Is your organization prepared for this new era of joint accountability and quality improvement? Are you well-positioned to achieve successful hospital-physician alignment?

We are at a critical time in healthcare; issues of payment reform, clinical integration and improved quality are driving significant change in the delivery of care. The most successful healthcare institutions are those that find a way to cooperatively and

strategically align the two most critical pieces of the healthcare equation: the hospital and the physician.

The evolving physician/hospital relationship

For most of the 20th century, the physician/hospital relationship was informal, based on medical staff privileges, practice locations and previous referral patterns. It was an implicit relationship that involved no contracts, compensation or employment. In short, it was a relationship that was rarely strategic — and often adversarial. But since the arrival of managed care in the 1990s, that relationship has been dramatically transformed. Today’s physician/hospital relationships are often a more formal arrangement based on the hospital’s economic and strategic mission, the competitive marketplace and evolving payor relationships.

These explicit relationships now include:

How healthcare reform changes the relationships

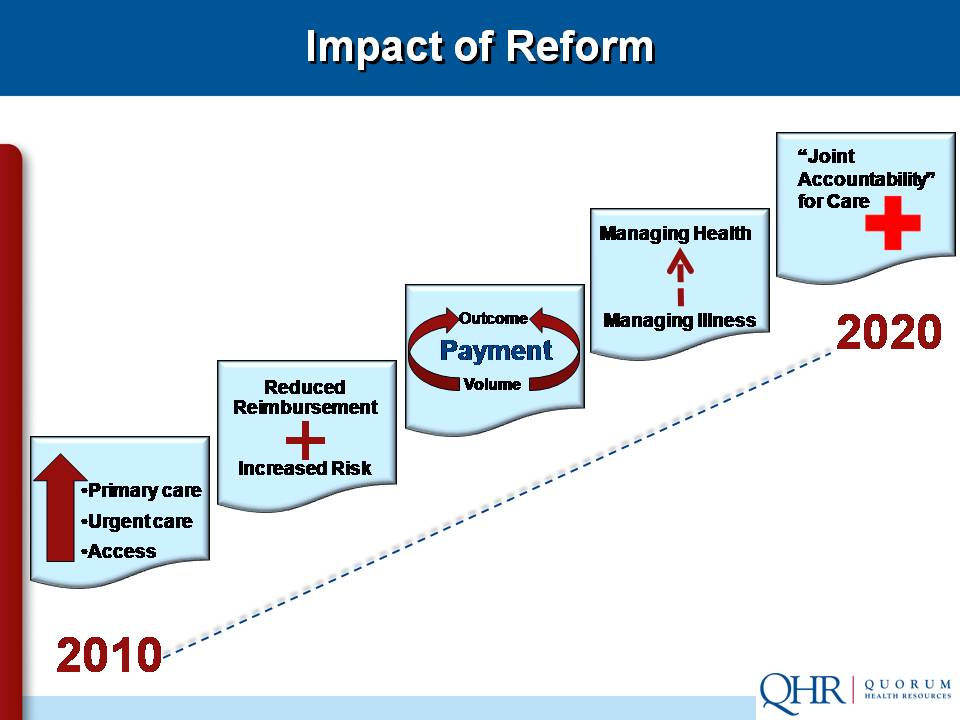

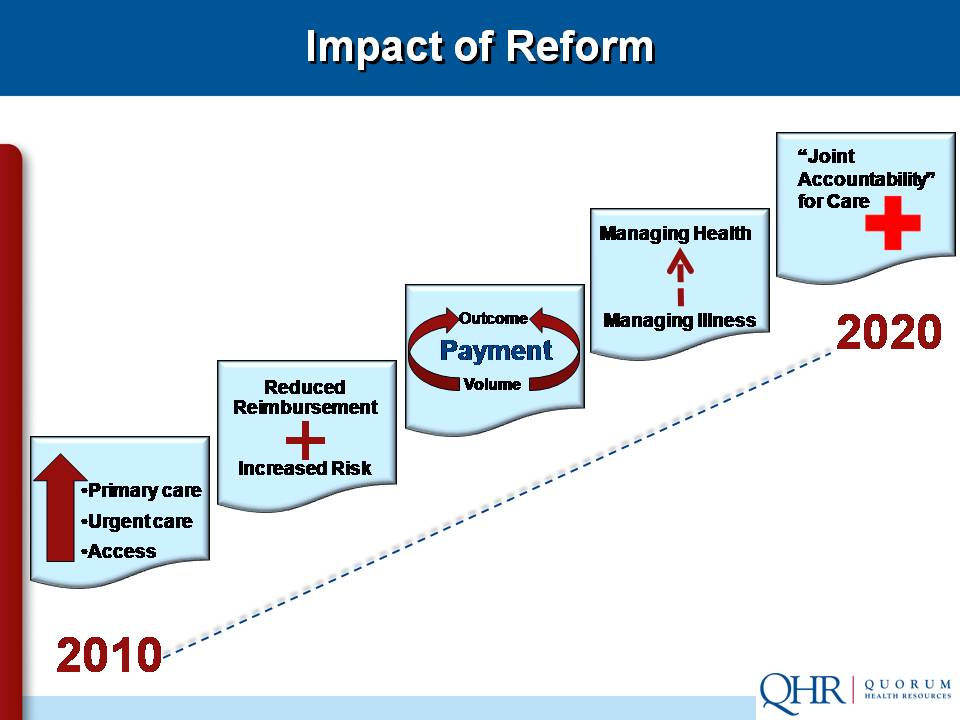

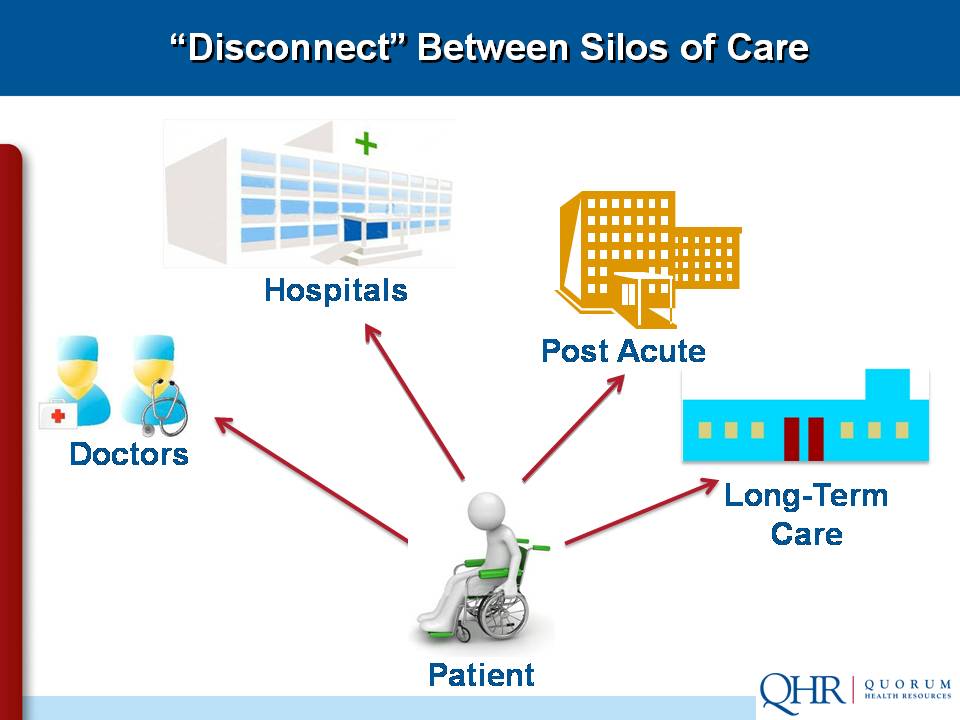

The recently enacted healthcare reform bill in reality is payment reform. The aim is to move reimbursement in the direction of rewarding quality and outcomes instead of volume. The legislation shifts the payment focus from individual productivity to joint accountability. And the reform bill attempts to align incentives across and among the silos of the delivery system.

