a different rating system for long-term and short-term debt from S&P and Fitch. The systems are similar in that both range from highest credit quality on one end to default on the other, with different degrees for each rating.

Choosing a CRA

There are several overall and sector-specific factors to consider when selecting which one of “The Big Three” to rate a bond issue. Generally, a borrower's prior experience with the rating process, internal readiness to be rated and whether there are other borrowers in the local market that have similarly rated bond issuances play a role in the decision-making process.

When evaluating the credit agencies, you and your investment banker should consider the following:

Finally, let’s take a look at each CRA by sector-hospitals and health systems, senior living and affordable housing — focusing on the number of rated bond issues in their portfolios at the time of publication and the criteria each one uses in rating bonds.

Hospitals and health systems:

Fitch has ratings on 230 revenue-supported hospitals and health systems, including 129 stand-alone hospitals and 101 health systems. The criteria for nonprofit healthcare include three categories of analytical focus: governance and management, operating profile and financial profile. Hospitals are rated on revenue-supported master criteria, unless a general obligation bond has been passed then tax-supported criteria apply.

Moody’s rates about 1,200 hospitals and health systems (no breakdown available). Its analysis focuses on market position, governance and management, operating performance, balance sheet and capital plan and covenants and legal framework.

S&P provides credit ratings to 410 stand-alone hospitals and 140 health systems. Criteria are divided into the Enterprise Profile, which looks at demographics, business position, management, payor profits, demand, medical staff and governance, and the Financial Profile, which exams an organization’s financial policies and performance, liquidity, financial flexibility, debt and liability. After evaluating the credit quality of hospital operations, S&P will assess the strength of the supporting tax base.

Senior living:

Fitch provides ratings for 74 continuing care retirement communities (CCRCs) and four nursing homes, which are evaluated using their respective sector-specific criteria. The analytical focus is the same as hospitals.

Moody’s has only one rated senior-living provider at this time.

S&P rates 70 CRCCs. The criteria are the same as hospitals.

Affordable housing:

Fitch rates four general obligation housing agencies, each with several rated indentures within them. Rating criteria for state housing finance agencies (HFAs) and single-family mortgage sector include: asset quality and loss mitigation, financial resources and management capabilities. The criteria for pooled multifamily housing bonds focus on pool composition and performance, issuer management of the pool, program financial strength and bond/legal structure.

Moody’s covers HFAs and nearly 1,000 single-family pooled and multifamily projects. HFAs are evaluated by: financial position, portfolio performance and composition, management and general underwriting criteria. Related categories like variable-rate demand bonds and multifamily housing bonds secured by Fannie Mae and Freddie Mac also are relevant.

S&P maintains ratings on 66 affordable real-estate transactions and 29 bond issues that benefit from Section 8 project-based subsidy. S&P evaluates a number of factors when determining the credit strength of a Section 8 property. While debt service coverage is a key component, S&P also take into account past financial performance of the property, the surrounding real estate market, the strength of the owner and the management team and the asset quality of the property.

Credit ratings in action

Lancaster Pollard was engaged by a hospital district in the Southwest to provide financing for a replacement critical access hospital. The district, which provides the CAH with operating and maintenance support, passed a general obligation bond with an 82 percent approval rating. It would have been a stretch to attain an investment-grade rating with the CAH’s revenues alone, so we reviewed past hospital ratings by two of the rating agencies to determine which CRA’s methodology would best fit our client’s situation and provide the most advantageous rating. Through the analysis, it became clear that one CRA would base its rating on the district’s taxing power and put less emphasis on the hospital's operations, whereas the other CRA would base its rating on the hospital’s revenue and then make adjustments based on tax support. Using the latter CRA would have resulted in a lower rating. We recommended the former and the hospital attained a BBB+ rating.

It’s really that simple: being familiar with how CRAs rate bond issues will help you be successful in obtaining the highest possible rating and lowest cost of capital for your project.

The Importance of a Strong Investment Policy Statement

Becoming a (Financially Stable) System

You’ve decided to fund your next capital project with a rated bond issue. Your next step is to decide which credit rating agency (CRA) to use. Now the dilemma: how do you pick the one that will get you the lowest cost of capital?

Role of credit ratings

Credit ratings, essentially opinions about credit risk issued by CRAs, play a role in enabling businesses, governments, non-profits and other entities to raise money in the capital markets through bond issuances.

"Having a rating is similar to a compass,” said Tom Woolsey, senior vice president at Lancaster Pollard and manager of its trading desk. “As an investor, a rating gives you a direction to your purchase and a focus point in the credit evaluation process. It allows you to consider ranges of rates within each rating category, which are used to differentiate between multiple types of issuances, such as hospitals, senior living and affordable housing.”

From an investment perspective, there are generally more buyers interested in rated debt than non-rated debt; therefore, having a rated issue increases the universe of prospective investors. On the whole, a rated product finds an easier path to portfolios than a non-rated one does, according to Woolsey.

The field: Fitch, Moody’s and S&P

However, finding a CRA that will give you the best rating for your issue involves research and serious consideration by you and your investment banker.

The three largest credit agencies in the United States are Standard & Poor’s (commonly called S&P), Moody’s Investors Service and Fitch Ratings. “The Big Three,” as they are called, have about 95 percent of the world-market share for ratings.

Each has its own criteria and methodology in measuring credit worthiness. In forming their opinions of credit risk, these credit agencies primarily use analysts or mathematical models or a combination of the two.

