Reprinted with Mark Farrah Associates’ permission.

Most of the nation's leading health plans saw enrollment gains in the first quarter of 2011 and all saw improved profit margins both year-over-year and for the quarter. Between December 2010 and March 2011 top plans saw an aggregate increase of more than 2.0 million members. While aggregated fully-insured business continued to experience losses, the administrative services only (ASO) segment gained over 2.2 million members during the primary 2011 open enrollment season. Membership gains occurred across Medicare, Medicaid and Commercial lines of business.

This brief presents key findings from MFA's review of enrollment and financial trends among seven top health insurers: Aetna, CIGNA, Health Care Service Corporation (HCSC), Humana, Kaiser Permanente, UnitedHealth Group and WellPoint. It looks at results from first quarter 2010 to first quarter 2011. Financial and membership data and observations were gleaned from the July 2011 Health Insurer Insights™ series. These seven health plans cover approximately 41% of the total population in the nation.

Overall membership gains

Year-over-year, total membership for the seven leading plans increased by 1.5 million (1.1%), from 126.5 million as of March 2010 to 128.0 million as of March 2011.

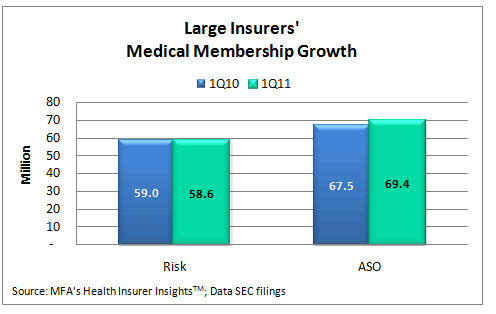

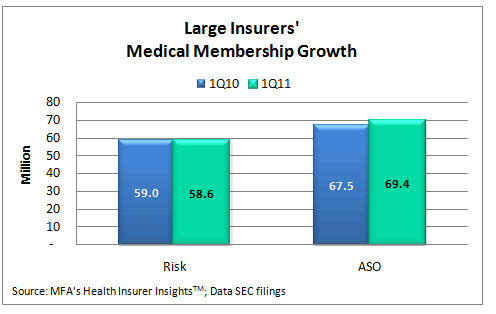

From March 2010 to March 2011, the administrative services only (ASO, also known as self-insured) segment gained more than 1.9 million covered lives, ending 1Q11 with approximately 69.4 million members. Fully-insured (risk) enrollment declined 402,000 members in the same period. Aggregate risk enrollment for the top plans totaled 58.6 million at March 2011.

Most of the nation's leading health plans saw enrollment gains in the first quarter of 2011. Between December 2010 and March 2011 top plans saw an aggregate increase of more than 2.0 million members. While aggregated fully-insured business continued to experience losses, the ASO segment gained over 2.2 million members during the primary 2011 open enrollment season.

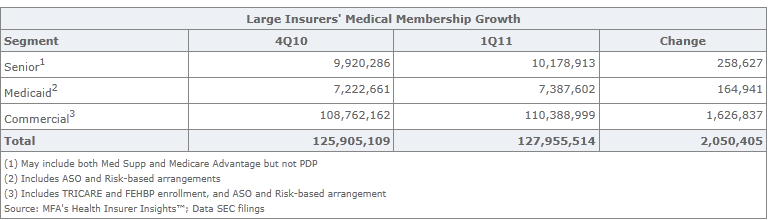

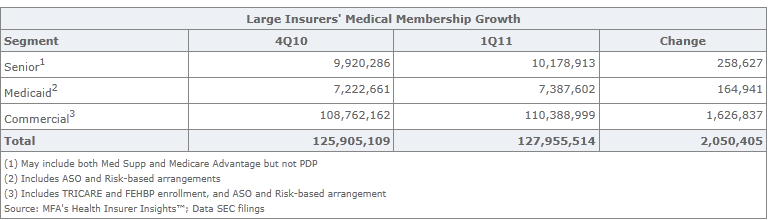

Both the Senior and Medicaid market sectors for top health plans continued to see growth, gaining nearly 259,000 and 165,000 net new members during the first quarter, respectively. The Commercial sector saw a net gain of 1.6 million members between December 2010 and March 2011. In comparison, the Commercial sector gained approximately 388,000 between December 2009 and March 2010.