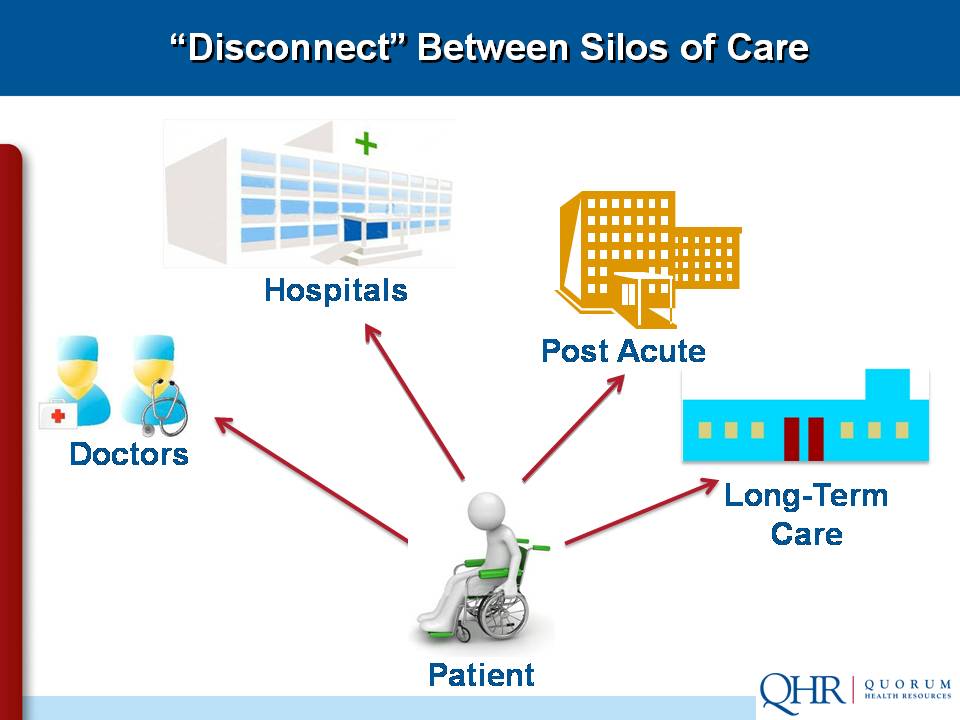

The old paradigm, in which each primary player acted independently, is disappearing quickly.