Moody’s uses a different rating system for long-term and short-term debt from S&P and Fitch. The systems are similar in that both range from highest credit quality on one end to default on the other, with different degrees for each rating.

Choosing a CRA

There are several overall and sector-specific factors to consider when selecting which one of “The Big Three” to rate a bond issue. Generally, a borrower's prior experience with the rating process, internal readiness to be rated and whether there are other borrowers in the local market that have similarly rated bond issuances play a role in the decision-making process.

When evaluating the credit agencies, you and your investment banker should consider the following:

- Fees — Fitch, Moody’s and S&P use the issuer-pay model where fees are determined in part by the service completed and the par amount of the debt issuance. Each of the agencies charge for the initial full rating and an annual fee for surveillance of the rating for the duration of the debt.

- Timeline — Typically, the rating process from initial meeting with a credit agency to public release of the rating takes about 90 days. However, as with any vendor, get a firm estimate of the time involved from the rating agency you’re considering.

- Recourse — Although credit ratings are final when made public, each CRA has its own philosophy or approach to customer satisfaction if an issuer isn’t satisfied with a rating. Moody’s states, “Ratings are never ‘final’ when they are issued as various internal and external circumstances can cause us to re-evaluate at any time.” Fitch explains it has a “very clear rating and review process, which includes an opportunity for a borrower to request additional review of any rating decision…” S&P considers the rating process voluntary. It holds that “the client decides whether or not to make the rating public.”

- “Sell-ability” — When considering a CRA to rate a bond issue, borrowers should take into account the size of each CRA’s bond-rating portfolio for their industry as bond investors tend to favor the rating agency with the most investment-grade bonds for that sector.

- Approach — Borrowers should review and understand the criteria that each CRA uses when rating a bond issuance. Generally, each CRA has sector-specific criteria which identify key qualitative and quantitative credit factors that guide the rating decision. These will be discussed further for each sector below.

Finally, let’s take a look at each CRA by sector-hospitals and health systems, senior living and affordable housing — focusing on the number of rated bond issues in their portfolios at the time of publication and the criteria each one uses in rating bonds.

Hospitals and health systems:

Fitch has ratings on 230 revenue-supported hospitals and health systems, including 129 stand-alone hospitals and 101 health systems. The criteria for nonprofit healthcare include three categories of analytical focus: governance and management, operating profile and financial profile. Hospitals are rated on revenue-supported master criteria, unless a general obligation bond has been passed then tax-supported criteria apply.

Moody’s rates about 1,200 hospitals and health systems (no breakdown available). Its analysis focuses on market position, governance and management, operating performance, balance sheet and capital plan and covenants and legal framework.

S&P provides credit ratings to 410 stand-alone hospitals and 140 health systems. Criteria are divided into the Enterprise Profile, which looks at demographics, business position, management, payor profits, demand, medical staff and governance, and the Financial Profile, which exams an organization’s financial policies and performance, liquidity, financial flexibility, debt and liability. After evaluating the credit quality of hospital operations, S&P will assess the strength of the supporting tax base.

Senior living:

Fitch provides ratings for 74 continuing care retirement communities (CCRCs) and four nursing homes, which are evaluated using their respective sector-specific criteria. The analytical focus is the same as hospitals.

Moody’s has only one rated senior-living provider at this time.

S&P rates 70 CRCCs. The criteria are the same as hospitals.

Affordable housing:

Fitch rates four general obligation housing agencies, each with several rated indentures within them. Rating criteria for state housing finance agencies (HFAs) and single-family mortgage sector include: asset quality and loss mitigation, financial resources and management capabilities. The criteria for pooled multifamily housing bonds focus on pool composition and performance, issuer management of the pool, program financial strength and bond/legal structure.

Moody’s covers HFAs and nearly 1,000 single-family pooled and multifamily projects. HFAs are evaluated by: financial position, portfolio performance and composition, management and general underwriting criteria. Related categories like variable-rate demand bonds and multifamily housing bonds secured by Fannie Mae and Freddie Mac also are relevant.

S&P maintains ratings on 66 affordable real-estate transactions and 29 bond issues that benefit from Section 8 project-based subsidy. S&P evaluates a number of factors when determining the credit strength of a Section 8 property. While debt service coverage is a key component, S&P also take into account past financial performance of the property, the surrounding real estate market, the strength of the owner and the management team and the asset quality of the property.

Credit ratings in action

Lancaster Pollard was engaged by a hospital district in the Southwest to provide financing for a replacement critical access hospital. The district, which provides the CAH with operating and maintenance support, passed a general obligation bond with an 82 percent approval rating. It would have been a stretch to attain an investment-grade rating with the CAH’s revenues alone, so we reviewed past hospital ratings by two of the rating agencies to determine which CRA’s methodology would best fit our client’s situation and provide the most advantageous rating. Through the analysis, it became clear that one CRA would base its rating on the district’s taxing power and put less emphasis on the hospital's operations, whereas the other CRA would base its rating on the hospital’s revenue and then make adjustments based on tax support. Using the latter CRA would have resulted in a lower rating. We recommended the former and the hospital attained a BBB+ rating.

It’s really that simple: being familiar with how CRAs rate bond issues will help you be successful in obtaining the highest possible rating and lowest cost of capital for your project.

More Articles Featuring Lancaster Pollard:

Opportunity Knocking: Taking Advantage of Low Short-term Interest RatesThe Importance of a Strong Investment Policy Statement

Becoming a (Financially Stable) System