Provider preparation for MACRA represents a distinct opportunity for organizations to establish an integrated strategy for Senior Markets that includes Medicare Advantage.

Is your organization MACRA ready? If so, you have probably invested significantly in infrastructure, innovative policies and procedures focused on care management, and consumer engagement strategies. MACRA is here to stay, but have you considered the broader Senior Market opportunity? The number of seniors is substantial and continuously growing; synergies across Senior Markets may exist. By looking through the MACRA lens, you may see potential for Medicare Advantage (MA); MACRA capabilities being built today are highly transferable, offering the opportunity to take a more holistic portfolio approach to the Senior Market.

MACRA is transformative and here to stay

Although Republicans and Democrats continue to have conflicting views related to many healthcare reform topics, MACRA has bipartisan support, enacted by Congress through a House vote of 392-37 (212 Republicans and 180 Democrats) and a Senate vote of 92-8 (46 Republicans and 44 Democrats). This consensus suggests that MACRA will continue during the Trump Administration—it also replaces arguably one of the most unpopular physician payment mechanisms (the sustainable growth rate or “SGR”), which required annual “Doc Fix” legislation by Congress in order to achieve equitable physician payments during much of the last ten years.

It is widely recognized that the transition from FFS payments to payment for quality and value imposed by MACRA is critical to the sustainability of the healthcare system. As such, we believe that changes made by the Trump Administration during its regulatory roll out are unlikely to significantly change MACRA’s goal; extensions in the timeline or modifications to the options for participation are most likely. The MACRA CY2018 Quality Payment Program proposed rule recently issued by CMS does provide additional flexibility for participation as well as further exclusions. CMS estimates that approximately 65% of Part B charges will continue to remain in the program.

As a result, organizations have begun to make significant investments in preparation for success in the post-MACRA environment. The majority will participate via the Merit-Based Incentive Payment System (MIPS) track, creating a footrace of provider and health system peers to capture bonus payments based on performance in four defined categories. MIPS participants will now be focused on: identifying gaps in technology infrastructure, building more effective and efficient population health and care management approaches, and creating more robust and meaningful patient engagement capabilities to ensure long-term loyalty with their consumers.

Still, other providers will select to participate via the Advanced Alternative Payment Model (APM) track, resulting in additional focus on the analytics and risk stratification capabilities necessary to take on downside financial risk and succeed. Not surprisingly, MACRA is driving an increase in ACO and other APM models; between Q1 2016 and Q1 2017 the market experienced 11% growth of ACOs alone, according to recent Health Affairs analysis of the Leavitt Partners ACO Database commissioned to track the growth of accountable care. As these models become more prevalent, we believe that it will be critical for providers to ensure alignment of the capabilities necessary to succeed under each payment model and begin to leverage synergies.

Capabilities built to succeed under MACRA and MA are readily transferable

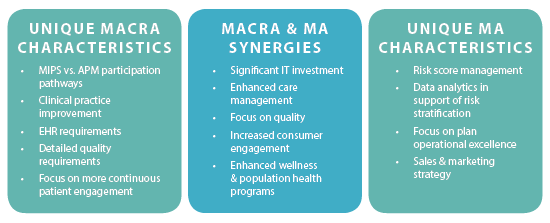

As organizations assess their capabilities under MACRA, they should also consider potential applicability to MA and across the entire Senior Market spectrum. While initially such a transition may seem challenging to many executives, there is an opportunity to leverage MACRA and MA synergies as a meaningful way to enhance growth and broaden the clinical service infrastructure within the enterprise. We encourage organizations to incorporate this view into their short and long-term strategic assessment and planning efforts; in effect, look through a MACRA “lens” to see the potential

of MA in their marketplace. MACRA capabilities being built today are highly transferable, offering the opportunity to take a more holistic portfolio approach to strategic planning and resource deployment.