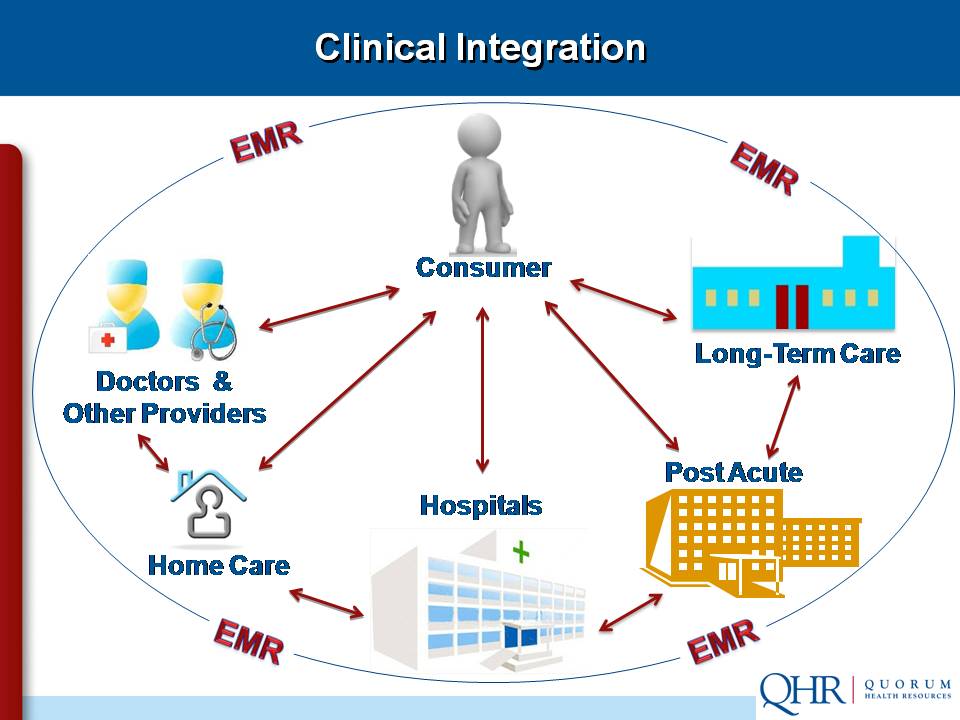

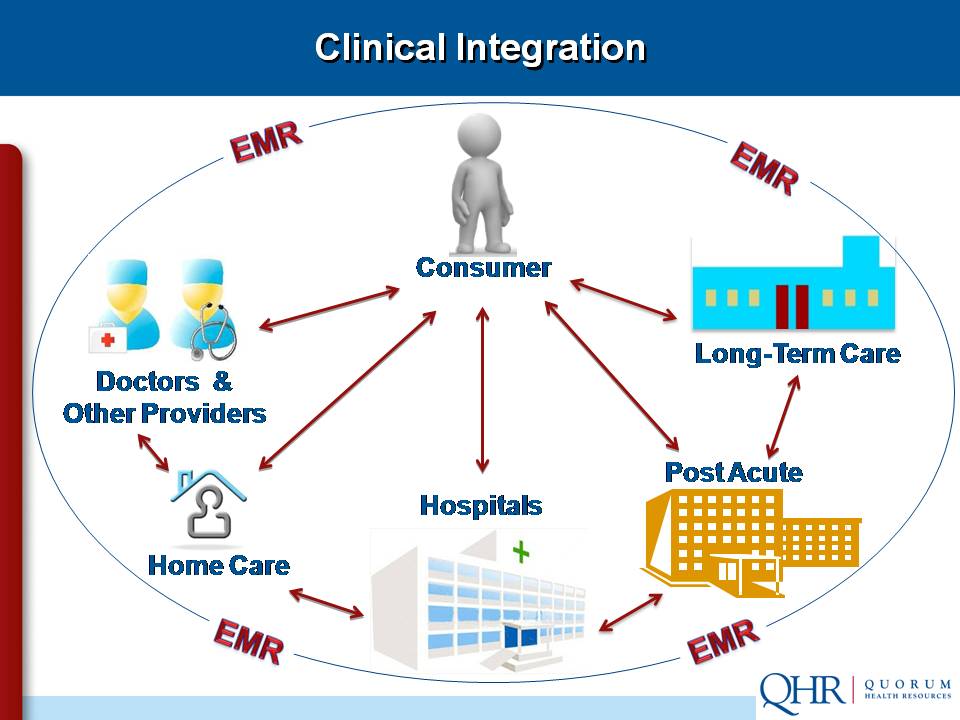

The physician/hospital relationship is moving inexorably toward clinical integration, where all providers — physicians, hospitals, post-acute care, pharmacy/drug vendors and therapy facilities — work together in an interdependent fashion so they can:

The patient is the hub of the new paradigm, which emphasizes quality improvement and joint accountability. But as the system evolves, pay-for-service and volume cannot be ignored.

