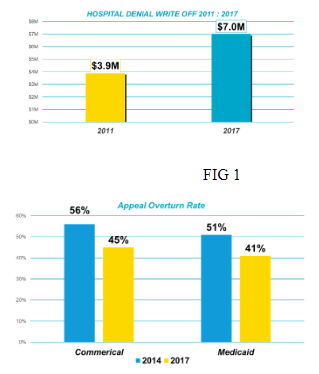

The healthcare industry continues to struggle with claims denial write-offs, which have climbed consistently over the past decade. Denials are a big issue and the challenge continues. Denial write-off adjustments average 3% to 4% of net revenue, which equates to $262 billion in initially denied claims for healthcare providers annually1. More specifically, per a 2017 Advisory Board study, one in ten claims was denied at an average 350-bed hospital2, representing an increase of over $3 million (or 79%) in adjustments (see Fig. 1) since 20113.

One out of every five dollars of revenue cycle management (RCM) expenses are attributed to denials-related issues4 and to top it off, 67% of denials are recoverable while 90% of denials are preventable.5 Effectively preventing denials can yield upwards of $5 million in additional revenue for a typical hospital.6

Not only are denials getting larger, but they are also getting harder to resolve as the appeal overturn win rate is declining significantly – the commercial overturn rate is down 11% while the Medicaid overturn rate is down 10% (see Fig. 2).7 Denials are also a costly task to resolve. According to a report, denials cost $118 dollars per claim to appeal, equating to $8.6 billion in administrative costs to our industry in 2016.1

Recognizing reasons for denials

Denials represent a broad term in our industry, and they can be categorized many different ways. Getting to specifics is important when attacking a denials issue - where and when a patient account is at risk for nonpayment is a key metric in which organizations should focus attention. Registration errors, insufficient documentation, and unclean claims represent areas that directly influence non-payment and claim delays – every time.

Denials can fall into categories of hard (or “fatal”) or soft (“recoverable”) denials, depending on their complexity. Soft denials may involve inaccurate or out-of-date demographic information. Another example may be a patient who registered under a different name than the name listed on the insurance card presented. Other “simple” issues surrounding the relationship of patient to policyholder, or a failure to update insurance or personal information can cause major eligibility denial issues downstream.

Hard denials, on the other hand, generally require the provider to appeal to the payer. In order to form a basis for appeal, the provider has to complete significant research to overturn the appeal and get paid for the claim. These involve medical necessity or precertification issues surrounding medical documentation and coding. Diagnoses, modifiers, clinical notes, other insurance information and other “proof” from the provider must be reconciled and submitted (often multiple times) to secure payment. These denials often result in unnecessary research and rework to determine how and why the denial occurred - which is a key to denial prevention.

Reasons for denials are also highly variable across organizations depending on how a denial is measured. Some organizations measure it as an initial denial while others track it as a bad debt adjustment, never to be recovered. Authorizations, eligibility and medical necessity top the list of the most common reasons for denials. According to TransUnion’s 2018 Revenue Cycle Management Customer Advisory Board, the most common reasons for denials were authorization-related denials due to changes in service and incomplete information. They also identified clinical-related denials due to poor clinical documentation as another area of opportunity. Members shared that denial reasons vary significantly based on patient types (for example, medical necessity is a top reason for inpatient and eligibility for outpatient).

Preventing denials before they happen…again

As denial reasons evolve and become significantly more complex, it’s important to have a strategy that prevents them from happening on a go forward, predictable basis. Providers need to deploy strategies that support their ability to rise above the game to ensure payment from their payers. TransUnion Healthcare Advisory Board members also reinforced this and shared that they are looking for analytical solutions that will help them have informed conversations with payers to help “get out of the game”.

Providers need a strategy that addresses denials in several areas:

- Eligibility

- Medical Necessity

- Authorizations

- Out of timely filing

- Clinical Denials (UR)

Denials fundamentally arise from a failure to consistently follow a published process. Most providers are challenged in a cycle of looking at the same denials, with the same issue, without much change in revenue. It is important to look at this differently and have a consistent process surrounding the reason for the denial, its scope, and most importantly, how to prevent it going forward. Providers must verify insurance rules and coverage or risk doing the procedure(s) for free and repeating the cycle. Automating real-time and batch eligibility verification data can ensure higher claim yield and prevent rework from denials prior to claim submission. For authorizations and medical necessity, it is important to keep up-to-date with payer business rules and stay compliant with ever-changing rules and regulatory requirements to avoid denials.

Deploying a more innovative analytics solution and targeting denial prevention tactics based upon the trend of the denials will help prevent denials. Successful organizations create and track appeals for denied claims to minimize manual re-work and streamline the appeals process.