The Patient Protection and Affordable Care Act's (PPACA, also known as health care reform) requirement that health insurers cover dependents to age 26 most likely influenced the 2011 results for the Commercial sector. WellPoint mentioned in its first quarter 2011 10-Q SEC filing that it estimates for the 12 months ended March 31, 2011, "an increase of approximately 210,000 self-funded members attributable to the Age 26 dependent coverage policy change associated with the health care reform." The company estimated an additional "70,000 fully-insured members attributable to the Age 26 dependent coverage policy change," primarily in the Federal Employee Plan. WellPoint's total commercial membership increased 220,000 from 1Q10 to 1Q11. Aetna's senior executive vice president and chief financial officer, Joseph Zubretsky, mentioned in the company's 1Q11 Earnings Call "that the age 26 phenomenon had an impact of less than 100,000 members in Aetna's Commercial membership." Aetna experienced a loss of 649,000 Commercial members from 4Q10 to 1Q11 and a loss of 1 million Commercial members between 1Q10 and 1Q11. Without the increase in dependents between the ages of 18 and 26, Aetna's commercial enrollment losses would have been worse.

Health plans' enrollment results

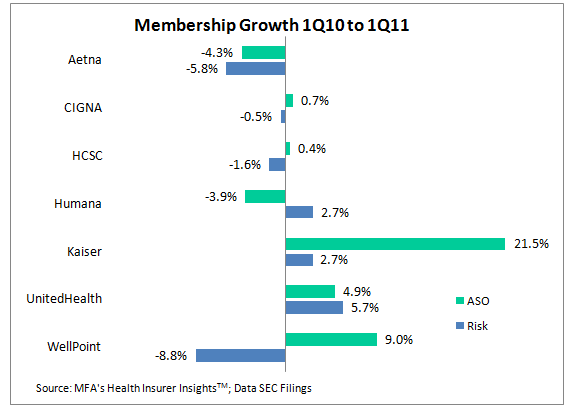

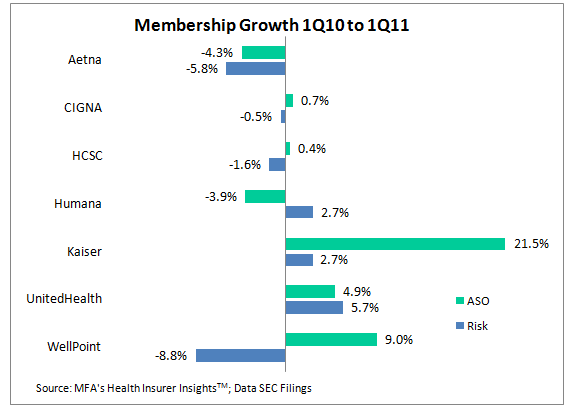

Five of the seven top plans saw membership gains between March 2010 and March 2011. UnitedHealth saw the largest growth among the leading plans, adding 1.710 million net new members between 1Q10 and 1Q11. WellPoint added 1.685 million new ASO members in 1Q11, but lost 1.322 million fully insured members, for a net gain of 363,000 total members year-over-year. UnitedHealth saw gains in both segments. Kaiser also saw growth in both segments, with a net gain of over 244,000 members for the same period. Aetna, the third largest health insurance organization in the country based on membership, lost a total of 894,000 members for the twelve months ended March 31, 2011.

HCSC lost an estimated 50,000 members from 1Q10 to 1Q11; however, HCSC ASO enrollment may be underestimated. According to a Standard & Poor's Global Credit Portal Ratings Direct® report, dated February 14, 2011, on Health Care Services Corp. (d/b/a Blue Cross Blue Shield of Illinois, New Mexico, Oklahoma, and Texas), "The Company will add several large national administrative services only (ASO) accounts in 2011." Standard & Poor's estimated HCSC's overall enrollment will "grow slightly to 12.5 million to 12.7 million members in 2011." Mark Farrah Associates currently estimates HCSC enrollment as 12,547,000.

CIGNA and Humana both reported modest net gains in enrollment. However, for CIGNA gains in ASO offset losses in risk-based business. Humana saw the reverse, with growth in fully-insured membership offset by losses in self-funded business.