The challenge of "split focus"

It’s important to note that we’re moving incrementally from the volume/growth model to the new paradigm that focuses on joint accountability and quality improvement. Most physicians and hospitals are still being compensated for pay-for-service and productivity rather than for improved outcomes and higher quality. It’s essential to maintain a “split focus” that keeps a careful eye on volume and growth as we evolve toward clinical integration.

Compensation based on quality improvement

Here’s an example of how the volume/growth model can be adjusted to provide fair compensation for higher quality and improved outcomes:

A large hospital in the Northwest asked some of the leading corporations in the region to identify areas where service could be improved. One company felt it was paying too much for lower back pain treatment. The hospital reviewed its courses of treatment and

discovered that patients went through expensive CT/MRI scans and pain management upfront, yet 95 percent of them ended up in physical therapy. So the hospital revised the treatment plan. They screened initially for neurological problems (which accounted for the other 5 percent), then sent the other patients directly to physical therapy. The company reported that employees returned to work much faster and had significantly less pain.

The hospital then asked the insurance company to change the compensation policy, but was flatly denied. That’s when the large corporation got involved to help establish a payment policy that rewards quality and outcomes, not

volume.

But keep in mind: this arrangement wouldn’t have been possible without the direct intervention of a Fortune 500 company. Many smaller companies are still tied to the current compensation system.

The physician/hospital enterprise

We often hear the term “enterprise” yet fail to grasp that it’s a word that connotes difficulty, risk and a shared sense of purpose. Here are the four definitions you’ll find in the dictionary:

When physicians and hospitals work as allies, they can create solutions tailor-made for their unique circumstances. This eliminates the stalemates that can arise when a hospital is willing to employ but the physicians aren’t interested, and vice versa.

Example 1: When employment makes sense

A group of four hospitals in the Western U.S. was being challenged by a proverbial “800 pound gorilla” — a huge integrated healthcare network employing many physicians. The four-hospital group felt its cardiac services line was in jeopardy, so they reached out to four cardiology groups and two cardiac surgery practices. In the new enterprise, it made sense to employ the cardiac surgeons and align the cardiology practices more closely with the four hospitals. This physician/hospital enterprise has prospered by establishing a center of excellence to share best practices and utilize strategic marketing and co-branding.

Example 2: When contracts make sense

A small, county-owned Critical Access Hospital has a staff of 14 providers. Both the physicians and hospital management agreed that it would be a nightmare trying to recruit and retain medical personnel as county employees. So they came up with a solution that worked for all parties: the physicians formed a corporation and contracted their services to the hospital.

Three generations of physicians

A successful transition to clinical integration depends in large part upon a better understanding of the three

generations of physicians:

The “Maverick” has the entrepreneurial, independent mindset of an owner. The Maverick lives to work, is a pillar of the community, and views the hospital as a competitor.

The “Survivor” is the private partner who is reluctant to be either an owner or employee. The Survivor works to earn, shifts risk, and sees the hospital as a resource. Most Survivors simply want to practice medicine successfully until their careers end.

The “Newbie” is from the Millennium generation. Newbies actively seek employment, embrace change and are willing to take risks. Although they lack the experience of Mavericks and Survivors, Newbies have a strong sense of purpose and are lifestyle-focused. Newbies are not interested in working 80-hour weeks, and they’re often willing to take less money if there’s greater fulfillment.

Anyone can be a catalyst

The “Catalyst” is the dynamic profile that will dominate the next decade. These physicians are typically employed partners with a stewardship mindset. Catalysts are change agents who are outcome-focused and believe in sharing risk. They view the hospital as a strategic partner.

The Catalysts will transform the physician/hospital relationship because they’re enterprise-minded, IT savvy and patient-focused. Many are cross-trained in other fields like law or business, so they’re excellent problem-solvers.

Although most Catalysts come from the Newbie category, don’t assume that every Newbie has the operational experience to be an instant change agent. And don’t overlook the Mavericks and Survivors who have the potential to become powerful Catalysts.