Leveraging your data to optimize your revenue

Denials management has always been a key area of revenue opportunity, and yet few organizations have had success in mitigating them. While healthcare providers possess enormous amounts of denials related data, they are often challenged with being able to successfully derive actionable insights from them. A key strategy is to leverage technology that automatically, for each payer, calculates the overturn success rate by denial code to a high level of specificity in the denial reason, payer involved, and the dollars at risk. For denial prevention it is critical to evaluate:

- Revenue. The true dollar value that has been denied.

- Data. The accurate and actionable denial reasons, including opportunities to integrate the data from all the available sources (remits, website/DDE, payer correspondence, representative phone conversation etc.)

- Analytics. Analysis of the denials by department, DRG, procedure code, revenue code, diagnosis code, and service area, to understand trends for bulk resolution.

- Resources. Using predictive analytics to help prioritize representatives’ time on first working denials where there is a history of successfully overturning them.

- Prevention: A move from traditional denial management to– actionable data, and leveraging it to identify “prevention” and not just “management” opportunities.

It is important to leverage solutions that bring data together from several source systems to evaluate line-item level denials that can be used to work denied claims, but also puts processes in place to avoid new denials going forward. By taking the approach above, and calculating success rate of overturning denials by denial reason and payer, successful organizations can prioritize which accounts they need to be put in front of staff for resolution, versus outsourcing accounts with lower success rates to external vendors or writing off lower balance accounts completely.

In a TransUnion Healthcare case study, the return on investment, through leveraging an innovative analytics tool targeting denials prevention, maximized reimbursement, at the right cost, in the shortest time possible, was clearly identified. The results showed a 5-10x improvement in these areas across several initiatives such as zero balance bill underpayments, payer contract language shortfalls, appeal strategies, consolidation strategies, and labor savings.

A detailed examination revealed three key principles:

- Improvements in net revenue occurred through reducing unnecessary software costs. Contract management solutions, or denials software typically were not yielding the anticipated results, and were subsequently replaced with a solution that drove results in payment and overturns, instead of measuring denial activity.

- Outsourcing costs were reduced 50-75% as well as a reduction in labor costs associated with payer contract maintenance and payment integrity. Through having the right data, delivered to the right people, at the right time, an organization was able to effectively manage payments and drive yield, with a 20% reduction in headcount.

- Cash was accelerated 3-5% through avoiding untimely filing and billing follow up black holes. Contracts were re-written to drive higher reimbursement and yield, through identifying areas where underpayments were occurring at a higher rate than other payers. A/R days were also significantly reduced in this process by 10-30% by avoiding re-work and billing delays associated with common soft denials.

In summary, denial prevention requires a new strategy. A strategy that deploys an innovative analytics solution that can bring data together in a way that maximizes reimbursement, accelerates cash collection, and eliminates cost. The paradigm of managing denials must transition to that of prevention. Leveraging people, process and technology represents a critical step in driving yield in denials prevention.

Sources:

- Change Healthcare Healthy Hospital Index, https://www.changehealthcare.com/blog/wp-content/uploads/Change-Healthcare-Healthy-Hospital-Denials-Index.pdf

- Modern Healthcare, https://www.modernhealthcare.com/revenue-cycle/why-your-denials-are-skyrocketing-and-3-ways-hospitals-can-respond

- Advisory Board Company Biannual RCM survey, https://www.advisory.com/research/revenue-cycle-advancement-center/at-the-margins/2014/12/denials-management

- HFMA, https://www.hfma.org/topics/hfm/2018/september/61848.html

- Advisory Board, https://www.advisory.com/research/revenue-cycle-advancement-center/at-the-margins/2014/12/denials-management

- HFMA, https://annual.hfma.org/2019/Custom/Handout/Speaker0_Session1155_1.pdf

- Becker’s Hospital Review, https://www.beckershospitalreview.com/finance/denial-rework-costs-providers-roughly-118-per-claim-4-takeaways.html

About the Author

Jonathan Wiik has almost 25 years of healthcare experience in acute care, health IT and insurance settings. He started his career as a hospital transporter and served in clinical operations, patient access, billing, case management and many other roles leading up to Chief Revenue Officer. His cumulative expertise gives him keen awareness and vast knowledge into the inner workings of the revenue cycle across the continuum of care. He currently serves as a Principal of Healthcare Strategy at TransUnion Healthcare.

For more information about price transparency, patient payment estimation and financial clearance solutions, visit transunion.com/patient-access. TransUnion Healthcare’s robust revenue recovery solutions help maximize reimbursement opportunities. Learn more: https://www.transunion.com/revenue-recovery.