Various macro trends are converging in ways that are disrupting all healthcare industry participants. Here's how to respond.

The pressures facing the U.S. healthcare industry are well-known:

- The population is aging. The U.S. Census Bureau predicts that by 2030, the proportion of people in the United States age 65 and older will climb from 13 percent to 19 percent of the population. Since annual per capita healthcare costs tend to be much higher for older adults, this suggests a dangerous scenario in which a shrinking percentage of working adults will be asked to shoulder soaring costs for a growing cohort of elderly dependents.

- Healthcare costs are still out of control. According to the CMS, total U.S. healthcare costs are projected to reach nearly $4.8 trillion by 2021, by which time they will account for nearly 20 percent of gross domestic product (up from less than $3 trillion and under 18 percent of 2013 GDP).

- Many more people will be insured. According to the Congressional Budget Office and the Joint Committee on Taxation, the 2010 Patient Protection and Affordable Care Act now being rolled out will lead to 34 million more non-elderly Americans obtaining health insurance by 2021. By that time, approximately 95 percent of all non-elderly legal U.S. residents likely will have health insurance, a significant increase over the 83 percent insured in 2011.

These macro trends are converging in ways that are disrupting all healthcare industry participants. Employers, for instance, are putting pressure on insurers to reduce charges and carry more risk. Insurers are pressuring providers to do the same.

Meanwhile, providers are being asked to take on new financial risks tied to quality of care. By 2017, the PPACA will require Medicare to modify payments to all physicians and physician groups based on risk-adjusted quality and cost metrics. The PPACA already has led CMS to reduce payments for hospitals with what it considers to be excess readmissions of patients with acute myocardial infarction, heart failure or pneumonia. CMS has proposed expanding this list of applicable conditions for 2015.

All this has pushed payers and providers alike to take steps to reduce costs while improving quality. In California, Blue Shield has tried to improve outcomes for knee and hip replacement surgeries for California Public Employee Retirement System retirees by moving toward a centers of excellence strategy. Blue Shield identified 16 facilities with a history of strong results for knee and hip replacements and announced that it no longer would fully cover CalPERS members' costs for these procedures if performed at other facilities.

An analysis by research company HealthCore Inc. found that this strategy lowered CalPERS' health plan costs for these procedures by 19 percent between 2010 and 2011 for participants in a pilot centers of excellence program.

Meanwhile, in the Pacific Northwest, Group Health Cooperative asked more than two dozen surgeons and over a dozen physician assistants to create evidence-based medicine decision tools for making go or no-go decisions on knee and hip replacements. Implementing these guidelines over an 18-month period from 2009 to 2010, Group Health reported a 38 percent reduction in knee replacements and a 26 percent reduction in hip replacements, lowering costs by 12 percent to 21 percent.

Like these organizations, every healthcare player will have to develop new strategies, competencies and tactics to stay competitive.

Strategies for success

There are three overarching strategies that healthcare organizations must pursue to succeed in these turbulent times:

1. Focusing on customer centricity. Every type of organization will need to focus on empowering individual customers to improve quality and reduce costs.

- For payers, this means refining member segmentation and product design, especially for high-cost or high-risk individuals.

- For providers, this means developing a patient-centered culture in which coordinated teams of physicians, nurses and non-clinical staff diagnose and treat patients more efficiently.

- For large employers, this means moving beyond one-size-fits-all programs toward more tailored, analytics-based solutions.

2. Managing risk with new business models. Every type of organization will need to analyze the costs and benefits of assuming or shifting risk.

- For payers, this could mean shifting risk toward consumers by emphasizing cost awareness and preventative care. It also could mean repositioning risk to providers by negotiating contracts that include partial or global capitation and pay-for-outcomes models. In a number of instances, payers have taken even more dramatic steps by entering the provider space, creating integrated healthcare systems where payers have direct control over the cost and quality of care.

- For providers, this could mean beginning to view the assumption of risk as a competitive advantage. For example, a provider could take a fixed fee to cover an employee population instead of charging for each service provided. To take on risk profitably, providers need more efficient ways to treat costly conditions by developing capabilities to stratify risk, developing predictive models and redesigning organizational processes.

- For employers, this could mean continuing the trend toward shifting more risk to employees through high-deductible health plans with health savings accounts (also known as consumer-driven health plans). Over the next three to five years, some small and medium-sized employers likely will push employees out of firm-sponsored plans into the new private health insurance exchanges mandated by the PPACA.

3. Building scale. Every type of organization will need to invest in the advanced information technology capabilities required to facilitate and manage large-scale consolidation.

- For payers, this means larger national players will have a scale advantage as the industry moves to payment for outcomes. Regional Blue Cross and Blue Shield organizations already are pooling resources and partnering across state lines.

- For providers, this means consolidation will continue. The larger the hospital network, the deeper its pockets for IT and infrastructure investments. Hospitals will continue to acquire smaller competitors and also will increasingly choose to employ physicians directly in order to own the care continuum.

- For employers, this means combining resources within regions or specific sectors to increase leverage with payers and enhance the organization's ability to manage employees' healthcare.

