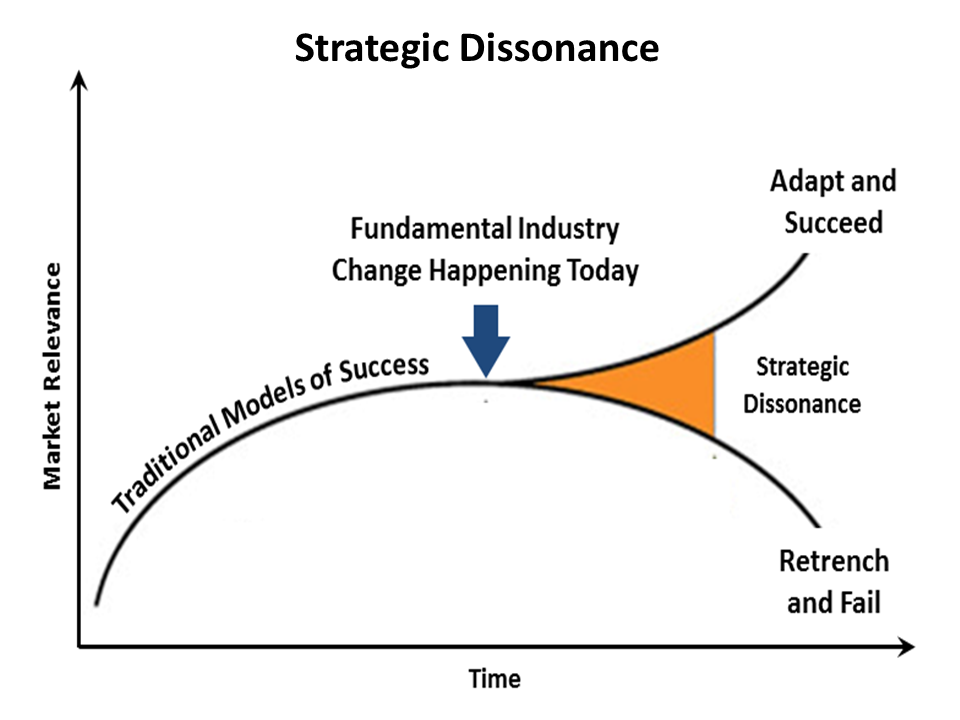

The concept of strategic dissonance is not new. In the mid 1990's it was used to describe why a high-technology organization might hang on to its old way of doing things too long.

Strategic dissonance describes disconnect between an organization's actions and intent when an organization passes the inflection point where old models of success no longer work. We believe the concept is useful for describing many health systems' actions today.

Healthcare as an industry has clearly passed several inflection points with radical changes to the health systems' competitive basis and position. For some the recognition they are operating in a period of strategic dissonance is lacking. For others, the adaptation to the new models of success is slow. To accelerate the health system's thinking an adaptation, we offer five tips and implications to healthcare's period of strategic dissonance.

Tip 1: Identify the industry inflection point

Identifying the important industry inflection point is difficult. There are the major events like the patient protection and affordable care act or the consolidation of industry participants. However, understanding if an individual event is going to fundamentally alter the industry's basis for competition cannot be directly gleaned from an event. For confirmation it is useful to look for the first indicators that an event has actually created a new industry structure. The best early indicators an industry is in the early stages of strategic dissonance are changing customer demands and the entrepreneurs that are recognizing and meeting the unmet demands.

As such, health systems should be actively looking for new industry entrants and thoroughly investigating why they are entering. Rather than assume the outside organization is ignorant of "what works in healthcare" the strategically astute will view each entrant as an indicator of strategic white space in their industry position and seek to understand what the new entrant sees that the health system does not.

Tip 2: Ask the customer

When in doubt ask the customer what they want and track how those wants have changed over time. Any significant change in the customers' wants signifies an inflection point and indicates the direction of the new competitive basis.

An important first step is identifying the customer early in their decision making process. For health systems the customer has historically been defined as "patient" (or in some cases the physician). "Patient-centered care" is a strategy to focus on that customer.

However, with change to the industry, the definition of customer may also change. Today we see a new customer emerging: the healthcare consumer. While often the consumer is or becomes a patient, they are not always so at the point when they are making their decisions. In fact many of the "best" commercially insured patients are the well, non-patient occasional healthcare consumers. Reaching them with a system of health is as important in the new environment as reaching the patients with a system of care was in the old environment. Beware therefore which customers you ask and how you ask the questions. Using tip 3 below can help identify the new customer definitions.

Tip 3: Identify what others, particularly new entrants are doing about the change

Knowing there has been an industry-wide change is only a start, the health system must also identify the new basis for competition. Rather than follow the current industry leader, there is often more insight to be gained by looking from the outside-in. What are the new entrants to the industry doing? While most new entrants to the provider industry have no idea what they are getting into, evaluating what these new entrants are trying to do can provide valuable insight into the industry's likely new competitive frameworks.

Pairing this outside insight with industry knowledge and experience can allow health systems to rapidly adopt the new ideas in a way that can be practically implemented across an entire health system's market and thus get to market scale faster.

Tip 4: Be willing to set aside the old industry "rules"

The major organizational challenge with fundamental industry change is strategic dissonance. The rules of the game have changed, the health system is organized under the old rules and often refuses accept this change. With every strategy discussion or process, at least some of the time should be spent evaluating what would happen if some of the current "way we do business" was changed.

Successful organizations have an advocate to challenge the industry rules status quo thinking.

Tip 5: Invest in testing ideas for capability rather than financial returns

In an industry undergoing fundamental change, waiting for clarity on the new rules is not the safest approach. Rather taking multiple small bets will allow the organization to learn the new rules faster while limiting losses and not having to "bet the company" on an old or heretofore unproven strategy. Large health systems can and are using incubators to invest in entrepreneurial activities and test various ideas. Smaller systems can use joint ventures and short-term contracts to test new ideas and, when backed by a team that is actively seeking to learn from the relationships, bring the learning into the health system.

In this case hiring outsiders that are focused on building your capabilities rather than outsourcing your solution should be the focus. Learn rather than outsource.

Summary

The concept of strategic dissonance is not new. What is new is the formal application of the concept to healthcare. Today many health systems are in a position of strategic dissonance. The five tips offer ways to identify the major industry inflection points that lead to strategic dissonance and understand the new industry rules of success.

Kate Lovrien and Luke C. Peterson are principals at Health System Advisors. Together, they have spent more than 25 years advising senior healthcare leaders on their market and organizational strategy.

Health System Advisors is a strategy think tank and consulting firm focused on helping health systems improve their market and industry position. Through M&A, partnership strategy, ambulatory planning and service line development offerings, we live out our mission: Advise Leaders, Advance Organizations, Transform the Healthcare Delivery Industry.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.