Combined the seven leading companies reported a net gain of 1,497,638 members, up 1.2%, from 1Q10 to 1Q11. Aggregated ASO enrollment grew 2.8% and risk enrollment declined -0.7%, year-to-date for these organizations.

Profitability improvements

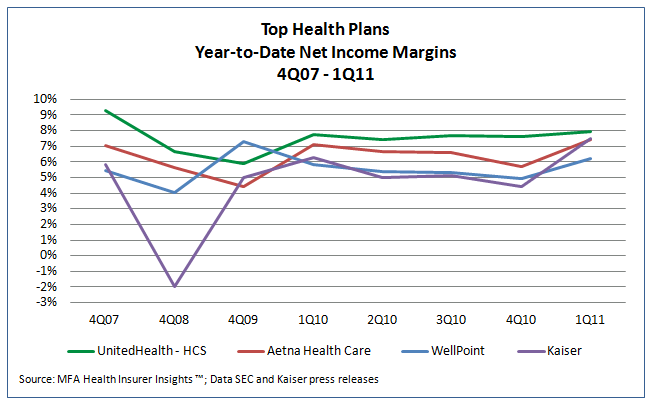

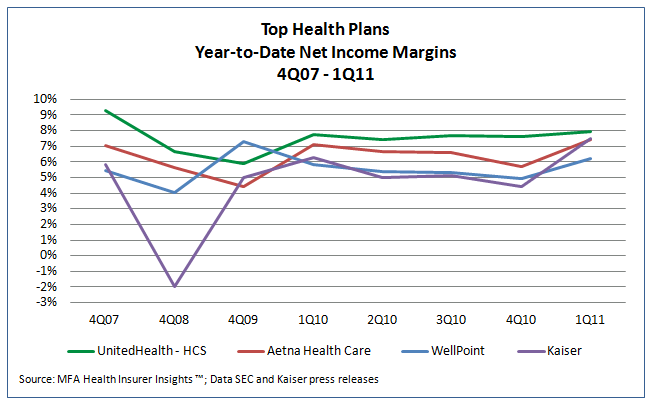

It is difficult to compare leading health plans' financial situations because they use diverse strategies to grow their respective businesses and operate with disparate business models. However, all of the top health plans saw improved profitability year-over-year between 1Q10 and 1Q11 and from 4Q10 to 1Q11.

UnitedHealth Group's UnitedHealthcare business unit, the leading health carrier in terms of revenues, reported a 7.95% profit margin* for the quarter ended March 31, 2011 compared to the 7.77% UnitedHealthcare reported for 1Q10. Kaiser Foundation Hospitals and Health Plan's, net income margin* of 7.68% for 1Q11 is up from 6.42% as of 1Q10. Aetna's Health Care sector's margin* of 7.45% through March 2011 was also up compared to the 7.10% margin reported through March 2010. WellPoint, the second largest carrier in terms of revenue, reported its profit margin grew from 5.81% in 1Q10 to 6.22% in 1Q11.

* Profit margin is net income (loss) divided by total revenues.

CIGNA Health Care, whose primary health business centers around municipal government, Taft-Hartley Trusts and global employers, reported its profit margin was up close to 2.1% year-over-year. Humana, with more than 60% of its enrollment from federal government programs, saw the smallest gains. Humana reported a net income of 3.43% for 1Q11, up from 3.07% as of 1Q10.

First quarter 2011 financial performance for most plans included accruals for certain expenses related to health care legislation, including medical loss ratio rebates and implementation costs for The International Statistical Classification of Diseases and Related Health Problems, 10th Revision standard (known as "ICD-10"). Most health plans in the U.S. must make the ICD-10 change to their claims systems by January 1, 2012 to enable reimbursement and resource allocations beyond that date. After two years of mixed financial and enrollment results, 2011 appears to be off to a good start for the top health plans in the U.S.

Health Insurer Insights™

For consistent updates about membership changes and business strategies for top health insurers, subscribe to Health Insurer Insights™ . A low cost, Health Insurer Insights subscription includes quarterly profiles for plans such as Aetna, CIGNA, Coventry Health Care, Health Care Service Corporation (HCSC), Health Net, Humana, Kaiser Permanente, UnitedHealth Group, Universal American and WellPoint. You choose how many plans you want and the frequency which you receive them. Profiles are sent electronically to subscribers. For a free demonstration of Health Insurer Insights™ and other MFA products, email ProdMgr@markfarrah.com.