How a Maverick became a Catalyst

A cardiac surgery group in a large metropolitan area was acquired by a regional health network to become part of its physician division. One of those surgeons was a classic “Maverick” who had built his own practice from scratch twice.

The regional network decided to add a heart surgery and cardiology program to its southern hospital because of the influx of many retirees. So even though the Maverick surgeon was an employee, the network asked him to help design and build the new program.

He immediately got involved with the architects and engineers in the design of the operating suites and recovery rooms. He hired his two former partners, and trained the anesthesiology and profusion staff. He even worked as a liaison with the cardiology group that came on board.

The heart program became so successful that it’s now getting patients from other nearby cities because surgeons can perform procedures at 50 percent of the cost of Las Vegas facilities.

Clinical integration: Measuring your progress

Here’s a practical checklist for assessing your organization’s readiness to achieve clinical integration.

1. Determine the prevailing business structure of your staff:

___% What percentage of your staff are in private practice?

___% What percentage are employees of the hospital system?

___% What percentage are contracted hires?

2. What’s the generational composition of your staff?

___% What percentage of your staff are Mavericks?

___% What percentage are Survivors?

___% What percentage are Newbies?

___% What percentage are Catalysts?

3. Who are your physician leaders?

List by name the formal and informal leaders on your

staff. How many of them are Catalysts?

_______________________________________________

_______________________________________________

4. Are any hospital organizations in your service area

gaining strategic advantage by achieving clinical

integration/alignment? ________________________

5. Which physician leaders on your staff fully understand

the benefits of achieving clinical integration — and the

consequences of not achieving it?

_______________________________________________

_______________________________________________

Seeing physician contracts in a new light

Both Newbies and Catalysts are looking for flexibility and options in physician contracts. That’s why your staff needs a comprehensive approach to contract terms, payment rates and a host of other issues.

QHR consultants have extensive experience in the complex world of physician contracts. We understand not only today’s best practices, but the “red flags” that can alert you to contract problems on the horizon.

Dual focus for success

Here are the keys to keeping your physician/hospital enterprise on a steady path toward clinical integration:

Maintain a split focus — Keep a watchful eye on volume and productivity in the near term while looking for innovative solutions that reward quality and joint

accountability.

Know the generational differences and act accordingly — Each group has unique qualities that can make them effective Catalysts.

Identify, recruit and invest in physician leaders, especially Catalysts who understand the importance of moving toward clinical integration.

Empower providers by tracking outcomes so that the enterprise can remain patient-centric.

B.J. Millar is a director or the Physician Services Group at QHR Consulting. Contact him at BJ_Millar@qhr.com or by phone at (801) 455-6092.

Download a checklist on how to prepare for employed physicians: "Preparing for the employed physician: Comprehensive check — Things to do before the physician arrives to begin employment and practice."

We are at a critical time in healthcare; issues of payment reform, clinical integration and improved quality are driving significant change in the delivery of care. The most successful healthcare institutions are those that find a way to cooperatively and

strategically align the two most critical pieces of the healthcare equation: the hospital and the physician.

The evolving physician/hospital relationship

For most of the 20th century, the physician/hospital relationship was informal, based on medical staff privileges, practice locations and previous referral patterns. It was an implicit relationship that involved no contracts, compensation or employment. In short, it was a relationship that was rarely strategic — and often adversarial. But since the arrival of managed care in the 1990s, that relationship has been dramatically transformed. Today’s physician/hospital relationships are often a more formal arrangement based on the hospital’s economic and strategic mission, the competitive marketplace and evolving payor relationships.

These explicit relationships now include:

- Employment – both primary care physicians and specialists

- Service contracts – directorships; call coverage for ED physicians, anesthesiologists, etc.

- Equity partnerships – joint ventures where physicians and hospitals share in the cost of imaging centers, surgery centers, etc.