In order to comply with MACRA, provider organizations are building a set of core competencies that can also well position their organizations to participate in MA as a participating provider, through risk-based MA contracts, or even as a provider- sponsored MA plan.

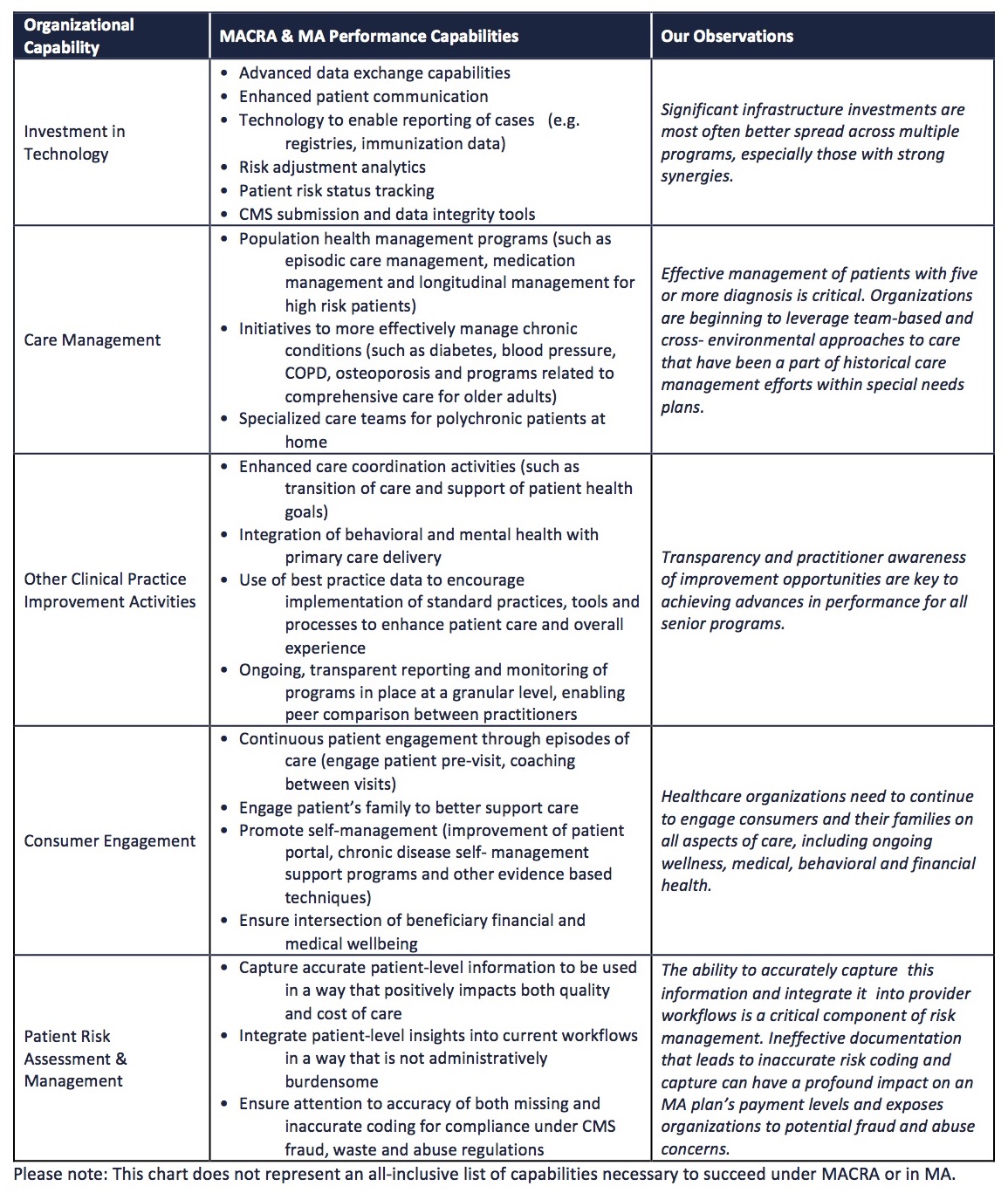

Performance Capabilities in Post-MACRA Environment

For illustrative purposes, organizations can contemplate how well the full set of MACRA measures (which are more expansive and detailed) correlate to those historically used by the MA program. Steps can certainly be taken to align the performance measures that physicians will be tracking through MIPS with MA Star rating strategies.