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. We are a licensed redistributor of NAIC data. MFA's Health Coverage Portal™ includes both risk-based and administrative services only membership and detailed financial data by plan, parent, state, region and nationally. Committed to simplifying analysis of health insurance business, our products include Health Coverage Portal™, Health Insurer Insights™, Medicare Business Online™, Medicare Benefits Analyzer™ , Health Plans USA™ and the new County Health Coverage™, which offers population and health plan enrollment data by county nationwide.

Most of the nation's leading health plans saw enrollment gains in the first quarter of 2011 and all saw improved profit margins both year-over-year and for the quarter. Between December 2010 and March 2011 top plans saw an aggregate increase of more than 2.0 million members. While aggregated fully-insured business continued to experience losses, the administrative services only (ASO) segment gained over 2.2 million members during the primary 2011 open enrollment season. Membership gains occurred across Medicare, Medicaid and Commercial lines of business.

This brief presents key findings from MFA's review of enrollment and financial trends among seven top health insurers: Aetna, CIGNA, Health Care Service Corporation (HCSC), Humana, Kaiser Permanente, UnitedHealth Group and WellPoint. It looks at results from first quarter 2010 to first quarter 2011. Financial and membership data and observations were gleaned from the July 2011 Health Insurer Insights™ series. These seven health plans cover approximately 41% of the total population in the nation.

Overall membership gains

Year-over-year, total membership for the seven leading plans increased by 1.5 million (1.1%), from 126.5 million as of March 2010 to 128.0 million as of March 2011.

From March 2010 to March 2011, the administrative services only (ASO, also known as self-insured) segment gained more than 1.9 million covered lives, ending 1Q11 with approximately 69.4 million members. Fully-insured (risk) enrollment declined 402,000 members in the same period. Aggregate risk enrollment for the top plans totaled 58.6 million at March 2011.

Most of the nation's leading health plans saw enrollment gains in the first quarter of 2011. Between December 2010 and March 2011 top plans saw an aggregate increase of more than 2.0 million members. While aggregated fully-insured business continued to experience losses, the ASO segment gained over 2.2 million members during the primary 2011 open enrollment season.

Both the Senior and Medicaid market sectors for top health plans continued to see growth, gaining nearly 259,000 and 165,000 net new members during the first quarter, respectively. The Commercial sector saw a net gain of 1.6 million members between December 2010 and March 2011. In comparison, the Commercial sector gained approximately 388,000 between December 2009 and March 2010.

The Patient Protection and Affordable Care Act's (PPACA, also known as health care reform) requirement that health insurers cover dependents to age 26 most likely influenced the 2011 results for the Commercial sector. WellPoint mentioned in its first quarter 2011 10-Q SEC filing that it estimates for the 12 months ended March 31, 2011, "an increase of approximately 210,000 self-funded members attributable to the Age 26 dependent coverage policy change associated with the health care reform." The company estimated an additional "70,000 fully-insured members attributable to the Age 26 dependent coverage policy change," primarily in the Federal Employee Plan. WellPoint's total commercial membership increased 220,000 from 1Q10 to 1Q11. Aetna's senior executive vice president and chief financial officer, Joseph Zubretsky, mentioned in the company's 1Q11 Earnings Call "that the age 26 phenomenon had an impact of less than 100,000 members in Aetna's Commercial membership." Aetna experienced a loss of 649,000 Commercial members from 4Q10 to 1Q11 and a loss of 1 million Commercial members between 1Q10 and 1Q11. Without the increase in dependents between the ages of 18 and 26, Aetna's commercial enrollment losses would have been worse.

Health plans' enrollment results

Five of the seven top plans saw membership gains between March 2010 and March 2011. UnitedHealth saw the largest growth among the leading plans, adding 1.710 million net new members between 1Q10 and 1Q11. WellPoint added 1.685 million new ASO members in 1Q11, but lost 1.322 million fully insured members, for a net gain of 363,000 total members year-over-year. UnitedHealth saw gains in both segments. Kaiser also saw growth in both segments, with a net gain of over 244,000 members for the same period. Aetna, the third largest health insurance organization in the country based on membership, lost a total of 894,000 members for the twelve months ended March 31, 2011.