- Strategic alliances – coordinated marketing campaigns and co-branding; centers of excellence

How healthcare reform changes the relationships

The recently enacted healthcare reform bill in reality is payment reform. The aim is to move reimbursement in the direction of rewarding quality and outcomes instead of volume. The legislation shifts the payment focus from individual productivity to joint accountability. And the reform bill attempts to align incentives across and among the silos of the delivery system.

The old paradigm, in which each primary player acted independently, is disappearing quickly.

The physician/hospital relationship is moving inexorably toward clinical integration, where all providers — physicians, hospitals, post-acute care, pharmacy/drug vendors and therapy facilities — work together in an interdependent fashion so they can:

- Pool infrastructure and resources

- Develop, implement and monitor protocols, "best practices," and other processes

- Furnish higher quality care in a more efficient manner than can be achieved independently

The patient is the hub of the new paradigm, which emphasizes quality improvement and joint accountability. But as the system evolves, pay-for-service and volume cannot be ignored.

The challenge of "split focus"

It’s important to note that we’re moving incrementally from the volume/growth model to the new paradigm that focuses on joint accountability and quality improvement. Most physicians and hospitals are still being compensated for pay-for-service and productivity rather than for improved outcomes and higher quality. It’s essential to maintain a “split focus” that keeps a careful eye on volume and growth as we evolve toward clinical integration.

Compensation based on quality improvement

Here’s an example of how the volume/growth model can be adjusted to provide fair compensation for higher quality and improved outcomes:

A large hospital in the Northwest asked some of the leading corporations in the region to identify areas where service could be improved. One company felt it was paying too much for lower back pain treatment. The hospital reviewed its courses of treatment and

discovered that patients went through expensive CT/MRI scans and pain management upfront, yet 95 percent of them ended up in physical therapy. So the hospital revised the treatment plan. They screened initially for neurological problems (which accounted for the other 5 percent), then sent the other patients directly to physical therapy. The company reported that employees returned to work much faster and had significantly less pain.

The hospital then asked the insurance company to change the compensation policy, but was flatly denied. That’s when the large corporation got involved to help establish a payment policy that rewards quality and outcomes, not

volume.

But keep in mind: this arrangement wouldn’t have been possible without the direct intervention of a Fortune 500 company. Many smaller companies are still tied to the current compensation system.

The physician/hospital enterprise

We often hear the term “enterprise” yet fail to grasp that it’s a word that connotes difficulty, risk and a shared sense of purpose. Here are the four definitions you’ll find in the dictionary:

- A project or undertaking that is especially difficult, complicated or risky

- Readiness to engage in daring or difficult action

- A unit of economic organization or activity

- A systematic, purposeful activity

When physicians and hospitals work as allies, they can create solutions tailor-made for their unique circumstances. This eliminates the stalemates that can arise when a hospital is willing to employ but the physicians aren’t interested, and vice versa.

Example 1: When employment makes sense

A group of four hospitals in the Western U.S. was being challenged by a proverbial “800 pound gorilla” — a huge integrated healthcare network employing many physicians. The four-hospital group felt its cardiac services line was in jeopardy, so they reached out to four cardiology groups and two cardiac surgery practices. In the new enterprise, it made sense to employ the cardiac surgeons and align the cardiology practices more closely with the four hospitals. This physician/hospital enterprise has prospered by establishing a center of excellence to share best practices and utilize strategic marketing and co-branding.

Example 2: When contracts make sense

A small, county-owned Critical Access Hospital has a staff of 14 providers. Both the physicians and hospital management agreed that it would be a nightmare trying to recruit and retain medical personnel as county employees. So they came up with a solution that worked for all parties: the physicians formed a corporation and contracted their services to the hospital.

Three generations of physicians

A successful transition to clinical integration depends in large part upon a better understanding of the three

generations of physicians:

The “Maverick” has the entrepreneurial, independent mindset of an owner. The Maverick lives to work, is a pillar of the community, and views the hospital as a competitor.