Intersection of these capabilities lends itself to a portfolio approach for Senior Markets

MACRA should be the stimulus that drives provider organizations to develop an integrated senior strategy, focused on attracting a particular patient population within a predetermined mix of senior programs. MA should be a part of this portfolio mix.

The Medicare market represents a significant portion of the overall population and is continuously growing. The Congressional Budget Office estimates that there are approximately 58 million Medicare beneficiaries of all ages in 2017, growing to over 75 million in the next ten years as Boomers continue to age into the program—approximately 10,000 Boomers turn 65 each day. As a result, Medicare enrollment is rising at a rate not seen in history of the program, greater than 6% annually, which will continue for the next 13 years. More important for strategic consideration is the fact that one in three beneficiaries across the nation is enrolled in MA, and in some states, MA penetration is greater than 50%. These highly penetrated states are still experiencing consistent growth, signaling that the MA saturation point has not yet been reached.

In addition, MA growth may be accelerated by several key factors:

1. The current administration’s healthcare policy appears to favor privatization, which could enhance the existing trend of growth in MA;

2. In 2020, the most popular Medicare Supplement plans (C & F) will no longer be available to newly eligible Medicare individuals, as a result of MACRA regulations. These plans represent 63% of all Medicare Supplement enrollment;

3. New wave of consumers (Boomers) offers the opportunity to engage and attract new patients that exhibit significantly different shopping behavior than past Medicare beneficiaries. This growth story coupled with potential for revenue certainty (as compared to MIPS), clear attribution of beneficiaries and opportunities for effective deployment of care management represent a strong rationale for provider organizations to evaluate all of their options for MA participation.

How can organizations strategically build a Senior Market portfolio?

We recognize that a one-size fits all Senior Market solution does not exist; organizations should evaluate core competencies, patient mix and existing relationships in order to arrive at an action plan. We believe that the optimal view of how to succeed under MACRA or under MA must

be informed through an evaluation of a provider organization’s patient portfolio across all Senior Markets, as synergies exist.

Institute a broad, portfolio-based approach

• How can you engage beneficiaries as patients, members and future members (age-ins) across payer types?

• What is the right Senior Market program mix?

• How do you measure performance (financial and market share) across this portfolio?

Inventory key capabilities across FFS, MA & ACO populations

• What capabilities do you currently employ? Which

capabilities can easily be deployed? What gaps

exist?

• What technology investments will be required?

• What processes and procedures need to be

implemented (care management, risk assessment, population health models)?

Establish a differentiated consumer experience

• How can you differentiate the patient experience?

• Who influences this today? Who should influence

this experience in the future?

Implement member/patient level economics

• What do the economics look like at a member/patient level?

• How can you evaluate the key factors (payment, risk adjustment, cost to service and site of care)?

• How can you serve these populations most effectively?

Commit to this portfolio evaluation and consistent re-evaluation, since strategy may evolve over time with changes in market factors or appetite for risk. By answering these questions, provider organizations can uniquely position themselves to use multiple levers in order to optimize growth and financial performance across Senior Markets.

About the Author: Cary Badger

Cary Badger has over 20 years of healthcare industry experience with deep Medicare Advantage expertise. He has assisted clients with market expansion and acquisition strategies, new market and product entry, Medicare and ancillary distribution opportunities, as well as other Senior Market opportunities. Prior to joining HealthScape, Cary most recently led the business and market development of four regional health plans at The Regence Group. To learn more, contact Cary at cbadger@healthscape.com.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.