HCSC lost an estimated 50,000 members from 1Q10 to 1Q11; however, HCSC ASO enrollment may be underestimated. According to a Standard & Poor's Global Credit Portal Ratings Direct® report, dated February 14, 2011, on Health Care Services Corp. (d/b/a Blue Cross Blue Shield of Illinois, New Mexico, Oklahoma, and Texas), "The Company will add several large national administrative services only (ASO) accounts in 2011." Standard & Poor's estimated HCSC's overall enrollment will "grow slightly to 12.5 million to 12.7 million members in 2011." Mark Farrah Associates currently estimates HCSC enrollment as 12,547,000.

CIGNA and Humana both reported modest net gains in enrollment. However, for CIGNA gains in ASO offset losses in risk-based business. Humana saw the reverse, with growth in fully-insured membership offset by losses in self-funded business.

Combined the seven leading companies reported a net gain of 1,497,638 members, up 1.2%, from 1Q10 to 1Q11. Aggregated ASO enrollment grew 2.8% and risk enrollment declined -0.7%, year-to-date for these organizations.

Profitability improvements

It is difficult to compare leading health plans' financial situations because they use diverse strategies to grow their respective businesses and operate with disparate business models. However, all of the top health plans saw improved profitability year-over-year between 1Q10 and 1Q11 and from 4Q10 to 1Q11.

UnitedHealth Group's UnitedHealthcare business unit, the leading health carrier in terms of revenues, reported a 7.95% profit margin* for the quarter ended March 31, 2011 compared to the 7.77% UnitedHealthcare reported for 1Q10. Kaiser Foundation Hospitals and Health Plan's, net income margin* of 7.68% for 1Q11 is up from 6.42% as of 1Q10. Aetna's Health Care sector's margin* of 7.45% through March 2011 was also up compared to the 7.10% margin reported through March 2010. WellPoint, the second largest carrier in terms of revenue, reported its profit margin grew from 5.81% in 1Q10 to 6.22% in 1Q11.

* Profit margin is net income (loss) divided by total revenues.

CIGNA Health Care, whose primary health business centers around municipal government, Taft-Hartley Trusts and global employers, reported its profit margin was up close to 2.1% year-over-year. Humana, with more than 60% of its enrollment from federal government programs, saw the smallest gains. Humana reported a net income of 3.43% for 1Q11, up from 3.07% as of 1Q10.

First quarter 2011 financial performance for most plans included accruals for certain expenses related to health care legislation, including medical loss ratio rebates and implementation costs for The International Statistical Classification of Diseases and Related Health Problems, 10th Revision standard (known as "ICD-10"). Most health plans in the U.S. must make the ICD-10 change to their claims systems by January 1, 2012 to enable reimbursement and resource allocations beyond that date. After two years of mixed financial and enrollment results, 2011 appears to be off to a good start for the top health plans in the U.S.

Health Insurer Insights™

For consistent updates about membership changes and business strategies for top health insurers, subscribe to Health Insurer Insights™ . A low cost, Health Insurer Insights subscription includes quarterly profiles for plans such as Aetna, CIGNA, Coventry Health Care, Health Care Service Corporation (HCSC), Health Net, Humana, Kaiser Permanente, UnitedHealth Group, Universal American and WellPoint. You choose how many plans you want and the frequency which you receive them. Profiles are sent electronically to subscribers. For a free demonstration of Health Insurer Insights™ and other MFA products, email ProdMgr@markfarrah.com.

Mark Farrah Associates (MFA) is a leading data aggregator and publisher providing health plan market data and analysis tools for the healthcare industry. We are a licensed redistributor of NAIC data. MFA's Health Coverage Portal™ includes both risk-based and administrative services only membership and detailed financial data by plan, parent, state, region and nationally. Committed to simplifying analysis of health insurance business, our products include Health Coverage Portal™, Health Insurer Insights™, Medicare Business Online™, Medicare Benefits Analyzer™ , Health Plans USA™ and the new County Health Coverage™, which offers population and health plan enrollment data by county nationwide.