The “Survivor” is the private partner who is reluctant to be either an owner or employee. The Survivor works to earn, shifts risk, and sees the hospital as a resource. Most Survivors simply want to practice medicine successfully until their careers end.

The “Newbie” is from the Millennium generation. Newbies actively seek employment, embrace change and are willing to take risks. Although they lack the experience of Mavericks and Survivors, Newbies have a strong sense of purpose and are lifestyle-focused. Newbies are not interested in working 80-hour weeks, and they’re often willing to take less money if there’s greater fulfillment.

Anyone can be a catalyst

The “Catalyst” is the dynamic profile that will dominate the next decade. These physicians are typically employed partners with a stewardship mindset. Catalysts are change agents who are outcome-focused and believe in sharing risk. They view the hospital as a strategic partner.

The Catalysts will transform the physician/hospital relationship because they’re enterprise-minded, IT savvy and patient-focused. Many are cross-trained in other fields like law or business, so they’re excellent problem-solvers.

Although most Catalysts come from the Newbie category, don’t assume that every Newbie has the operational experience to be an instant change agent. And don’t overlook the Mavericks and Survivors who have the potential to become powerful Catalysts.

How a Maverick became a Catalyst

A cardiac surgery group in a large metropolitan area was acquired by a regional health network to become part of its physician division. One of those surgeons was a classic “Maverick” who had built his own practice from scratch twice.

The regional network decided to add a heart surgery and cardiology program to its southern hospital because of the influx of many retirees. So even though the Maverick surgeon was an employee, the network asked him to help design and build the new program.

He immediately got involved with the architects and engineers in the design of the operating suites and recovery rooms. He hired his two former partners, and trained the anesthesiology and profusion staff. He even worked as a liaison with the cardiology group that came on board.

The heart program became so successful that it’s now getting patients from other nearby cities because surgeons can perform procedures at 50 percent of the cost of Las Vegas facilities.

Clinical integration: Measuring your progress

Here’s a practical checklist for assessing your organization’s readiness to achieve clinical integration.

1. Determine the prevailing business structure of your staff:

___% What percentage of your staff are in private practice?

___% What percentage are employees of the hospital system?

___% What percentage are contracted hires?

2. What’s the generational composition of your staff?

___% What percentage of your staff are Mavericks?

___% What percentage are Survivors?

___% What percentage are Newbies?

___% What percentage are Catalysts?

3. Who are your physician leaders?

List by name the formal and informal leaders on your

staff. How many of them are Catalysts?

_______________________________________________

_______________________________________________

4. Are any hospital organizations in your service area

gaining strategic advantage by achieving clinical

integration/alignment? ________________________

5. Which physician leaders on your staff fully understand

the benefits of achieving clinical integration — and the

consequences of not achieving it?

_______________________________________________

_______________________________________________

Seeing physician contracts in a new light

Both Newbies and Catalysts are looking for flexibility and options in physician contracts. That’s why your staff needs a comprehensive approach to contract terms, payment rates and a host of other issues.

QHR consultants have extensive experience in the complex world of physician contracts. We understand not only today’s best practices, but the “red flags” that can alert you to contract problems on the horizon.

Dual focus for success

Here are the keys to keeping your physician/hospital enterprise on a steady path toward clinical integration:

Maintain a split focus — Keep a watchful eye on volume and productivity in the near term while looking for innovative solutions that reward quality and joint

accountability.

Know the generational differences and act accordingly — Each group has unique qualities that can make them effective Catalysts.

Identify, recruit and invest in physician leaders, especially Catalysts who understand the importance of moving toward clinical integration.

Empower providers by tracking outcomes so that the enterprise can remain patient-centric.

B.J. Millar is a director or the Physician Services Group at QHR Consulting. Contact him at BJ_Millar@qhr.com or by phone at (801) 455-6092.

Download a checklist on how to prepare for employed physicians: "Preparing for the employed physician: Comprehensive check — Things to do before the physician arrives to begin employment and practice."