Capabilities in action

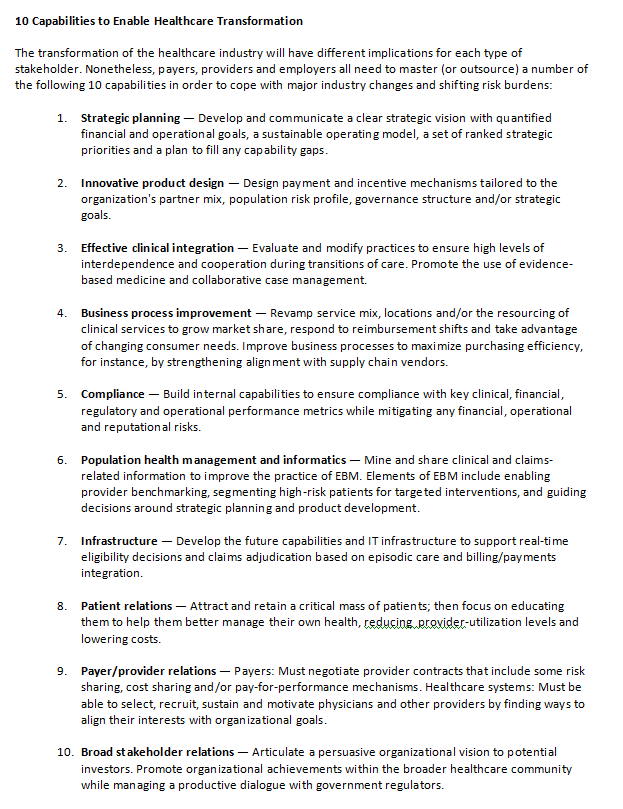

The diversity and scope of the healthcare industry make it impossible to recommend a general course of action for every player. Yet we can illustrate the ways in which two advanced organizations are leading the way by creatively establishing or strengthening some of the capabilities listed in the sidebar, "10 Capabilities to Enable Healthcare Transformation."

1. Business process improvement. A decade ago, ThedaCare, a northeast Wisconsin health delivery system with more than 6,000 employees, began focusing on improving processes and reducing waste by looking outside healthcare to a nearby power company that had reaped the benefits of lean techniques.

Applying the lessons of lean and the Toyota Production System, ThedaCare created the ThedaCare Improvement System. Leaders engage staff in week-long process improvement projects that have succeeded in reducing costs, eliminating waste and improving patient outcomes. From 2006 to 2009, TIS enabled ThedaCare to increase employee productivity by 12 percent, saving the hospital more than $27 million.

These cost savings have allowed ThedaCare to increase prices at a far lower rate than its competitors. By improving quality of care even as the organization keeps its costs among the lowest in the state, ThedaCare strengthened its relationships with both insurers and patients.

2. Effective clinical integration. Geisinger Health System serves more than 2.6 million residents in central and northeastern Pennsylvania. Its 2011-2015 Vision document notes the organization's ambition to serve as a model for integrated health services organizations. At Geisinger, this means a physician-led system that incorporates multidisciplinary group practices, clinical programs, a research program and an insurance provider (Geisinger Health Plan), all integrated on a sophisticated IT platform.

One of the most powerful elements of the Geisinger system is the standardization of best practices; i.e., the creation and deployment of a ProvenCare® model of treating certain conditions and performing specific procedures with the same protocols at all its facilities. Developed in partnership with the clinical and health plan divisions of Geisinger, the ProvenCare model requires Geisinger physicians to follow evidence-based best-practice guidelines. The ProvenCare model holds multiple members of the surgical team responsible for patient care through a system of checks and balances that are documented and cross referenced in a patient’s electronic health record.

ProvenCare has delivered impressive results. In its 2011 system report, Geisinger analyzed five years of data available since implementing the first ProvenCare model for coronary artery bypass graft patients and found that ProvenCare protocols had lowered in-hospital mortality by 67 percent and reduced the likelihood that a patient would need blood products during surgery by nearly 50 percent. Geisinger is so confident that ProvenCare will deliver favorable surgical outcomes that it promises to cover the entire cost of any follow-up care provided by a Geisinger clinician in a Geisinger facility for Geisinger Health Plan members who experience avoidable complications within 90 days of a ProvenCare procedure. (The company notes that it hopes to expand this warranty to members of other insurance plans in the future.)

Geisinger's ProvenCare program illustrates how healthcare organizations that excel in one of the 10 capabilities that enable healthcare transformation probably will possess other capabilities as well. While the ProvenCare model was developed in the context of clinical integration (capability #3), it also demonstrates strategic planning (capability #1) and innovative product design (capability #2). In addition, the program relies on the IT (capability #6) needed to establish EBM care guidelines and track the program’s success through patient electronic medical records. And the organization’s pioneering embracement of a pay-for-performance culture helps Geisinger differentiate itself and appeal to both patients (capability #8) and payers (capability #9).

Fortune favors the bold

As noted, the pace of change in the U.S. healthcare industry is accelerating. The next few years will see major changes in technology, healthcare economics and organizational structure, particularly as the PPACA takes effect.

Organizations should avoid the trap of assuming that current local dominance will grant them immunity to the wider forces sweeping the industry. At the moment, innovative national clinics are taking market share from complacent local providers. Since early 2012, for example, Kaiser Permanente has opened four new medical centers in Maryland, Virginia and Washington, D.C.

Meanwhile, Mayo Clinic's CEO is looking beyond Minnesota as his organization contemplates a 20-year expansion plan. Even retailing behemoth Wal-Mart has expressed interest in taking on a larger role in the healthcare marketplace.

Providers that hesitate will find it increasingly hard to recruit the best physicians. Physicians will prefer to join organizations that are tackling change proactively rather than seeking to hold back the tide.

Even healthcare organizations that recognize the urgency to act can freeze as they try to figure out how to prioritize all the changes needed to stay ahead of the competition and cope with the forces transforming the industry. The key to breaking free of that paralysis is to focus on a three-pronged strategy: empower customers, manage risk by deploying new business models and build scale to take advantage of the IT capabilities that are absolutely critical to future success.

Phil Polakoff, MD MPH, is FTI Consulting's Chief Medical Executive. He is a widely recognized health management thought-leader. Dr. Polakoff is extensively involved in advising healthcare organizations on how to transform successfully from fee-for-service to value-based population health delivery systems.